ARK Funds Amend ETF Prospectus To Remove Investment Concentration Limits

We have been following the volatility with flows in and out of ARK Funds over the last few months, make note of Cathie Wood’s performance and “proprietary” investing style as the NASDAQ has whipsawed back and forth for the better part of 2021.

Now, it looks like ARK is making some changes in its disclosures commensurate with its recent “active investing style”, wherein it has been rotating out of large cap tech names and into smaller, more speculative names, especially in its ARKK flagship fund.

ARK funds filed an amendment to its prospectuses for its ETFs on Friday, making some little recognized changes that were caught by @syouth1 on Twitter over the weekend.

First screencap shows language that was removed re ownership of ADRs, warrants, etc. (in red). Second shows language removed re limits on investing 30%+ of assets in a single firm and investing in 20+% of firm’s shares (also encircled in red). Source: https://t.co/yDVAHJTf6Y pic.twitter.com/ZJUlRSxQ5n

— Jeffrey Ptak (@syouth1) March 26, 2021

As the tweet notes, the new ARK SEC filing does several things. First, on a perfunctory note, it specifies risks related to investing in SPACs, noting that they are “subject to a variety of risks beyond those associated with other equity securities”.

Special Purpose Acquisition Companies (SPACs). The Fund may invest in stock of, warrants to purchase stock of, and other interests in SPACs or similar special purposes entities. A SPAC is a publicly traded company that raises investment capital for the purpose of acquiring or merging with an existing company. Investments in SPACs and similar entities are subject to a variety of risks beyond those associated with other equity securities. Because SPACs and similar entities do not have any operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the SPAC’s management to identify a merger target and complete an acquisition. Until an acquisition or merger is completed, a SPAC generally invests its assets, less a portion retained to cover expenses, in U.S. government securities, money market securities and cash and does not typically pay dividends in respect of its common stock. As a result, it is possible that an investment in a SPAC may lose value.

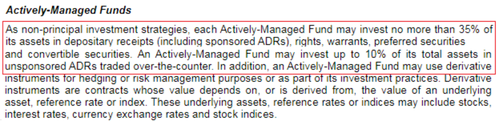

But then the filing gets very interesting – language is removed that allows ARK funds to take even larger concentrations in names – in addition to over-the-counter traded ADRs, which are notoriously riskier products than normal equity.

The amendment removes ARK’s limit to invest 10% of its total assets in any active fund in ADRs that are traded over-the-counter.

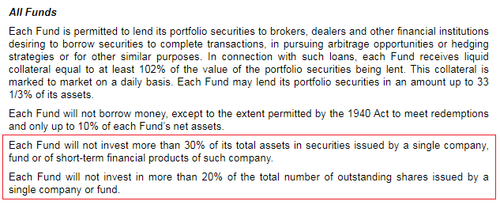

On top of that, the amended prospectus removes language that formerly limited ARK to investing no more than 30% of a fund’s total assets into securities issued by a single company. Another “rule” removed was language preventing ARK from investing in more than 20% of a company’s total outstanding shares.

The amendments portend ARK piling further into concentrated, high-risk names that dominate their respective funds. Wood’s recent rotation out of big cap names like Microsoft and into “speculative” smaller cap companies like Workhorse and Vuzix has made it clear that the firm’s appetite for risk continues to grow as NASDAQ volatility continues.

Obviously, if a pin is finally going to prick the NASDAQ gamma bubble that has blown up over the last 12 months, the higher Wood’s concentration in speculative names, the more spectacular a crash would be for ARK funds.

But for now, ARK continues to hold up – we noted it will be launching its Space ETF as soon as this week. And despite noting that the NASDAQ gamma squeeze appears to be over, Wood and her team seem hell bent on continuing to tempt fate. We’ll keep a close eye on the situation going forward.

Tyler Durden

Mon, 03/29/2021 – 10:24

via ZeroHedge News https://ift.tt/31rX3P5 Tyler Durden