Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain

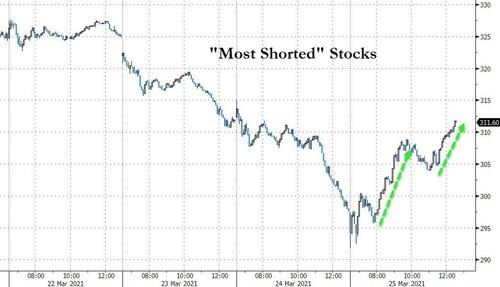

Thanks to yet another big short-squeeze that began shortly ahead of the EU close. This was the biggest short-squeeze since late January.

Source: Bloomberg

Small Caps went from down over 1.5% ahead of the EU close to up over 2.5%. Nasdaq ended lower as late day selling pressure hit…

Before today, the last six days have seen the market has dropped in the last hour.

S&P and Dow are back to unch on the week, Nasdaq remains red and Small Caps still down over 4.3%.

Value outperformed Growth today but both ripped off the EU close…

Source: Bloomberg

Many of the major indices found support at key technical levels.

The S&P broke its 50DMA and ripped back above it…

Nasdaq found support off its 100DMA…

GME exploded higher today, up a shocking 50% plus and erasing all of yesterday’s losses…

The VIX term structure remains unusually steep…

Between lingering pandemic fears, lack of short-sellers & rising T yields, VIX term structure remains unusually steep — showing traders are anticipating more volatility in the future. Both the 3- & 6-month futures contracts cost ~20% more than their historical average@business pic.twitter.com/5fnQQnU7t3

— Danielle DiMartino Booth (@DiMartinoBooth) March 25, 2021

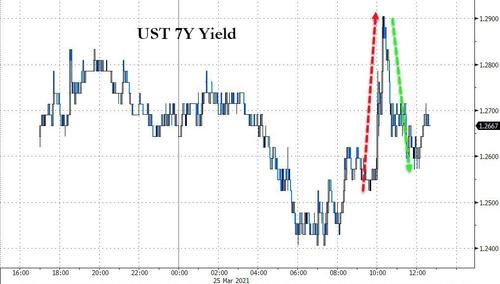

A really ugly 7Y auction today (with a huge tail) sent yields spiking higher…

Source: Bloomberg

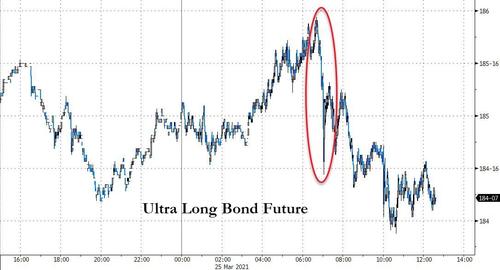

…and that was after an early flash crash – in prices – for the ultra bond futs contract…

Source: Bloomberg

…but by the close the curve was very mixed with the short-end lower (2Y -1bps) and long-end up over 3bps…

Source: Bloomberg

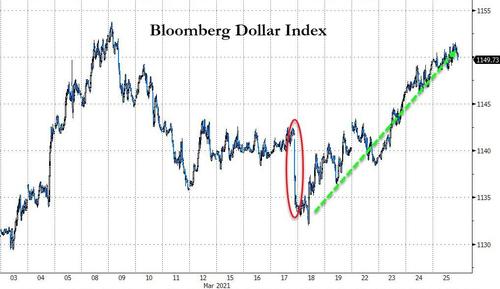

The dollar continued to surge from the post-FOMC plunge lows, now back near early March highs…

Source: Bloomberg

The Polish Zloty fell to its weakest against the Euro since early 2009…

Source: Bloomberg

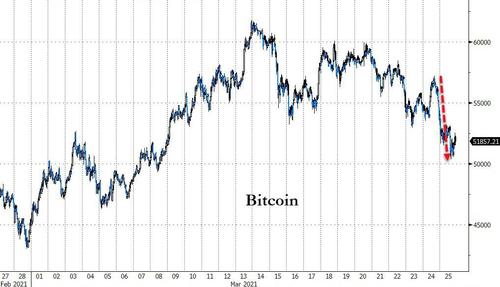

Bitcoin plunged back near $50k today…

Source: Bloomberg

Precious metals were flat today despite dollar gains as crude and copper pushed lower…

Source: Bloomberg

Oil erased all of yesterday’s supposed Suez blockage spike with WTI back below $58…

Silver saw a big tumble intraday and ripped back around the same time as the ultra bond flash crashed…

Gold and the Ultra bond both fell at exactly the same time…

Finally we note that the massive divergence between bond and stock performance this quarter will likely mean some notable rebalance flows in the next few trading days, as we have detailed previously.

Source: Bloomberg

Tyler Durden

Thu, 03/25/2021 – 16:00

via ZeroHedge News https://ift.tt/3riLhAN Tyler Durden