Greece Is Setting Itself Up For Another Financial Crisis

Tyler Durden

Thu, 12/10/2020 – 05:00

Authored by Antonis Giannakopoulos via The Mises Institute,

The Greek economy shrunk by a record 14 percent in the second quarter of 2020 while at the same time government efforts to ‘’cure’’ the economy have set the country on the road to cross the 200 percent debt-to-GDP ratio as the IMF forecasts. In the meantime, government budget deficits have reached new heights (around 7 percent).

The Government’s Response to the Recession

The Greek government tried to combat the economic downturn with a loose fiscal and monetary policy (through the European Central Bank). The initial aim was to support pretty much everyone from the public and private sector for the bad months of the covid-19 lockdown and hope for economic recovery when the summer arrived, with the tourist industry saving the day. It soon became evident, however, that this was wishful thinking. People from the tourist industry admitted that it could take years for the industry to recover its past numbers. The situation looked even worse once people realized how dependent the whole economy is on tourism: it accounts for 20 percent of GDP and provides 22 percent of all employment in Greece. Furthermore, the Greek government’s solutions, like those of most of the other governments in Europe, were primarily demand-side policies.

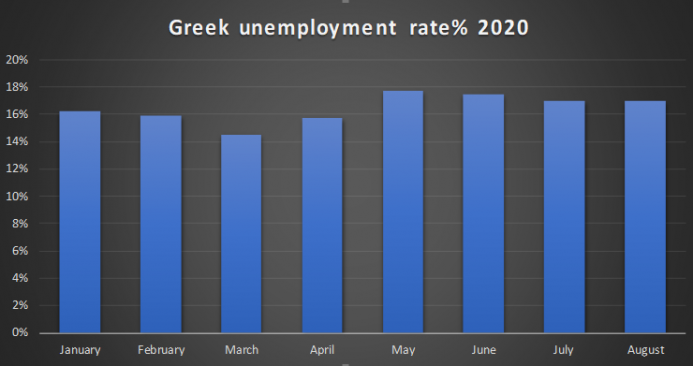

As I predicted in one of my past articles, these measures could only provide short-run relief, only postponing the pain until later. The unemployment rate saw a 1.2 percent increase from March to April, of 1.3 percent from April to May, and it saw a minor decrease during the summer tourist period. The Organisation for Economic Co-operation and Development (OECD) has estimated that the unemployment rate will reach roughly 20 percent by the end of the year.

Source: Trading Economics.

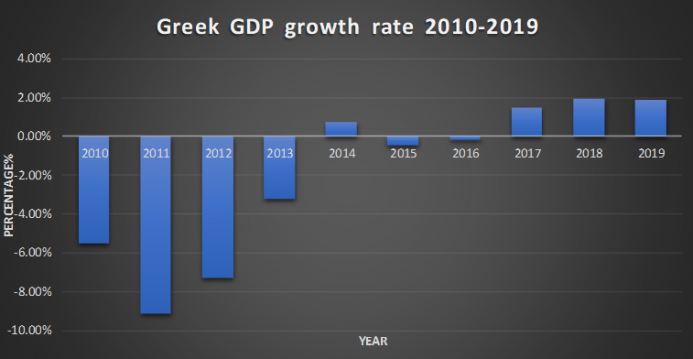

In the meantime, that the GDP saw a 14 percent contraction in the second quarter means that the Greek economy will need years to reach its precorona numbers, especially considering its anemic growth rate over the last decade.

Source: International Monetary Fund, World Economic Outlook: The Great Lockdown (Washington, DC: International Monetary Fund, April 2020).

What Went Wrong?

The ECB’s balance sheet had a massive increase from 39 percent of the GDP to 54 percent during the summer. In comparison the Fed’s balance sheet is around 32 percent of GDP. The injections of liquidity via the ECB have effectively zombified a considerable number of companies in the EU, with corporate debts reaching new highs. In the case of Greece, the government has exploited its new, EU-sanctioned fiscal leeway, which has allowed it to perpetuate structural problems in its economy along with large deficits. During the tourist season, the costs were so high that a considerable segment of the tourist industry decided to not even work this summer since they would lose less money this way.

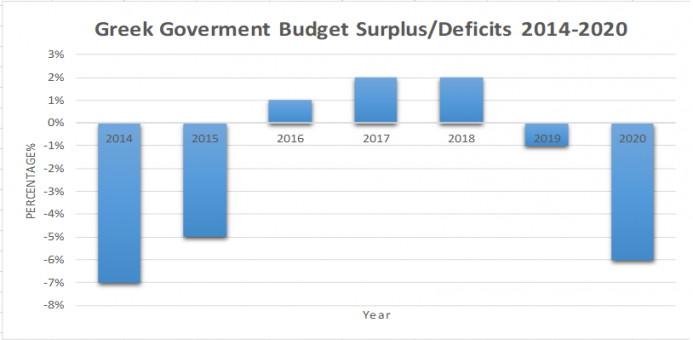

Government intervention made things even worse by failing to address the biggest problem in the economy, which is its inflexible labor laws. Rather than partially liberalizing the laws, the state made them even more restrictive and inflexible. For this reason, businessmen have failed to adjust to the corona crisis shock. Making hiring more expensive and riskier is a recipe for disaster, especially in a fragile economy that lacks savings and investments like Greece. While the spending didn’t manage to stimulate the economy, we can’t say that it had an immediate negative effect short term at least, since it was mostly financed by the European Union. On the other hand, cheap credit and loans were made possible by the ECB and by putting political pressure on banks, thus prolonging another major structural problem of the overall economy: lack of savings and more debt. The budget deficits are also a matter that needs to be addressed, since it has reached new highs, making the 2010s a lost decade for the whole economy, since the whole point of ‘’European austerity’’ was to make the debt more sustainable.

Source: Trading Economics

As the Greek minister of finance admitted the tax cuts that were made during the last few months won’t be permanent, since the new target is for Greece to have the biggest fall in debt-to-GDP in the eurozone. The state secretary of finance also talked recently about a possible new austerity program similar to that of the previous decade. On the surface, budget surpluses are a good thing and much needed, but it is important to ask these surpluses will become a reality. The tax cuts won’t be permanent, so it seems that Greeks will soon be undertaking the same failed strategy that they tried for a decade and was promoted by European officials in Brussels—high tax rates to increase government revenues but very minimal cuts in public expenditures. But the problem wasn’t the tax cuts but government spending and deficits. Deficits have a greater crowding-out effect on the private sector than just spending. At the end of the day, these deficits will have to be paid by future generations. Potential tax increases in the future would be an even bigger disaster for the private sector. The cure is worse than the disease.

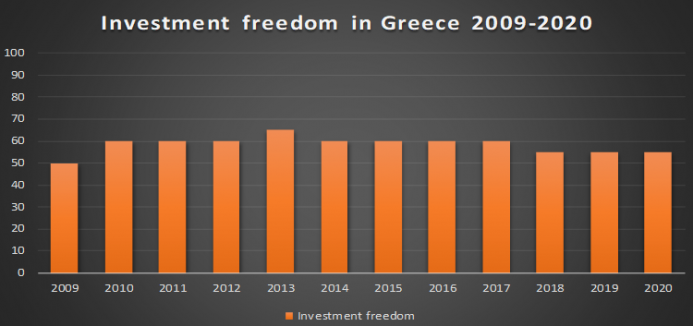

The center-right government that came into power in July of 2019 has failed to liberalize the economy and make market-oriented reforms, and the pandemic has made things even worse. It hasn’t made any major tax cuts that would be permanent and could have a big impact on alleviating some of the pressure on the private sector. Deregulation was also a major issue: the Greek economy was and still is in desperate need of foreign investment; however, investment freedom hasn’t seen a significant increase, and major investments and infrastructure programs are way behind schedule. Bureaucratic obstacles extend even to the judiciary branch, making it inefficient and slow, with corruption widespread.

Source: Heritage Foundation, Index of Economic Freedom, 2020.

The Heritage Foundation’s Index of Economic Freedom can give us some useful insight on state economic freedom in Greece.

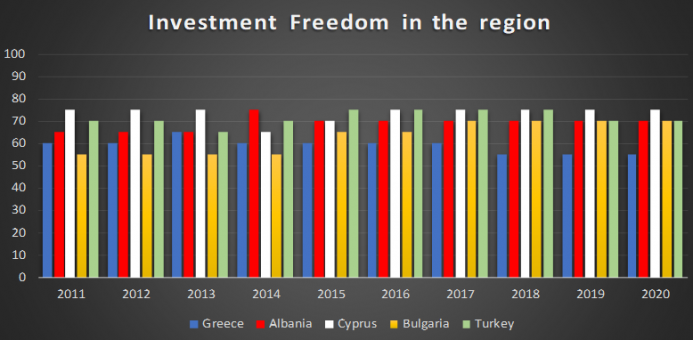

The following graph compares investment freedom in Greece with countries that compete for investment in the same region.

Source: Heritage Foundation, Index of Economic Freedom, 2020.

Conclusion

People need to understand that when you have an economy with weak productivity that’s highly indebted, shutting down the economy two times in one year has repercussions that will be here to stay for years depending on the recovery policies. The economy needs major structural reforms. Labor laws need to be liberalized. Budget surpluses are indeed the correct goal, especially now, to avoid another debt crisis, but the surpluses need to come from cuts made in the public sector. Tax cuts need to become permanent and even bigger for the economy to grow and expand. Last but not least, making foreign and domestic investments easier, less expensive, and minimizing the potential risk is a matter of utmost urgency, since Greece is being outcompeted by neighboring countries.

Greece needs to take advantage of its potential. A business-friendly environment with a liberalized market is the way to go. It can minimize the negative effects of the corona crisis and solidify a slow but strong recovery that will make the country more productive and give it prospects of getting out economic trouble and becoming an economic powerhouse in the region.

via ZeroHedge News https://ift.tt/3741UcU Tyler Durden