ECB Stuns Markets By Slowing Pandemic Purchases Amid Jawboning Panic

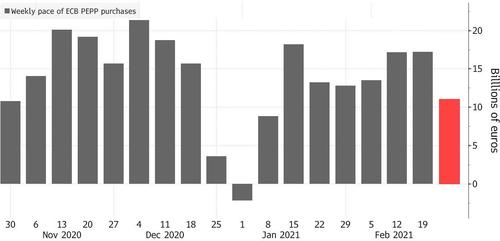

The ECB has gone and done it once again: the world’s most incompetent and confused central bank – which has a habit of saying one thing and doing the opposite – has managed to shock markets once again, because after unleashing full-blown verbal diarrhea late last week with one of its members even going so far as suggesting boosting QE to keep the yield surge in check, the ECB moments ago unveiled that last week, the pace of pandemic bond-buying last slowed to a two-month low even as officials warned that a global rise in yields could derail the economic recovery.

In a nutshell, this is what the ECB reported today, indicating a slowdown in purchases across most QE lines:

- ECB PEPP: +€12.037bln (prev. +€17.223bln).

- APP: PSPP +€1.570bln (prev. +€5.245bln).

- CSPP +€0.085bln (prev. +€0.704bln).

- CBPP3 -€0.067bln (prev. +0.273bln).

- ABSPP +€0.063bln (prev. -0.152bln)

The key number here is that the ECB settled 12 billion euros ($14.5 billion) of purchases under its emergency program, compared to 17.2 billion euros the week before. As Bloomberg notes, while an ECB spokesman said that the decline was due to much higher redemptions, it hardly inspired confidence in bond traders that the ECB was doing “whetever it takes” to keep rates low at a time when the global central bank commitment to yield curve control was put in question.

Putting the number in context, for the last two weeks purchases had been in proximity to the €17bln mark, while today’s €12.037bln figure was a drop from this it is still well within the range of recent weeks data, according to Newsquawk.

While ECB officials pledged last week to avoid any undue rise in yields, their verbal interventions only briefly stopped investors from selling which is why the market was focused on today’s disappointing bond purchase report.

In response to the report, German bonds pared gains, leaving the 10-year yield seven basis points lower at minus -0.32% compared to minus -0.34% earlier.

That said, the latest ECB data did not reflect orders made Thursday and Friday, as transactions take a couple of days to settle and show up in the ECB’s accounts. Which may explain the unexpectedly big decline in purchases. As such, traders will need to wait until next Monday for next week’s data to see the full impact of purchases as the reports only encapsulate purchases up until the prior Wednesday. Additionally, desks have noted talk of the ECB accelerating purchases of BTPs seemingly from today rather than undertaking any real increase last week. If this proves the case, such activity will not be evident until next Monday’s PEPP report and even then it will not be possible to discern changes to BTPs explicitly in the weekly release alone.

Realizing that the market would be less than excited about the latest ECB purchase data, at the same time the central bank returned to what it does best, verbal jawboning, and governing council member Francois Villeroy de Galhau scrambled to reassure markets that the ECB “must react against any unwarranted rise in bond yields, firstly by using its pandemic asset purchase program and should be clear it does not exclude cutting rates to ensure favorable financing conditions.”

The Bank of France Governor spoke in a conference immediately after the above data showed the ECB slowed pace of pandemic bond-buying last week.

“There are other elements in this tightening of financing conditions, including excessive spillovers and tensions on the term premia. In so much as this tightening is unwarranted, we can and must react against it, starting with an active flexibility of our PEPP purchases” Villeroy said, adding that the ECB’s forward guidance could be strengthened to make it clear it could tolerate inflation running above 2% for some time.

“We cannot completely ignore the past inflation shortfalls, and that in the future we should be ready to accept inflation above target for some time. As necessary, our forward guidance could be strengthened to make this tolerance explicit.”

Villeroy also said the latest consumer data showed signs of an upturn in inflation expectations and that “this is good news, but it shouldn’t be overstated” as it “it primarily reflects temporary factors rather than a persistent and significant change in the inflation path”

In conclusion, the French central banker also says the ECB will keep policy accommodative as long as necessary and stands ready to adjust all its instruments, inlcuding possibly lowering interest rates.

As Newsquawk notes, this was the first weekly release that has been accompanied by such commentary from an ECB spokesperson; serving to highlight the ECB’s attention on yields and perhaps their concerns as to how a ‘drop’ in purchases may be received by market participants given the heightened focus on the data.

After initially dipping, European bonds have since stabilized encouraged by Villeroy’s comments, although at some point the world’s biggest hedge fund central bank will have to put some (freshly printed) money where its endlessly jawboning mouth is.

Tyler Durden

Mon, 03/01/2021 – 10:33

via ZeroHedge News https://ift.tt/3bMVU9v Tyler Durden