Nomura Warns Stocks Are “Fragile” As Quarter-End Rebalancing Overwhelms ‘Weaponized Gamma’ Horde

With ‘Ramp Capital’ dead, investors are growing anxious that the huge and hotly-anticipated quarter-end rebalancing flows will overwhelm any BTFD enthusiasm (as ‘weaponized gamma’ retail players appear to have jumped ship).

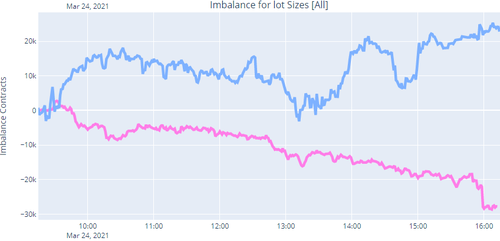

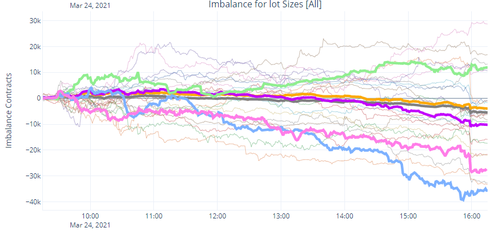

As Nomura’s Charlie McElligott notes this morning, it does indeed look like the much-hyped “pension quarter-end rebalancing” flows are evidencing themselves in the market, effectively VWAP buying TY vs VWAP selling ES over the course of the day the past two sessions, as evidenced by our futures bid-ask “imbalances” monitor across all lot sizes.

Particularly looking at ES (S&P E-Mini) imbalance, we see the last two days (Pink yesterday 3/24, Light Blue 3/23) being two of the four most “sold” of the entire past month window

And this morning we are seeing a similar pattern:

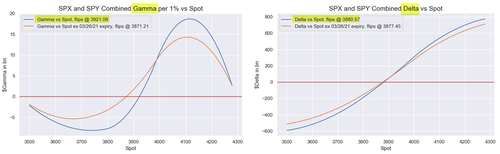

And as we have warned, McElligott note that within US Equities Options positioning, this seeming pension quarter-end rebalancing supply “sell-off” now sees Dealers “short Gamma” vs spot in SPX (Gamma vs Spot, flips at 3921.09—currently -$4.9B, 14.2%Ile), while Delta vs spot is now sitting directly on the “neutral / flip” line (Delta vs Spot, flips at 3880.57)…

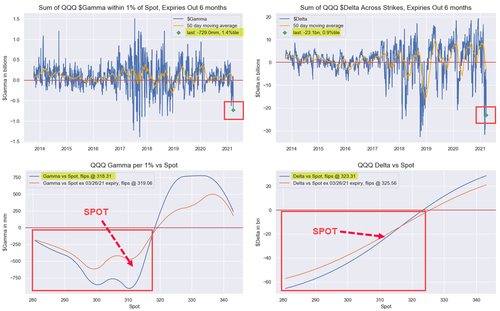

But it is still the cumulative Nasdaq (QQQ) options positioning dynamic which remains so fragile and thus, under the most duress, with $Gamma at -$729mm (1.4%ile) and Dealers “short Gamma” vs spot (neutral line 318.31 vs spot 312.50), while $Delta too is now back to “extreme negative” at -$23.1B (0.9%ile)…

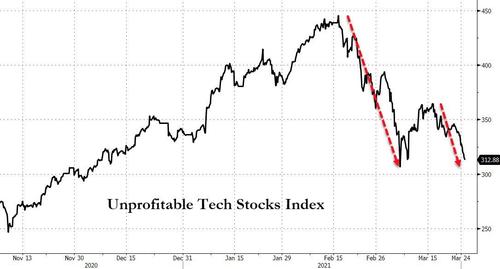

Crucially, McElligott warns that one big problem is that Mega Cap Tech exposure has been reduced into not just the “Cyclical Value” rotation on “reflation renormalization + stimulus” narrative…but also, the past year’s speculative euphoria into “Unprofitable Hyper-Growth” stocks as well…

HOWEVER, the leak in the “Speculative Frenzy / Unprofitable” stocks has now accelerated in the recent trading window:

-

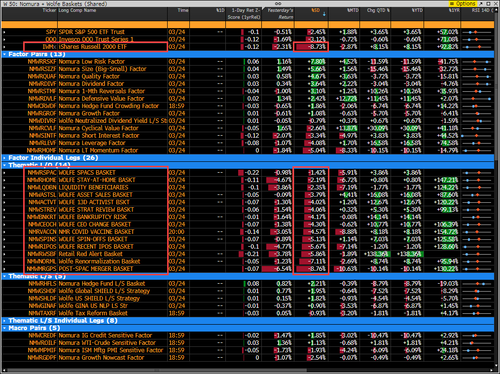

Wolfe “Bankruptcy Risk” basket -5.0% over past 2 sessions

-

ARKK Innovation ETF -6.2% 2d move

-

Wolfe “Retail Red Alert” basket -7.2% 2d move

-

Wolfe “Recent IPOs” basket -7.2% 2d move

-

Wolfe “Post-SPAC Merger” basket -10.0% 2d move

-

“High Realized Vol” basket -13.4% 2d move

-

As of yesterday’s close, 140 of 190 names in the Wolfe “SPACs” basket are trading below the $10 quasi-threshold

-

Additionally, we see Bitcoin mired in its longest consecutive day losing streak since Dec and is now -14.5% since making all-time highs just two weeks ago

And this too is also part of the theory behind the rollover in total US Equities Call options volumes as the Retail “weaponized Gamma” horde steps back after lighting so much premium on fire with deep OTM upside purchases over the past 1.5 months , much of which has expired worthless

Finally,as we previously noted, there is another reason why call-buying is fizzling out: Daytraders are learning and adapting, and instead of amplifying their returns with leverage (call-buying overlays), they are hedging their positions… which removes one more marginal enabler of the meltup.

And unless Powell and his pals accelerate the buying once more, we suspect the markets will really throw a tantrum.

Source: Bloomberg

Get back to work Mr.Powell. The market will never be satiated as former Dallas Fed president Richard Fisher’s previously warned:

“[The Fed] cannot live in fear that gee whiz the market is going to be unhappy that we are not giving them more monetary cocaine.“

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, and even 2007-2009.. and have only seen a one-way street… of course they’re nervous.”

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?”

“…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

Tyler Durden

Thu, 03/25/2021 – 08:52

via ZeroHedge News https://ift.tt/3d41iWq Tyler Durden