ECB Preview: Here Comes Another €500 Billion In QE

Tyler Durden

Thu, 12/10/2020 – 05:45

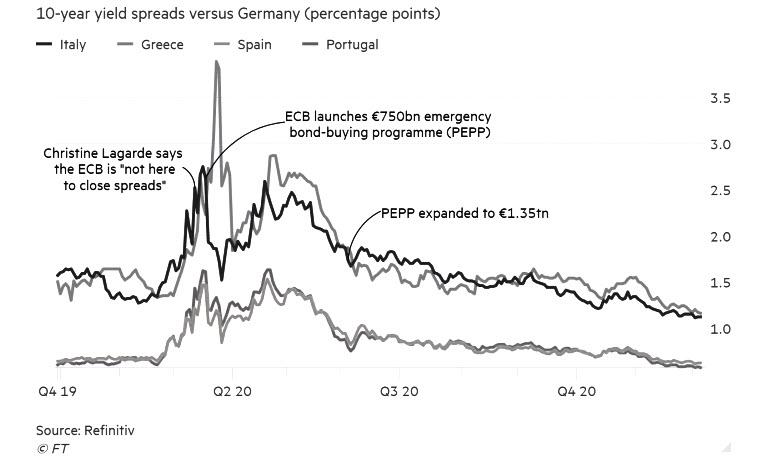

Last March, the ECB’s then-brand new boss Christine Lagarde sparked a mini crisis when quipped that it was not the job of the European Central Bank to narrow the gap in borrowing costs between the eurozone’s stronger and weaker members. The resulting bond selloff and market mess prompted the ECB’s chief economist Philip Lane to secretly call some of the largest asset managers to calm them that Lagarde had no idea what she was talking about and to stop selling.

Nine months on, investors have gone all-in on bets that the ECB boss has changed her mind, and is here “to close spreads” after all.

Ahead of the central bank’s next policy meeting, the FT notes that spreads in the eurozone’s periphery have been squeezed by relentless demand for riskier bonds. The buying helped push Portugal’s 10-year yield below zero for the first time. Spain is not far behind, and Italy — the last big eurozone market to offer a significant positive yield over a decade — has seen its spread closing in on its lowest since the region’s debt crisis a decade ago.

With the ECB expected to expand its €1.35tn emergency asset purchase program by (at least) another €500bn, investors are increasingly relaxed about holding peripheral bonds despite the explosion in debt levels driven by the pandemic.

Are they right? Courtesy of NewSquawk, here is a breakdown of what to expect:

- ECB policy announcement due Thursday 10th December; rate decision at 12:45GMT/07:45EST, press conference 13:30GMT/08:30EST

- PEPP and TLTRO set to be tweaked, rates, PSPP and tiering expected to be left untouched

- The upcoming release will also be accompanied by the latest round of staff economic projections

OVERVIEW: After telegraphing in October that further stimulus would be unveiled at the upcoming meeting, the consensus looks for a €500bln addition to the PEPP programme and 6-month extension until December 2021 (a longer extension has been speculated by some), while a majority of economists expect no change to its PSPP. Elsewhere, market participants expect policymakers to tweak the parameters of the Bank’s TLTROs. Rates are set to be left unchanged, whilst an adjustment to the tiering multiplier is not expected this time around. Accompanying economic projections are set to see a downgrade to the near-term inflation outlook, but greater focus could be placed on the initial 2023 forecast. For growth, any near-term optimism on vaccines could be tempered by how the ECB addresses the yet to-be passed recovery fund and disappointing Q4 2020 outturn.

PRIOR MEETING: As expected, policymakers opted to stand pat on policy settings, with rates and bond-buying operations held at current levels. The main takeaway from the initial announcement was the introduction of a new paragraph in the statement noting that risks to the economic outlook were “clearly tilted to the downside” and the new round of Eurosystem staff macroeconomic projections in December “will allow a thorough reassessment of the economic outlook and the balance of risks.” Additionally, “on the basis of this updated assessment, the Governing Council will recalibrate its instruments, as appropriate, to respond to the unfolding situation.” In terms of the policy measures set to be unveiled in the final meeting of 2020, President Lagarde did not delve into specifics. Despite policymakers acknowledging the bleak outlook for the region, the ECB chief stated that no discussion was held on unveiling measures at the October meeting with policymakers wanting to gather further evidence on the economic impact of the second wave of COVID across the Eurozone.

RECENT DATA: Q3 Eurozone GDP was confirmed as showing a 12.5% Q/Q expansion from Q2 with the Y/Y figure printing a 4.3% contraction. On the inflation front, the Y/Y flash CPI print for November remained at -0.3%, with core CPI holding steady at 0.4%. Survey data has highlighted the differing fortunes of the services and manufacturing sectors with the EZ-wide Markit PMI report showing the former in contractionary territory and the latter in expansionary, the broader composite reading fell to 45.1 in November from 50.0 in October. Markit noted, that while the EZ economy has slipped back into a downturn, the decline is of a far smaller magnitude than seen in the spring. The unemployment rate in the Eurozone for October came in at 8.3%, with the figure obscured by regional employment support schemes.

RECENT COMMUNICATIONS: Beyond the clear signposting at the October meeting by Christine Lagarde that stimulus is set to be unveiled in December, the ECB President has reaffirmed that all options are on the table. That said, Lagarde (Nov 11th) talked up the efficacy of PEPP and TLTROs throughout the pandemic, suggesting that they will “likely remain the main tools for adjustment”. Additionally, the central banker emphasised that “what matters is not only the level of financing conditions but the duration of policy support, too”, suggesting that any expansion to the PEPP could also be met with an extension from the current endpoint of end-June 2021. Chief Economist Lane – who many view as the thought-leader at the ECB –has echoed Lagarde’s views on the efficacy of PEPP and TLTROs, whilst also noting that it is essential that the macroeconomic recovery is not derailed by a premature steepening of the yield curve. Germany’s Schnabel, one of the more vocal members of the Governing Council, recently remarked that the ECB is not obliged to do what the market expects it to, before going on to state that a 12-month extension to PEPP is one option being considered, and that the ECB could also look at a longer duration or more favorable rate for TLTROs. Elsewhere, on vaccines, Ireland’s Makhlouf says the ECB will have to evaluate the emergence of the COVID-19 vaccine, suggesting that no firm view on the matter is currently held by the Governing Council at this stage; however, Vice President de Guindos noted that vaccine developments will be taken into account at the meeting. On the prospects for a further dive into negative territory for the deposit rate, Spain’s de Cos refused to rule out a rate reduction, but acknowledged that rates were close to the lower bound, Austria’s Holzmann has stated that such a move would not have an effect. In terms of lesser talked about measures the Bank could take, outgoing Hawk Mersch recently pushed-back on the prospect of the ECB expanding its purchase remit to include “fallen angels”

RATES: From a rates perspective, consensus looks for the Bank to stand pat on the deposit, main refi and marginal lending rates of -0.5%, 0.0% and 0.25% respectively. A recent research piece from the Bank noted that the reversal rate for the deposit rate stands around -1%, suggesting there is around 50bps of space until further rate reductions could become counterproductive. That said, whilst all options are said to be on the table (and it might help stem some of the recent EUR appreciation), commentary from central bank officials has done little to suggest that rate tweaks are on the cards. Additionally, when faced with the option of lowering the deposit rate in March as the crisis was unfolding, policymakers refrained from doing so. As a guide: markets currently assign a 13.5% chance of a 10bps cut to the deposit rate at the upcoming meeting and around a 55% probability by the end of next year.

BALANCE SHEET: With the balance sheet seen as the preferred easing tool for the Governing Council, focus remains on any adjustments to its bond-buying operations. Its PEPP currently has an envelope of EUR 1.35trl and is set to run at least until the end of June 2021, whilst its regular Asset Purchase Programme (of which the Public Sector Purchase Programme is a component) runs at a monthly pace of EUR 20bln together with the purchases under the additional EUR 120bln temporary envelope until the end of 2020. A Reuters survey of economists stated that expectations are for a EUR 500bln addition to the PEPP programme and 6-month extension until December 2021. UBS also expects the ECB to extend its commitment to reinvesting the principal of maturing securities purchased under PEPP by another year, from currently end-2022 to end-2023. Note, 33 of 44 surveyed do not think that the ECB will expand the PSPP, according to the survey. Going back to PEPP, expectations have continued to gather steam since the October meeting, and it remains to be seen if policymakers could trigger a “dovish surprise” on this front. Policymakers could opt to increase the PEPP by more than EUR 500bln, however, in recent weeks policymakers have placed greater emphasis on reassuring markets about the duration of its support. Accordingly, ECB’s Schnabel has touted the possibility of a 12-month (consensus looks for 6-month) extension to PEPP. Additionally, the prospect of including “fallen angels” into its Corporate Sector Purchase Programme (CSPP) lingers around the bank, however, this idea recently received pushback from outgoing hawk Mersch.

TLTROs: Given recent rhetoric from policymakers on the efficacy of Targeted longer-term refinancing operations (TLTROs), a tweaking of its current operations has also formed part of the consensus ahead of the meeting. As it stands, the facility has just two auctions left (10th December, and 18th March 2021) with current borrowing conditions running with a rate of -0.5% for three years or as low as -1% for banks that reach certain lending requirements. The Reuters survey found that 37 of the 48 economists surveyed expect the ECB to change the terms of its TLTROs, however, there are differing views on how this will be carried out. SocGen highlights four potential ways in which the ECB could act on this front, 1) it could go for a longer maturity, or signal continuous TLTROs, 2) it could lower the threshold for the best available rate, 3) lower the best interest rate below -1%, and 4) include new loan types such as mortgage lending. SocGen themselves predict “largely unchanged conditions” with “around five quarterly operations until March 2022, for corporate lending only, 3-year loans at -1% at best, lending threshold for best rate at 0%”.

TIERING: Another option for the ECB could be an adjustment to the existing tiering multiplier of six (exempt from negative interest rates) amid rising levels of excess liquidity. However, a complicating factor is that a large part of the recent increase in excess liquidity is attributed to the ECB’s TLTRO-III facility. Therefore, an increase in the tiering multiplier could undermine policymaker’s efforts to get banks to lend to the corporate sector. One option, UBS says, would be for the ECB to exempt funds from TLTRO-III, in which case it could raise the tiering multiplier to nine from six in order to keep banks’ deposit costs constant. However, UBS suggests that even this could prove to be too generous given the lending incentives in the TLTRO scheme that already reduce net deposit costs. As such, the Swiss bank looks for no adjustment on this front in December. Additionally, SGH Macro notes that an increase in the multiplier would be unlikely to occur unless met with an accompanying deposit rate cut.

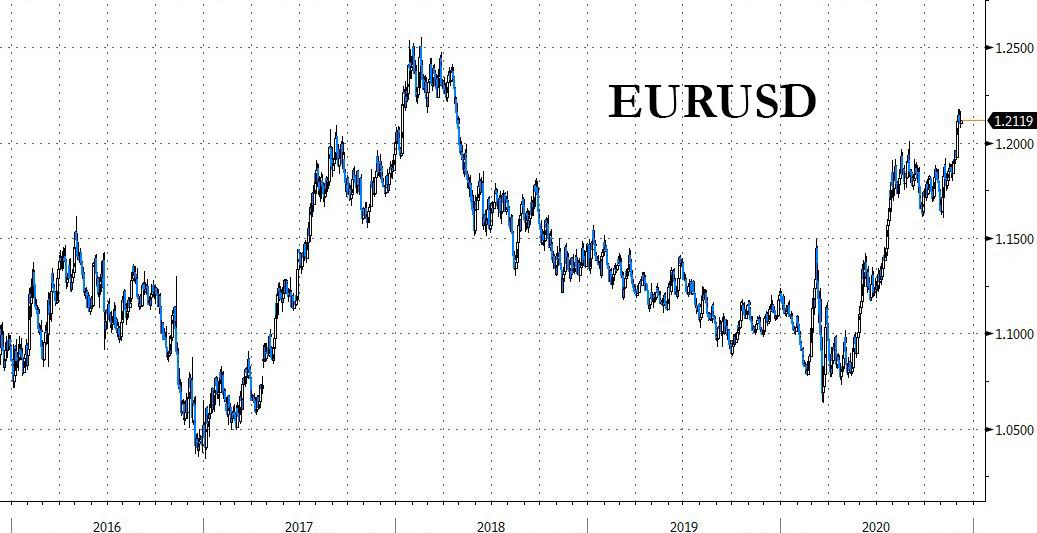

EUR: The recent appreciation of the EUR which has seen EUR/USD breach 1.20 and trade at levels not seen since 2018, has raised questions as to whether or not the ECB will attempt to talk down the currency. Note, at the September meeting after EUR/USD breached 1.20, President Lagarde noted that “the ECB does not target an FX level but will continue to monitor developments, including the EUR”. Morgan Stanley, however, suggests that we are not at levels that will concern policymakers given that the move in EUR/USD is more of a by-product of USD weakness, rather than EUR strength. In fact, the trade-weighted Euro is “a little weaker than in the summer,” the bank notes. As such, the EUR may prove to not be a major feature of the upcoming meeting.

ECONOMIC PROJECTIONS: Please see below for the September Staff Economic Projections: Inflation: 2020 +0.3% (unch), 2021 +1.0% (prev. 0.8%), 2022 +1.3% (unch) GDP: 2020 -8.0% (prev. -8.7%), 2021 +5.0% (prev. +5.0%), 2022 +3.2% (prev. +3.3%) This time around, from a growth perspective, despite a potentially disappointing Q4 outturn, better than expected growth in Q3 should see the ECB revise its 2020 estimate upwards to -7.2% from -8.0%, according to UBS. For 2021, despite the positive COVID vaccine updates, the fallout from Q4 2020 should prompt just a modest upgrade of its forecast to 5.0% from 5.5%, albeit this is largely dependent on how the ECB factors in the (yet-to-be passed) recovery fund. For 2022 and 2023, the Swiss bank pencils in growth of 3.9% and 1.9% respectively. On the inflation front, UBS expects the 2020 reading to be revised lower to 0.2% given softer prints in recent months relative to ECB expectations, whilst the better growth environment should offset any drag from softer oil prices in 2021 and 2022, leaving them unchanged at 1.0% and 1.3%. Of potentially greater interest will be the initial 2023 estimate, which UBS expects to remain below the pre-COVID inflation trend of 1.6% and therefore warrant additional stimulus.

STRATEGIC REVIEW: One issue lingering at the Bank is its ongoing strategic review. The review has been delayed by the pandemic with its findings now not due to be released until September 2021. However, on the 30th September, President Lagarde delivered a speech in which she highlighted some preliminary considerations for the review. Lagarde noted that the ECB would be considering whether to depart from its current inflation target of “below, but close to 2%” and move towards a more “symmetric” target that would tolerate overshooting the 2% threshold. Ahead of the October meeting, Morgan Stanley suggested that accelerating the release of the outcome of the review could amount to another policy option for the Bank. However, MS noted that given the current H2 2021 timeframe, it seems implausible that the findings could be released in the near-term, particularly given reports of differing views on the Governing Council, which will make fostering consensus a more difficult task.

* * *

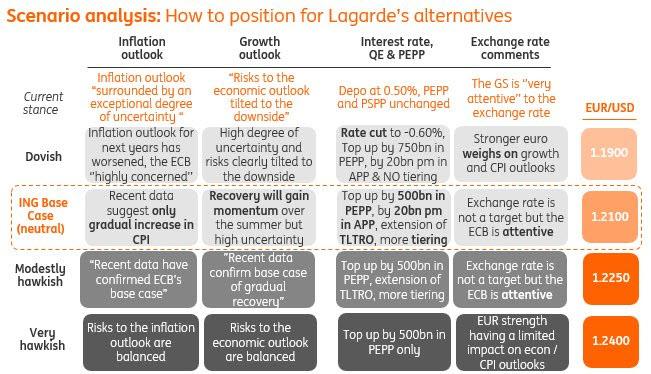

Finally, here is the traditional scenario matrix analysis from ING Economics, which as usual should be rather useful for FX traders hoping to gauge how to trade the Euro based on what Lagarde unveils tomorrow.

via ZeroHedge News https://ift.tt/3lZqLmn Tyler Durden