Stellar 30Y Treasury Auction Sends Yields Sliding

Tyler Durden

Thu, 12/10/2020 – 13:21

It had been a while since the US had a blockbuster auction, especially after two mediocre treasury sales earlier this year. Today’s 30Y was just the stellar auction the bond market needed.

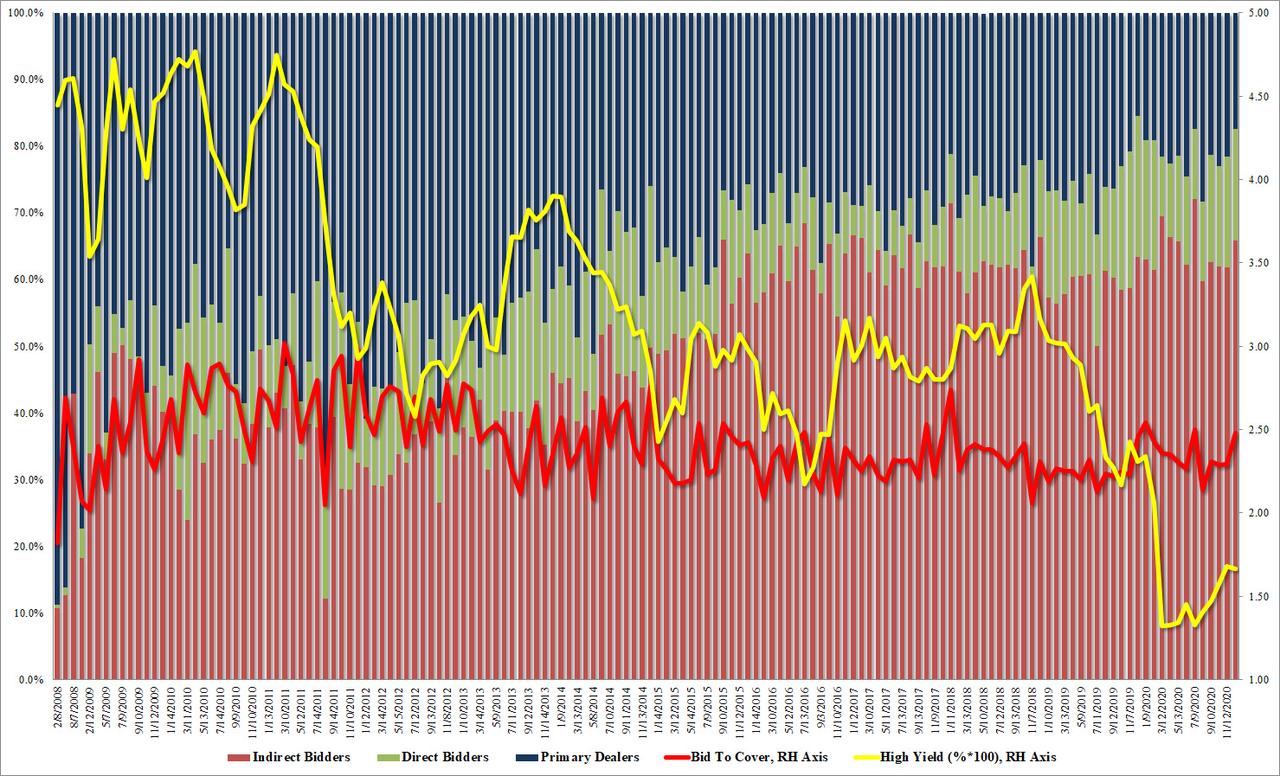

With $24BN in 30Y paper for sale, down from last month’s record $27BN, demand was blistering perhaps in light of the shaky equity market, and the high yield of 1.665% stopped through the 1.684% When Issued by 1.9bps, the biggest stop through since July ‘s 2.7bps.

The bid to cover of 2.481 was not only well above the 2.292 from November, but the highest since July.

The internals were also stellar, with Indirects jumping to 65.9% from 61.9% last month and the highest since July. And with Directs taking down 16.8% or the most since February, Dealers were left holding just 17.4% of the auction, the second lowest on record and only the 15.5% last December was a lower Dealer takedown.

Overall, a stellar auction after a series of average bond sales, and one which indicates that despite the surge in notional amount for sale, sold demand still remains even for the longest dated US debt. Not surprisingly, news of the stellar auction saw the yield curve quickly slide near session lows.

via ZeroHedge News https://ift.tt/39WlSbe Tyler Durden