As Prices Explode, When Will The Clueless Fed Finally Turn Hawkish?

During Powell’s WSJ video conference today the Fed chair was asked for his views on inflation. His response was, in typical Fed fashion, a lie: claiming that “he is well aware of history of high inflation and won’t allow it”, he is allowing it, adding that “inflation is currently very low.” Clearly the millionaire is relying on his Fed charge card (or concierge) for all daily purchases.

Others are less fortunate: among them was this respondent to the latest Mfg ISM who summarized the situation best:

“Things are now out of control. Everything is a mess, and we are seeing wide-scale shortages.”

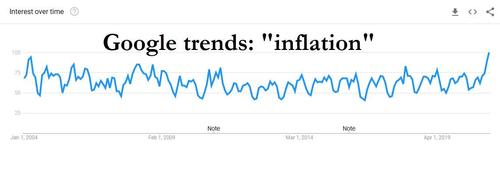

But the best snapshot of inflationary sentiment comes from Google Trends which was quite clear: searches for “inflation” are the highest they have been this century.

Yet while the Fed is clearly oblivious to soaring prices – arguing that this is just a transitory blip to be expected whenever the economy reopens – the time will eventually come for the Fed to hike rates.

But when?

For the answer we go to Bear Traps Report author Larry McDonald who has an amusing anecdote today answering just this question:

People forget how Volcker justified raising rates and mistakenly think it was solely an attack against inflation. That is false.

Volcker’s justification was that unemployment was going up anyway, so might as well raise rates to fight inflation. It was the combination of rising unemployment and rising inflation that led him to raise rates and restrict money supply, not inflation alone!

Inflation got so bad it was causing unemployment as firms cut employees to offset higher labor and commodity cost inputs. He is revered at the Fed.

Therefore we can assume that the Fed will keep rates lower and money supply growing until inflation starts increasing unemployment.

We are waaaay far away from that! Once commodity inflation morphs into wage inflation, and once wage inflation causes unemployment, then the Fed will become hawkish, not before.

Tyler Durden

Thu, 03/04/2021 – 15:45

via ZeroHedge News https://ift.tt/3kJNELi Tyler Durden