1.8 Million Jobs On Friday?

Treasury yields blew out overnight (with the belly in particular feeling the heat: 5s +5.5bps, 10s +6.0bps) during the Asian session in continuation of yesterday’s move higher, as the usual suspects – Japanese commercial banks – resumed selling in droves (see “Morgan Stanley Identifies The Source Of Massive Treasury Selling“), although it wasn’t clear what if any catalyst sparked the selling.

Trying to make some sense of the latest move in yields Nomura’s Charlie McElligott offered three reasons for the return of the reflation theme:

- vaccine renormalization

- fiscal stimulus now circulating into the “real economy”, and

- the expected large upside surprise in Friday’s NFP data now increasingly being priced-in, whose release McElligott notes “comes dangerously on the illiquid ‘Good Friday’ holiday-shortened session, risking a disorderly move”

We won’t focus much on topics 1 and 2 which we have covered extenisvely elsewhere on multiple occasions, but instead we will preview what may be a truly blockbuster payrolls report on Friday, coming right at a time when stocks are closed and when bonds are open only until noon.

So why focus on Friday’s jobs report? Because one month after the February Payrolls printed at 379K, nearly double the consensus estimate of 198K, Wall Street expects the labor market to resume its torrid upward trajectory with a whopping 650K print.

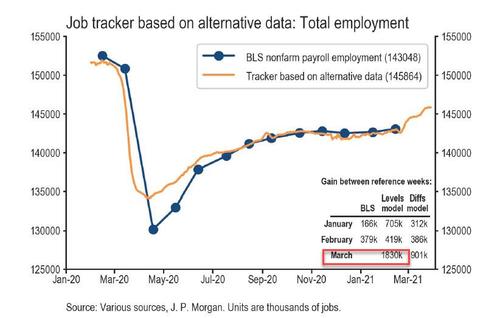

While on the surface this will likely send yields sharply higher as it provides fresh fuel to the reflation narrative, a chart published today by JPMorgan took our breath away. In the bank’s latest “quant and econ dashboard report”, JPMorgan compares the BLS payrolls series with its own alternative data-based tracker of jobs data. Remarkably, it found that after a period of almost uniform convergence between the two series, the March “alternative data” print was a whopper, one which implies the matched BLS print will be around 1.8 million jobs!

To be sure there are several other reflationary considerations laid out by McElligott, which we note below…

- With the market sniffing the pull-forward of US QE taper in addition to then likelihood of “front-loaded” Fed hikes, 5s are in a really tricky spot, and this is why 5s30s—which was really the “reflation steepener” of choice for so long last year—has now actually stalled-out, sitting around this 1.50 level for approximately two months now

- The better the reopening data gets, the more likely it is that we more of this inflection from phase 1 steepening “reflation feel-good” as the long-end reflects higher growth- and inflation- expectations, to the phase 2 flattening “Fed tightening” stage, where the front-end / belly leading the repricing ahead of Fed policy adjustment—with the potential for this to begin evidencing itself to markets by the time of the next Fed SEP in June potentially needing to reflect an improved forecast

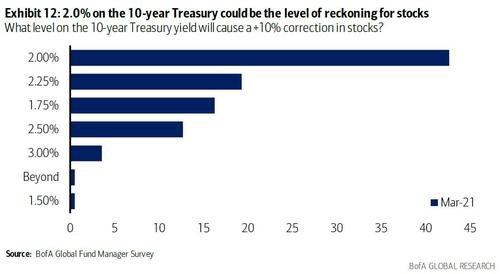

In this context, imagine what happens to the 10Y – and certainly the belly and the 5Y – if we do get a 1.8MM print (which has quickly emerged as the whisper number for Friday), smashing expectations by 3x, and unleashing a volley of TSY selling as the herd panics and dumps Treasurys faster than you can say a “failed 7Y auction.” Perhaps the only question in this “blowout payrolls” scenario is whether the 10Y – which today rose as high as 1.78% will find support at 2.00% or will it blow out above the level most on Wall Street (according to the latest BofA Fund Manager Survey)…

… agrees is the trigger for chaos not just in the bond but also stock market.

Tyler Durden

Tue, 03/30/2021 – 18:45

via ZeroHedge News https://ift.tt/3sBYTIR Tyler Durden