Zero Lessons Learned: Stock Buybacks Soar To All Time High

One would have hoped that if the global financial community had learned one lesson from the covid crisis, it would be that companies would be far less reckless when repurchasing billions in shares – all with the express purpose of making shareholders and management richer – while levering up and exposing themselves to catastrophic risk, usually culminating in taxpayer bailout requests as the following headline from just over a year ago summarized so well.

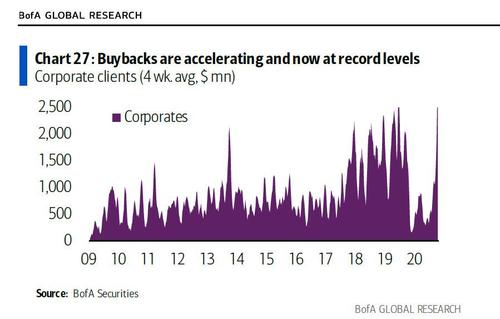

Alas, we are dealing with Wall Street, and if there is one lesson above all to be learned, it is that any secondary lessons that leads to less revenue are quickly forgotten. Which brings us to the latest Client Flow report, where we learned that despite a very modest slowdown vs the prior week, the recent resurgence in stock repurchases means that the four-week average buybacks are now at a record high in BofA’s data going back to June 2009…

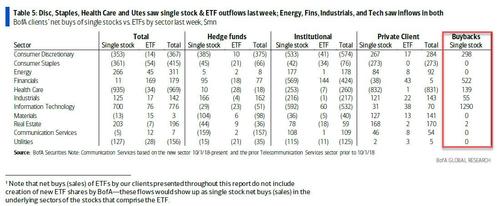

… driven by Tech as usual, although helped by a pick-ups in Cons Disc., Financials, and Health Care as well.

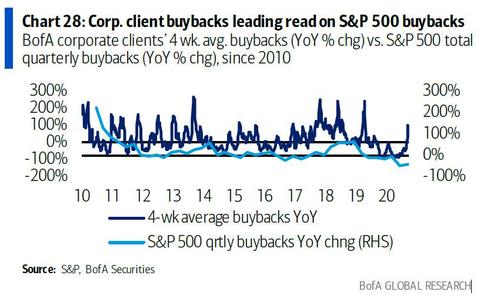

More amazing yet is that YTD, buybacks – most of which remain debt funded (by the very same companies that will demand a bailout once the market tumbles and they again face bankruptcy) are now on-pace with levels at this time last year.

In short: not only is everything back to abnormal, but we now have full-blown buyback mania back coupled with the Fed injecting $120BN in liquidity every month until at least 2022. For those who somehow think that this makes for a prudent shorting combination, our condolences.

Tyler Durden

Mon, 03/29/2021 – 13:00

via ZeroHedge News https://ift.tt/3rtIgO9 Tyler Durden