Stocks Crushed By Archegos Blowup Start Announcing Buybacks, Spike In Premarket

One of the biggest shocks in the aftermath of the Archegos margin call and hedge fund/prime broker blow up, is that the companies that have been swept in the “bath water” liquidation, who in the past had been aggressive buyers of their own stock, had remained suspiciously, almost ominously quiet and made no announcement about stabilizing their share prices by repurchasing their own stock as a result of the forced liquidations.

What made matters even more confusing is that the event that triggered this whole fiasco was Viacom’s stock sale exactly one week ago when Viacom raised $3BN in new capital, including the sale of 20MM shares of common stock at a price of $85. Well, with VIAC stock now trading at roughly half that price, we said two days ago that Viacom should immediately repurchase the same amount of stock not only for an immediate accounting gain but also to show support and belief in its own value.

VIAC stock is now trading at half the price where the company sold 20MM shares at $85 less than a week ago. The company should immediately announce a 20MM (or more) stock buyback

— zerohedge (@zerohedge) March 29, 2021

And while literally moments later, Tencent did announce a $1 billion buyback…

Here we go: TME first, VIAC, DISCA and all the others on deck. pic.twitter.com/jWnnTJ250g

— zerohedge (@zerohedge) March 29, 2021

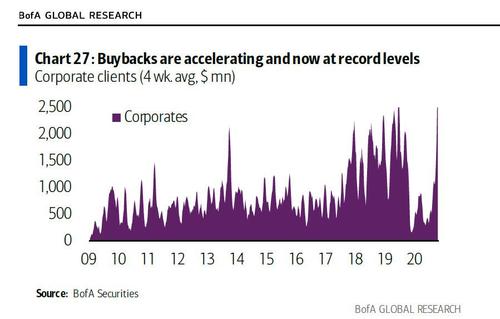

… so far media giants DISCA and VIAC have remained silent, much to out continued amazement, because while stock buybacks are now back at all time highs – as if the Covid crisis never happened – with the market back at a record, as we showed yesterday…

… they are missing where they are needed the most – when stocks tumble and when management should give demonstrate faith in its own value.

How have DISCA and VIAC not announced accelerated buybacks yet?

— zerohedge (@zerohedge) March 29, 2021

Yet while we wait for Viacom and Discovery to do the right thing, other companies swept up in the Archegos liquidation are stepping up, and in addition to the Tencent Music $1BN buyback noted above, this morning we also got news that Vipshop, one of the companies hammered by the forced unwind of Archegos announced a $500MM stock buyback, sending its stock sharply higher…

… and moments later, GSX Techedu ADR also soared as much as 9% in premarket trading after saying its founder, Chairman and CEO Larry Xiangdong Chen, announced he intends to use his personal funds to purchase up to $50 million of the company’s shares over the next 12 months. Chen said the company had repurchased $39.8 million of its shares under its up to $150 million share-repurchase program, and said he currently has not pledged any of his equity interest in the Company.

We expect every other name that has been hammered by the Archegos blow up to duly follow suit and to announce their own buybacks or else investors will suspect that something is far more broken with the underlying business and the far lower stock price is justified by something more than just a forced liquidation…

Tyler Durden

Tue, 03/30/2021 – 08:31

via ZeroHedge News https://ift.tt/3wb8714 Tyler Durden