Cryptos Jump, Small Caps Dump As ‘Archegeddon’ Hits Banks, Bonds, & Bullion

It’s Margin Madness…

Ever Given was freed, but Archegos anxiety provided just enough uncertainty to spook investors about where the next hit is coming from…“… be first, be smartest, or cheat… sell it all…”

There’s more than a little about this #Archegos blow-up that feels familiar. Including the degree to which counterparties possibly accelerated and intensified the sell-off. Then again, when you’re facing a likely stampede, being first to unload is a huge advantage. #investment pic.twitter.com/r693FXTR1P

— Grey Value Management (@GreyValue) March 29, 2021

Futures opened weak and stayed so throughout the Asia session as investors sold first and thought later amid Bill Hwang’s bloodbath (and contagion chatter). Europe brought some buying as the machines managed to get futures back to unch just in time for the US cash open which sparked a big puke (led by Small Caps). Stocks then bounced at the EU close, faded, and then ramped again as Morgan Stanley said it had no more blocks to sell. That bounce did not last as headlines hit into the last hour of Wells Fargo selling blocks. But… in an echo of Friday, everything went vertical in the last half hour… The Dow ended the biggest gainer, Small Caps were ugly, ending at the lows of the day despite the attempted bounce…

China tech stocks lost the ground they gained in the last hour manic-buying from Friday…

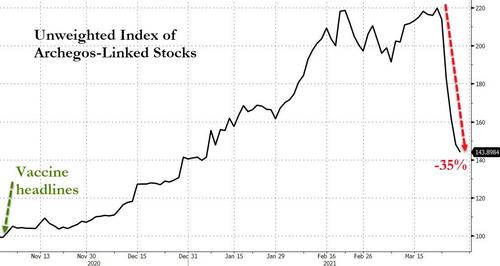

Hwang’s horde of over-levered stocks extended losses today…

Source: Bloomberg

ViacomCBS – which was clubbed like a baby seal on Friday – saw no dead cat bounce and lost further ground…

Defensives dominated price action today (but again everything reversed at the EU close)…

Source: Bloomberg

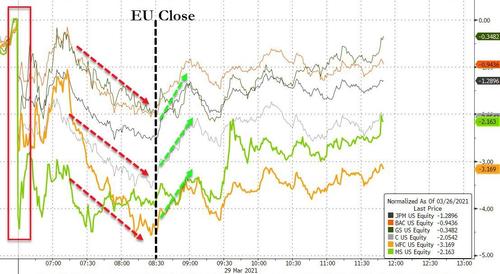

US Bank stocks were ugly (MS, WFC worst on the day extending their losses from Friday)..

Source: Bloomberg

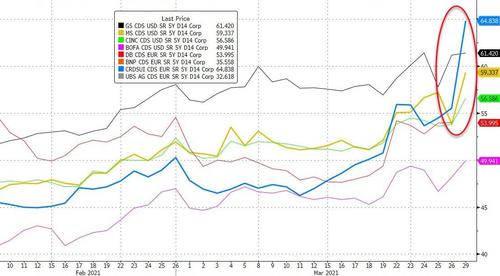

But the real anxiety was in broker CDS…

Source: Bloomberg

With Credit Suisse 1Y risk exploding (this is where derivatives counterparty risk managers would focus their hedges)…

Source: Bloomberg

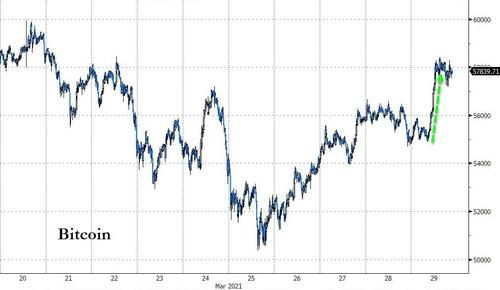

Amid this shitshow, cryptos were bid (safe haven) with Bitcoin back above $58,000…

Source: Bloomberg

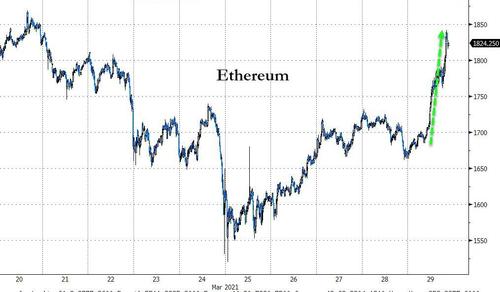

And Ethereum outperforming, spiking near $1850…

Source: Bloomberg

While cryptos were bid, bonds were battered – even as stocks sank and quarter-end rebalancing flows should have been supportive. Some suggested the sales were more liquidations as funds sold anything liquid to meet margin calls (the velocity and urgency of the move suggests that or major rate-locks ahead of some serious issuance)…Selling surges hit at the European open, the US open and after MS said block sales were done…

Source: Bloomberg

10Y Yields spiked back above 1.70%…

Source: Bloomberg

The dollar was a mess today, chopping around but ending marginally higher vs its fiat peers…

Source: Bloomberg

Oil prices remained in their recent range, tumbling on the good news that the Ever Given was freed and the Suez Canal was reopened, but a dip near $60 in WTI sparked a sudden buying urge among ‘traders’…

Gold was dumped early on too (at the US cash open) which again had the smell of forced liquidation flows…

Silver tumbled back below $25, near that spike low liquidation we saw earlier in the week…

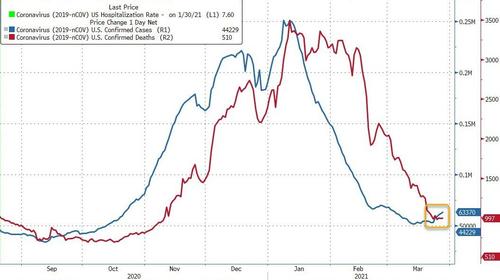

Finally, it’s definitely time to panic – according to the CDC – who took one look at this chart and warned all Americans of “impending doom”…

Source: Bloomberg

President Biden urged some states to pause reopening… just don’t tell him about Texas!

Source: Bloomberg

Tyler Durden

Mon, 03/29/2021 – 16:01

via ZeroHedge News https://ift.tt/3dm8hKx Tyler Durden