Powell Plunges Markets Into “Disorder”

Fed Chair Powell’s failure to deliver during his speech today – No hints at a ‘Twist’, refuses to speculate on repo issues, no pushback against recent bond vol, and no mention of SLR exemption – sparked chaos across all asset classes today with stocks, bonds, and gold puking as the dollar soared…

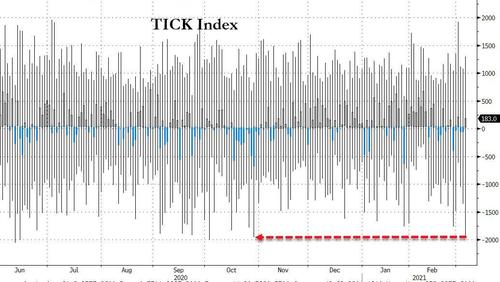

Powell sparked the biggest sell program since October…

Source: Bloomberg

Or to put it another way…

Small Caps were the days biggest loser, puking over 5% from the intraday highs. Stocks rebounded after S&P found support at its 100DMA and unch for the year and Nasdaq reversed right at its 10% correction level and 100DMA…

Nasdaq entered correction (down 10%) and is in the red for 2021. The S&P also fell into the red but found support there…

Source: Bloomberg

Robinhood’s brand new investor hotline right now pic.twitter.com/dNO0b64h1Y

— zerohedge (@zerohedge) March 4, 2021

The Nasdaq fell below its 100DMA today and all the other majors fell below their 50DMA but found support at those levels…

Energy stocks rallied on the day (as oil exploded higher) but tech wrecked and financials were hit (even with higher rates)…

Source: Bloomberg

Hedge funds have really puked up their favorite holdings. After a solid February, March has been a bloodbath…

Source: Bloomberg

BUZZ – the social media sentiment ETF – tanked from its open…

TSLA tumbled to $600…

ARKK sank hard – down 28% from the highs…

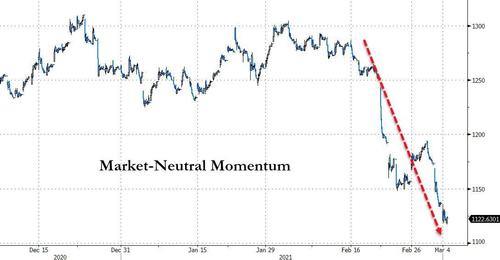

The collapse of momo stocks continued…

Source: Bloomberg

Growth and value puked – this was not simply rate-related…

Source: Bloomberg

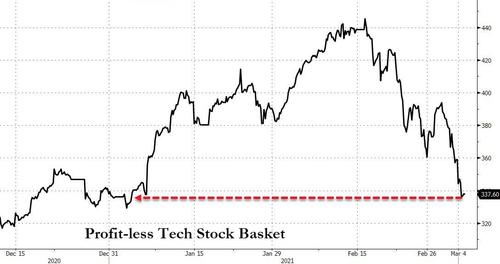

And suddenly, profitability (and not narratives) matter…

Source: Bloomberg

As IPOs and SPACs were clubbed like a baby seal into a bear market…

Source: Bloomberg

VIX spiked to 32 intraday…

Credit markets had an ugly day with IG and HY spreads blowing out…

Source: Bloomberg

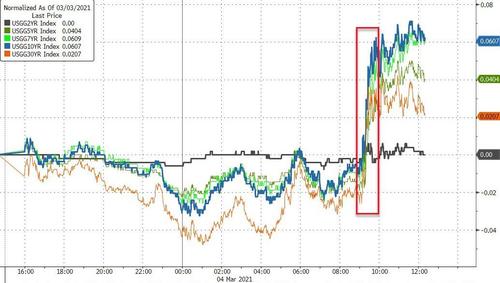

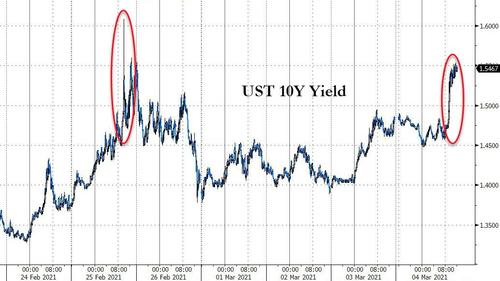

Bonds were a bloodbath today after Powell’s failure to deliver (2Y unch, 10Y +6bps)…

Source: Bloomberg

10Y yields spiked up to 1.55%… and stayed there…

Source: Bloomberg

Real yields surged higher and dragged gold down…

Source: Bloomberg

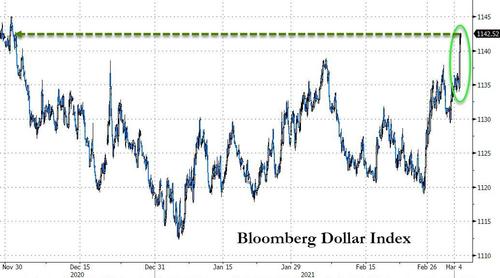

The dollar shot higher as we suspect liquidity fears are rearing their ugly head, hitting its highest since November…

Source: Bloomberg

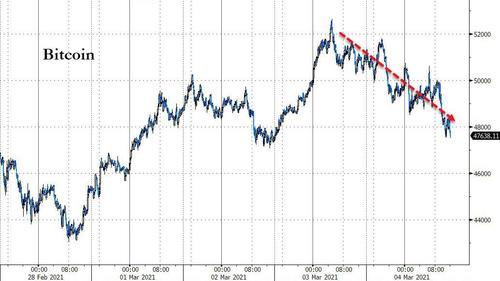

Broad selling pressure spilled over into crypto with Bitcoin dumping back below $50k…

Source: Bloomberg

Oil surged on surprise OPEC+ decision to not hike output…

And as oil prices surge, so $3.000 gas prices at the pump loom…

Source: Bloomberg

PMs were pummeled…with gold back below $1700..

And silver tumbled below $26, erasing all the Reddit-Raiders’ gains…

Finally, we note that amid all of Powell’s comments he said:

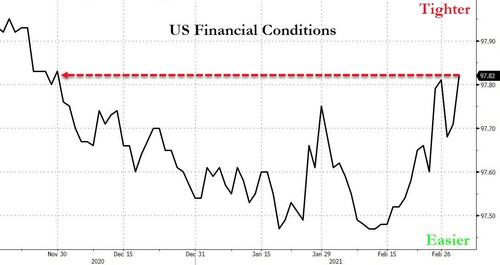

“I would be concerned by disorderly conditions in markets or persistent tightening in financial conditions that threatens the achievement of our goals.”

Well, judging by today’s explosion in vol across every asset class, and financial conditions at their tightest since November…

Source: Bloomberg

Dear Fed Chair: are market conditions still orderly?

— zerohedge (@zerohedge) March 4, 2021

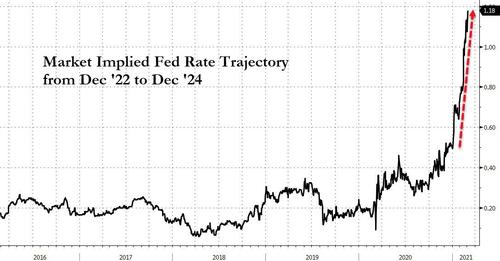

It’s time to get back to work, Mr. Powell. It’s pretty clear that’s what the market is demanding… and with the market pricing in 118bps of rate-hikes.between the end of 2022 and the end of 2024…

Source: Bloomberg

We leave you with former Dallas Fed president Richard Fisher’s comments:

“[The Fed] cannot live in fear that gee whiz the market is going to be unhappy that we are not giving them more monetary cocaine.“

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, and even 2007-2009.. and have only seen a one-way street… of course they’re nervous.”

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?”

“…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

Tyler Durden

Thu, 03/04/2021 – 16:00

via ZeroHedge News https://ift.tt/3rk2CtZ Tyler Durden