Brace For “Another Volatile Day”

After yesterday’s ‘malarkey’ – the worst start to a year for the S&P 500 in years – Robinhood’rs and their emotional support pigs were/are expecting a BTFD ramp. So far, not so much as stocks languish lower, unable to maintain any bounce overnight as China’s currency markets come back into play.

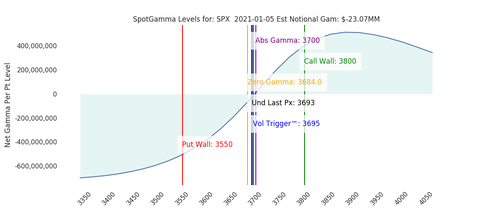

S&P 500 futs are trading around 3680, unable to break above the 3700 level which, as SpotGamma notes, is the gamma-neutral spot for the markets…

Due to this zero gamma position the options positioning experts are anticipating another volatile day.

From a position perspective nothing seemed to change materially as seen in the charts below.

There were small reductions in SPY puts>=SPY 370 – In the money puts closing on drawdowns is is generally what we expect to see.

However in SPX in the money puts were not net closed which could infer “retail” (SPY) monetized the drop, but “pros” (SPX) are holding protection. Any addition of puts could lead to dealer shorting.

SpotGamma goes on to warn that 3700 Strike & the VIX will be key today.

Markets under 3700 combined with a VIX that shifts higher likely leads to more downside in markets. 3600/360 seemed to gain the most puts which suggests that a move lower could pick up speed into 3600.

If VIX trends down that could signal “risk on” and we could see a quick return to 3745. There appears to be little in the way of resistance over 3700.

Tyler Durden

Tue, 01/05/2021 – 09:00

via ZeroHedge News https://ift.tt/3rX7XrN Tyler Durden