‘Poorest’ Americans Hit Hardest By Post-Pandemic ‘K-Shaped’ Inflation Surge

As long as you don’t eat food, use energy, or clean your home (assuming you are not homeless), the pandemic has been good to you.

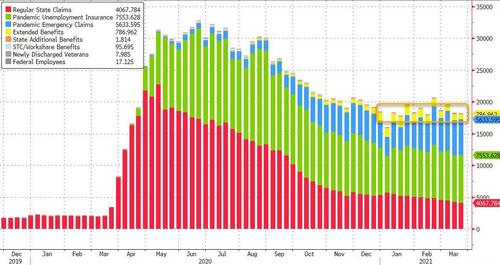

For low-income Americans, it has been a double-whammy of job losses (the total number of Americans receiving jobless benefits from the government has basically stagnated for the last four months)…

Source: Bloomberg

…and significant increases in the costs of living.

As Bloomberg reports, while the headline consumer inflation rate in the U.S. remains subdued, at 1.7% – but it masks large differences in what people actually buy.

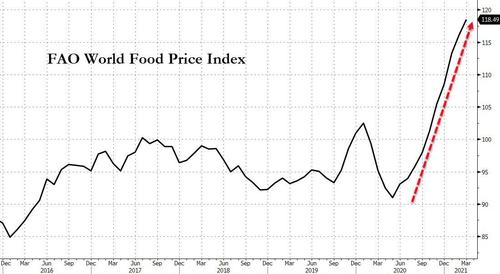

If you like to eat, food-price inflation is running at more than double the headline rate, and staples like household cleaning products have also climbed.

Source: Bloomberg

if you drive a car, gas prices have soared in recent months…

Source: Bloomberg

All of which might explain why confidence among the lowest income Americans is lagging significantly (because groceries or gas take up a bigger share of their monthly shopping basket than is the case for wealthier households, and they’re items that can’t easily be deferred or substituted)…

Source: Bloomberg

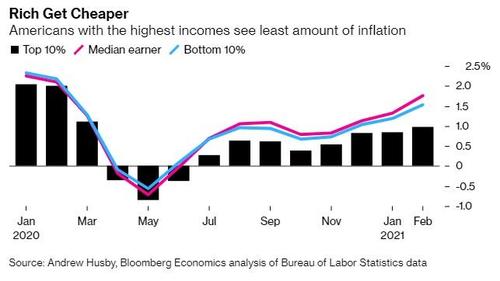

An analysis by Bloomberg Economics, which reweighted consumer-price baskets based on the spending habits of different income groups, found that the richest Americans are experiencing the lowest level of inflation.

As Bloomberg‘s Andrew Husby points out:

“On average, higher-income households spend a smaller fraction of their budgets on food, medical care, and rent, all categories that have seen faster inflation than the headline in recent years, and 2020 in particular.”

The question of who exactly gets hurt most by higher prices could become more urgently concerning as most economists – and even The Fed itself – expect inflation to accelerate in the next 12 months.

“The food price story and inflation story are important to the issue of equality,” says Carmen Reinhart, the World Bank’s chief economist.

“It’s a shock that has very uneven effects.”

So, in summary, The Fed is telling Americans – ignore “transitory” spikes in non-core inflation (such as food and energy), it’s just temporary and base-effect-driven (oh and we have the “tools” to manage it). However, despite all The Fed’s pandering and virtue-signaling about “equity” and “fairness”, it is precisely this segment of the costs of living that is crushing most of the long-suffering low-income population ($1400 checks or not).

And now all eyes will be on this morning’s PPI print which is expected to surge to +3.8% YoY.

Tyler Durden

Fri, 04/09/2021 – 07:40

via ZeroHedge News https://ift.tt/31XlJ1R Tyler Durden