Non-Profitable Companies Implode Amid Flashbacks Of The Dot Com Crash

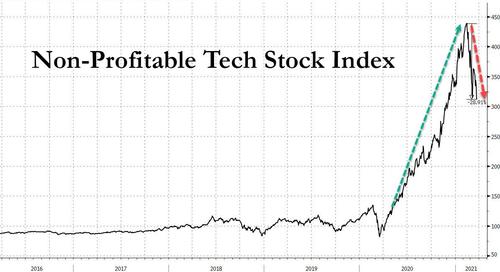

At the start of February, when the dual short squeezes of option gamma and WallStreetBets meme stocks were all the rage, a chart from Goldman indexing non-profitable tech companies was making the rounds across Wall Street desk; it showed the sector’s tremendous ascent since the Fed’s panicked response to the covid crisis, which more than quadrupled the return of this index.

Well, in the past month, things have gotten uglier, and at one point this morning, the index had plunged more than 30% from its February peak (now down 28.8%) after tumbling a whopping 7% yesterday.

Commenting on this furious reversal and the chart above, this morning Rabobank’s Michael Every – who evoked Jaws in his daily post for several other reasons – said “do you know what the graph of that particular market segment is starting to look like to me? A shark’s fin: and if that is indeed the case, we would soon see happy young traders suddenly pulled underwater and tossed around like rag dolls.”

Of course, this won’t be the first time “happy young traders are pulled underwater”, nor the first time that unprofitable companies explode higher only to crash immediately after. While many current traders won’t remember, and many may not even have been alive, an almost identical pattern presented itself in the run up to the bursting of the dot com bubble.

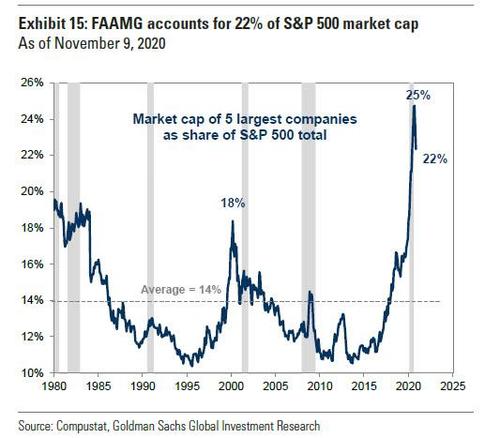

There are other reasons why the current market is “evoking memories of the dot-com crash” as Bloomberg notes this morning. One among them is the growing revulsion to the sector that in many ways defined 2020 – the FAANG names, which at one point last year account for a quarter of all market cap.

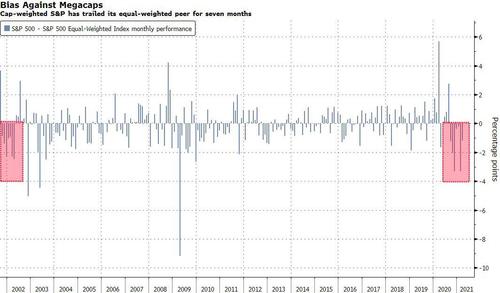

As Bloomberg’s Elena Popina writes in the daily Taking Stock colimn, “when the hegemony of the FAANG stocks cracked in September, it was a welcome reprieve for investors who watched a handful of names rule the market all year. Now it’s March, and the streak of under-performance by stocks with megacap bias is becoming historic.”

She refers to an equal-weight version of the S&P 500, which has outperformed its cap-weighted peer for seven months. That’s notable because it has now topped the streak after the financial crisis to become the longest stretch since the dot-com bust, indicating the buildup of a huge anti-megacap bias within the market. Said otherwise, a gauge of mega-cap stocks from Alphabet to Facebook and Netflix has trailed the S&P 500 Index for five out of seven months, as the value reversal kicked in and growth stocks have been left in the dust.

“Mega-cap tech, which dominates the market-cap-weighted index, is not looking as rosy in a post-pandemic world as we shift our consumption from screens to services,” said Max Gokhman, head of asset allocation at Pacific Life Fund Advisors.

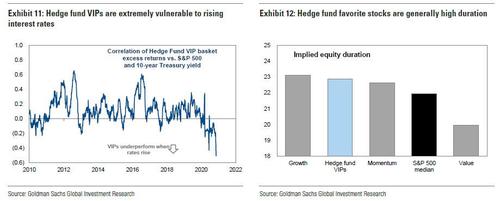

While it’s true that things have changed dramatically for tech stocks since the popping of the Internet bubble some 20 years ago, one thing stays the same: the group’s sensitivity to rising rates which has gotten even bigger. We have repeatedly shown this with a chart demonstrating the “duration” of the growth sector, and just how exposed the hedge fund community is to risk from higher interest rates (i.e. duration).

So going back to the bursting of the dot com bubble, Bloomberg reminds us that in the seven months from late 2001 through April 2002, the under-performance of the cap-weighted S&P 500 Index coincided with rising 10-year yields, which traded north of the 5% mark in the spring of 2002. A similar pattern happened in late 2009-early 2010, when a cap-weighted S&P 500 Index trailed its equal-weighted peer as yields went up.

“The difference this time around is that rates are likely to continue to climb over the long term,” said Matt Maley, chief strategist at Miller Tabak + Co. “In 2002 & 2009, they rolled back over after a couple of months.”

Actually no, Matt, the difference this time is that unlike 2002 and 2009, the Fed is now openly protecting stocks and defending even the dumbest equity investors, which is why Powell’s job (and that of his replacement in 2022) will be fascinating: how does the Fed achieve its two true mandates of runaway inflation (remember: no rate hikes until 2024) while avoiding a full blown crash in the tech sector.

Tyler Durden

Thu, 03/25/2021 – 12:25

via ZeroHedge News https://ift.tt/3feND1u Tyler Durden