Illinoisans Are Over-Taxed, New Study Confirms

Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

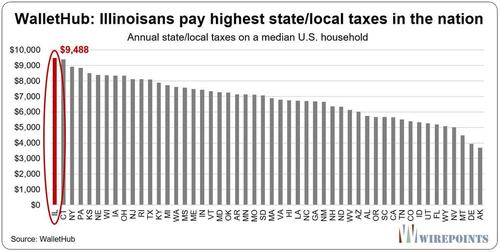

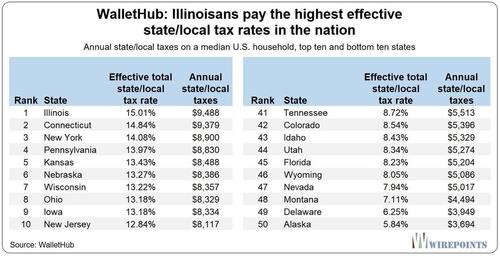

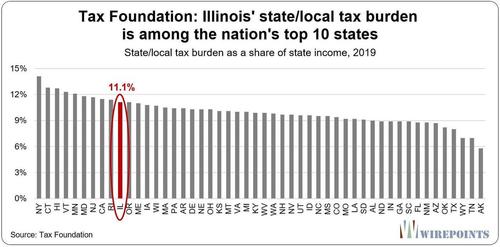

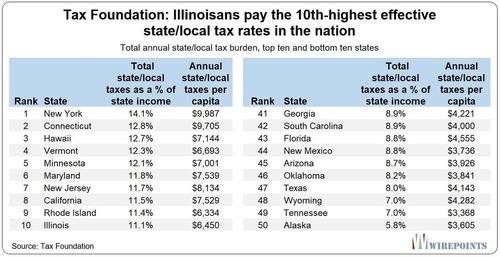

Two separate 50-state comparisons of state and local tax burdens released this week confirm Illinoisans pay some of the nation’s highest taxes.

WalletHub, the personal finance company, calculated that Illinoisans pay the highest effective tax rates in the country. A more comprehensive study by the Tax Foundation, a non-partisan think-tank, says Illinoisans pay the nation’s 10th-highest tax burden.

Either way, their findings validate what Illinoisans instinctively know: they’re overtaxed.

According to WalletHub, Illinois’ effective state-local tax rate is 15.01 percent. The median amount an Illinois household can expect to pay is $9,488 in taxes. Illinois beat out Connecticut, New York, Pennsylvania and Kansas to take the top-taxing position in the country.

At the other extreme are the low-tax states of Alaska, Delaware, Montana, Nevada, and Wyoming. Alaska is the lowest taxing by far. Its residents only face a tax bill of $3,700, almost three times smaller than the bill in Illinois. See WalletHub’s methodology here.

The Tax Foundation’s own model of state/local tax burdens ranks Illinois lower, but still in the top 10. The group calculates that Illinoisans pay 11 percent of their income to state/local taxes every year. The difference between the Tax Foundation’s findings and those of WalletHub’s stem from a difference in methodology.

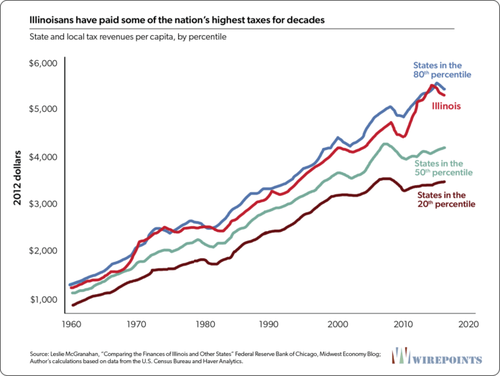

The Tax Foundation’s ranking matches closely with a separate analysis by economist Leslie McGranahan of the Federal Reserve Bank of Chicago. She found that Illinois’ per capita taxes have consistently remained among or near the top 10 states (the 80th percentile) for the past 60 years.

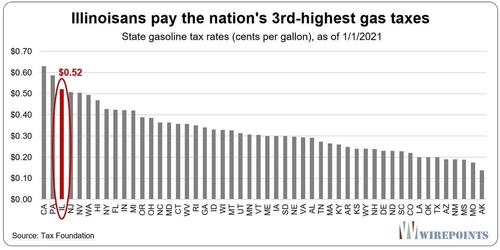

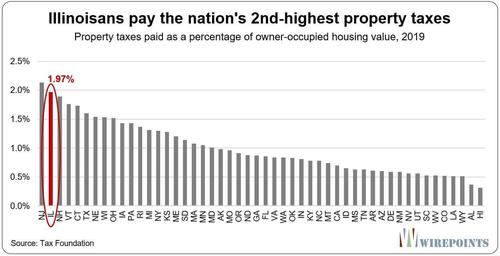

The Tax Foundation’s study ranked states across a variety of taxes and fees. Its data shows Illinois ranks relatively high (18th-highest) in income taxes per capita and in the middle of the pack for sales taxes per capita (27th-highest). But the state’s gas taxes and property taxes are some of the nation’s highest.

Illinoisans now pay the 3rd-highest gas taxes in the nation, behind only California and Pennsylvania. The state and local governments in Illinois now charge more than 50 cents for every gallon of gas pumped.

Property taxes are, of course, Illinois’ most painful tax, and for good reason. The Tax Foundation ranks Illinois property taxes as the nation’s 2nd-highest behind only New Jersey. Illinoisans pay nearly 2 percent of their home value each year in property taxes. That’s more than double what our neighbors in Indiana and Kentucky pay.

A separate study by Attom Data Solutions ranks Illinois property taxes as the highest in the nation.

The WalletHub and Tax Foundation releases come just two weeks after Illinois’ new House Speaker Chris Welch suggested lawmakers try for progressive income tax for a second time. Illinois Gov. J.B. Pritzker’s first attempt failed at the ballot in November.

Welch wants higher income taxes to pay for pensions, but Illinoisans soundly rejected the first attempt because they simply don’t trust their politicians. Illinois lawmakers continue to ignore the structural reforms Illinoisans desperately need.

The two new reports give Welch another reason why Illinoisans don’t want a progressive tax: they’re already overtaxed.

Tyler Durden

Mon, 03/15/2021 – 21:50

via ZeroHedge News https://ift.tt/3vBZsEL Tyler Durden