Dollar Dump Sparks Bid For Bonds, Bullion, Bitcoin, & Big-Tech

The Dollar resumed its freefall today, back to pre-FOMC plunge levels today…

Source: Bloomberg

…and it’s gone…

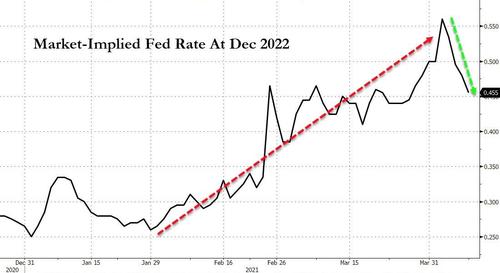

The short-term rates market continued its dovish reversal, now expecting over 10bps less tightening by the end of 2022…

Source: Bloomberg

And that helped send the S&P to a new record high (Nasdaq outperformed on the day and Small Caps managed solid gains are plunging at the cash open)…

Small Caps are glued to their 50DMA…

Growth has ripped back, erasing all of its relative weakness to value since the end of Feb…

Source: Bloomberg

“Most Shorted” Stocks were generally flat today as hedge funds’ favorite stocks ripped…

Source: Bloomberg

As the dollar dump returns, Gold rallied back above $1750 to its highest since late February today…

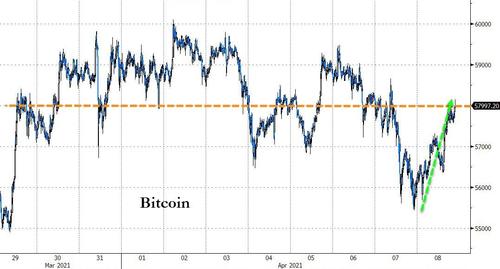

Bitcoin ripped back above $58,000 today…

Source: Bloomberg

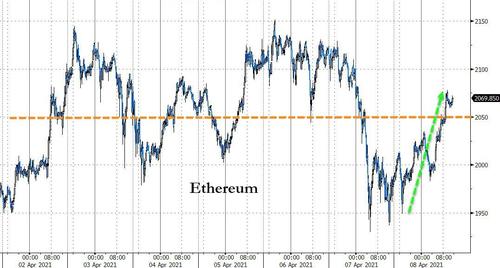

And Ethereum spiked back above $2050…

Source: Bloomberg

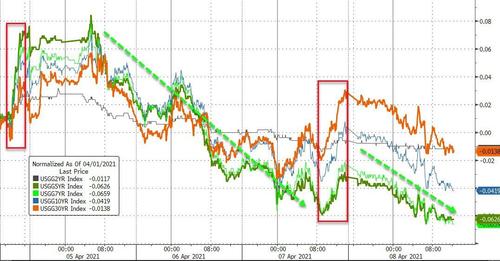

Bonds were bid, pushing 30Y yields lower since the Thursday equity close (remember bonds were open around the payrolls print)…

Source: Bloomberg

10Y Yield dropped back below 1.65% (so much for the spike in yields from payrolls)…

Source: Bloomberg

WTI was unable to get back above $60 today, despite the dollar weakness…

Silver jumped back above $25 this week and is extending gains…

Finally, it’s probably nothing but a United Nations gauge of global food prices climbed for a 10th month in March, driven higher by costlier vegetable oils, meat and dairy. This the highest level since June 2014…

Source: Bloomberg

Oh, and don’t pay any attention to this (for the first time ever, the S&P 500 is trading 3x Price-to-Sales)… it’s probably nothing too…

Source: Bloomberg

Oh, and for the first time ever, the US equity market cap is twice that of US GDP…

Source: Bloomberg

Tyler Durden

Thu, 04/08/2021 – 16:00

via ZeroHedge News https://ift.tt/3dR5ucx Tyler Durden