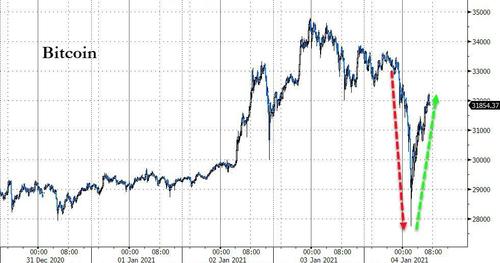

Cryptos Jump, Stocks Dump As “Everything Rally” Fades Early In 2021

Update (1100ET): The Wall Street Journal’s ‘speculation’ that the euphoria will continue in stocks is falling short this morning as equity markets give up anticipatory gains overnight…

Meanwhile, Bitcoin is roaring back, up over $4,000 from early morning crash lows, back above $32,000…

As we mocked overnight…

YTD return:

S&P500: 0.0%

Bitcoin 13.0%Time for an emergency @federalreserve meeting

— zerohedge (@zerohedge) January 3, 2021

* * *

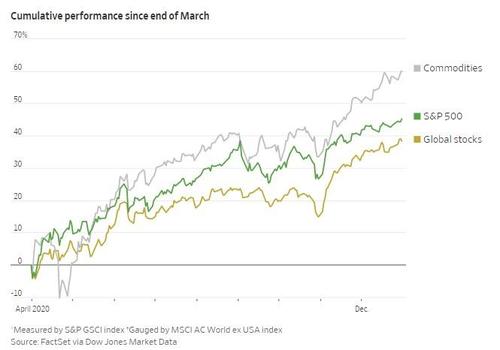

Framing the bubble in almost every asset class an “everything rally” is perhaps the most obvious (and most ignored by bubble-buyers) headline of the year – second maybe only to The Federal Reserve Presents… the “everything rally”.

Regardless that is the name the Wall Street Journal has bestowed on a 9 month rally that it thinks could wind up continuing, with steam, into 2021. A new article out over the weekend speculates that the euphoria heading into the end of 2020 is going to bode well for investors heading into 2021.

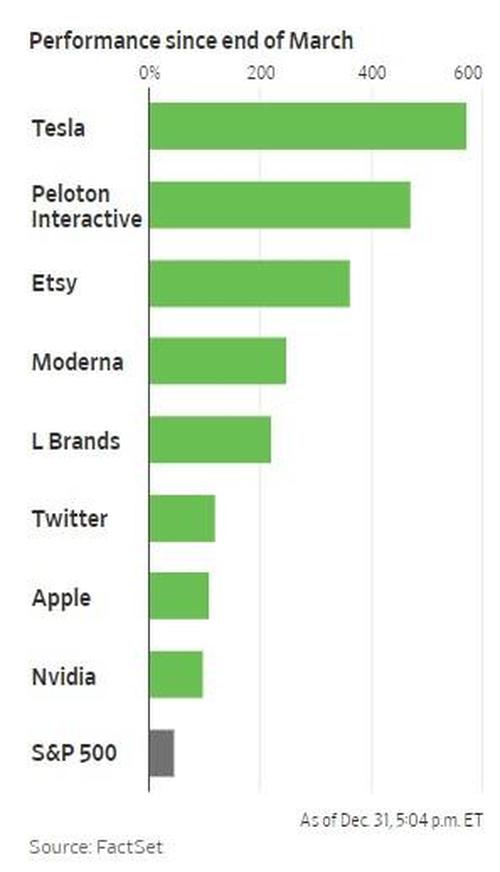

The S&P finished the year up 68% from its 52 week lows. Oil dropped below $0 for the first time in April but now stands at about $50 per barrel. In fact, after the March collapse in the market as a result of the coronavirus news, everything from equities, to global stocks, to bonds, to bitcoin and raw materials have all rallied.

Well, everything except the U.S. dollar…

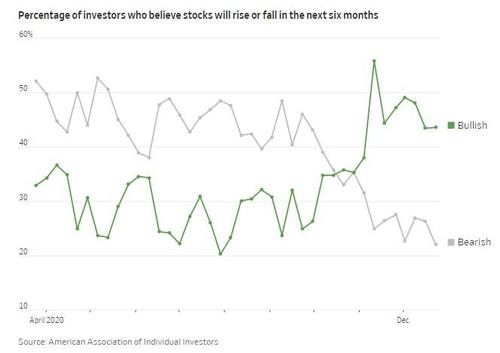

But that’s apparently OK, because heading out of a rally fueled by Central Banks, investors are expecting the quashing of coronavirus to give markets yet another shot in the arm. WSJ notes that bearishness, as measured by organizations including the American Association of Individual Investors, is at “multiyear lows”.

Emily Roland, co-chief investment strategist at John Hancock Investment Management said: “Investors can’t get enough risk – whatever it is. Momentum is a powerful force, and we don’t want to fight it.”

Her firm is increasing holdings in stocks and staying neutral in bonds. Roland, like many others, expects “ultralow” interest rates to continue supporting bonds and encouraging risk.

Meanwhile, the unknowns related to Covid-19 are slowly passing, as are political unknowns. The result of the runoff races in Georgia this week remains the one political unknown the market may not have accounted for yet. With those out of the way, potentially as early as Spring, the euphoria in the market could easily persist . PMs are adjusting their strategies accordingly, and there appears to be a bull for every part of the market still.

Meghan Shue, head of investment strategy at Wilmington Trust, increased her holdings in U.S. stocks and said: “We’re really encouraging our clients to look beyond.”

Lee Baker, president of Apex Financial Services in Atlanta, is pushing banks and travel stocks. “The expectations about certain [other] segments are overcooked,” he said.

Michael Kelly, global head of multiasset at PineBridge Investments has favored emerging markets. “Those markets have a lot more recovery potential,” he told the WSJ.

Finally, Victoria Fernandez, chief market strategist at Crossmark Global Investments, says she likes “faster-growing” companies tied to technology. But ultimately, even her bull case includes some obvious caveats. She concluded: “You have to be careful on some of these reopening trades that the sentiment is not already priced in.”

Maybe she didn’t get the memo that price discovery no longer exists.

…except in Crypto?

Tyler Durden

Mon, 01/04/2021 – 10:20

via ZeroHedge News https://ift.tt/2LiU5HE Tyler Durden