US Consumers Unexpectedly Paid Down Their Credit Cards In November; Have Repaid $115BN In 2020

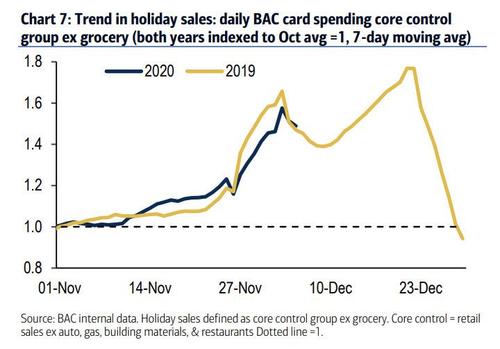

There appears to be a major discrepancy between BofA debit/credit card data, which showed a remarkable increase in the month of November…

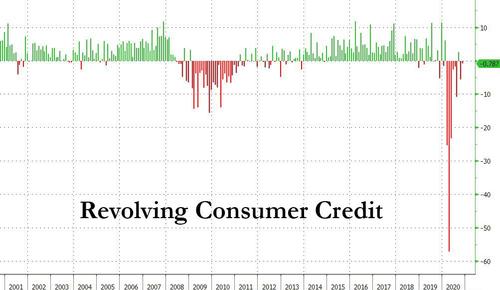

… and the Fed’s own consumer credit data aggregation, because according to the latest Consumer Credit report, in November revolving debt, i.e., credit card debt, shrank for a second consecutive month declining by $787MM following the $5.5 billion drop in October.

This means that in the first 11 months of 2020, US consumers have paid down a record $115bn in credit card debt.

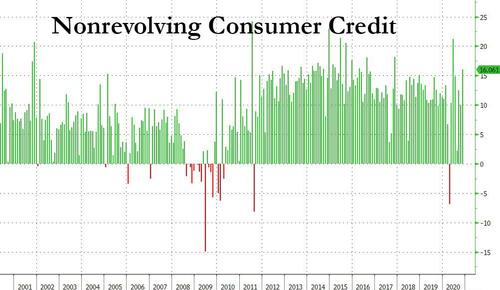

The flip side, however, is that as revolving credit dropped, non-revolving credit rose, and in November US consumers increased their student and auto loans – the two largest component of this category – by $16 billion…

… bringing the total November change to $15.3 billion, well above the $9BN increase expected by economists.

Tyler Durden

Fri, 01/08/2021 – 15:18

via ZeroHedge News https://ift.tt/3q4OvYK Tyler Durden