SEC Warns SPAC Backers They Can’t Bypass Securities Laws

As we noted earlier this week, it appears the days of SPACs debuting a dozen at a time, what many had speculated might be the peak of SPAC-mania, are over. Only a handful of new deals hit public markets this week.

On Friday morning, the FT reported that one reason for the slowdown appears to be a declining appetite for institutional financing from institutional investors like Fidelity and Wellington Management, which have poured billions of dollars into so-called “PIPE” vehicles, a critical aspect of SPAC dealmaking.

SPACs raise money from public markets during their debut, but getting a deal done typically requires an infusion of private capital, often from a variety of sources.

“There is a lot of indigestion,” said one senior bank executive. “The pendulum has swung to where if you’re in the market with a Pipe right now, it’s going to be really hard and painful. A Spac goes back into the ocean if you can’t get a Pipe done.”

As the market for SPACs hits the skids for the first time since the start of the current boom, which started with Chamath Palihapitiya taking Virgin Galactic public. Asked back in February about why he opted for the SPAC route, Richard Brandon, the legendary British businessman and Virgin founder, chalked it up to “impatience.” “The SPAC gets through all of the rigmarole of public companies. Yes, I thought, that’s great, let’s do it.”

Apparently, it’s exactly this attitude that has inspired the SEC’s latest admonition for SPAC sponsors.

In a letter, the SEC advised that blank-check companies aren’t an end-around to avoid disclosing key information to investors.

This isn’t the first time the SEC has issued a public warning about the SPAC boom (it issued an alert about celebrity-sponsored SPACs back in March) before word got out that the agency was asking banks and others working on the deal tough questions about compliance and investors protections.

John Coates, acting director of the SEC’s corporate finance division, said that despite their unique structure, special purpose acquisition companies are covered by federal securities rules. Claims that promoters face less legal liability than a traditional public offering are “uncertain at best,” he said. The agency has been warning for months that projections released by SPACs often aren’t reliable, and that individual investors often might not be fully apprised of the risks.

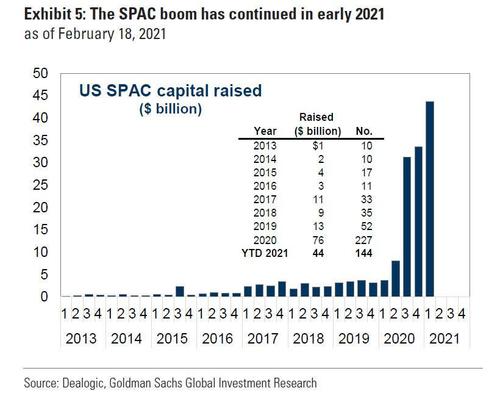

SPAC shares have seen decidedly mixed performance this year, which could be one reason for the slowdown in issuance. About 300 SPACs launched on U.S. exchanges in Q1, raising almost $100 billion. That total was more than all of last year.

In the letter below, the SEC lays out exactly how securities laws apply SPACs, and why SPACs must be careful to disclose all risks to public investors.

Over the past six months, the U.S. securities markets have seen an unprecedented surge in the use and popularity of Special Purpose Acquisition Companies (or SPACs).[1],[2] Shareholder advocates – as well as business journalists and legal and banking practitioners, and even SPAC enthusiasts themselves[3] – are sounding alarms about the surge. Concerns include risks from fees, conflicts, and sponsor compensation, from celebrity sponsorship and the potential for retail participation drawn by baseless hype, and the sheer amount of capital pouring into the SPACs, each of which is designed to hunt for a private target to take public.[4] With the unprecedented surge has come unprecedented scrutiny, and new issues with both standard and innovative SPAC structures keep surfacing.

The staff at the Securities and Exchange Commission are continuing to look carefully at filings and disclosures by SPACs and their private targets. As customary, and in keeping with the Division of Corporation Finance’s ordinary practices, staff are reviewing these filings, seeking clearer disclosure, and providing guidance to registrants and the public. They will continue to be vigilant about SPAC and private target disclosure so that the public can make informed investment and voting decisions about these transactions.

The basics of a typical SPAC are complex, but can be simplified as follows. A SPAC is a shell company with no operations. It proceeds in two stages. In the first stage, it registers the offer and sale of redeemable securities for cash through a conventional underwriting, sells them primarily to hedge funds and other institutions, and places the proceeds in a trust for a future acquisition of a private operating company.[5] Initial investors also commonly obtain warrants to buy additional stock as at a fixed price, and sponsors of the SPAC obtain a “promote” – greater equity than their cash contribution or commitment would otherwise imply – and their promote is at risk. If the SPAC fails to find and acquire a target within a period of two years, the promote is forfeited and the SPAC liquidates. About ten percent of SPACs have liquidated between 2009 and now.[6]

But most SPACs since 2009 have gone on to identify acquisition candidates. In their second stage, SPACs complete a business combination transaction, in which the SPAC, the target (i.e., the private company to be acquired), or a new shell “holdco” issues equity to target owners, and sometimes to other investors. SPAC shareholders typically have a vote on the so-called “de-SPAC” transaction, and many investors who purchased securities in the first stage SPAC either sell on the secondary market or have their shares redeemed before or shortly after the de-SPAC. After the de-SPAC, the entity carries on its operations as a public company. In this way, SPACs offer private companies an alternative pathway to “go public” and obtain a stock exchange listing, a broader shareholder base, status as a public company with Exchange Act registered securities, and a liquid market for its shares.

With that overview, I would like to focus on legal liability that attaches to disclosures in the de-SPAC transaction. Some – but far from all – practitioners and commentators have claimed that an advantage of SPACs over traditional IPOs is lesser securities law liability exposure for targets and the public company itself. They sometimes specifically point to the Private Securities Litigation Reform Act (PSLRA) safe harbor for forward-looking statements, and suggest or assert that the safe harbor applies in the context of de-SPAC transactions but not in conventional IPOs.[7] This, such observers assert, is the reason that sponsors, targets, and others involved in a de-SPAC feel comfortable presenting projections and other valuation material of a kind that is not commonly found in conventional IPO prospectuses.

These claims raise significant investor protection questions. Are current liability protections for investors voting on or buying shares at the time of a de-SPAC sufficient if some SPAC sponsors or advisors are touting SPACs with vague assurances of lessened liability for disclosures? Do current liability provisions give those involved – such as sponsors, private investors, and target managers – sufficient incentives to do appropriate due diligence on the target and its disclosures to public investors, especially since SPACs are designed not to include a conventional underwriter at the de-SPAC stage? Moreover, is it appropriate that the choice of how to go public may determine or be determined by liability rules?

To be sure, projections are woven into the fabric of business combinations. They of course help “sell” the deal, but they can also be a key component for boards and other participants in negotiating and understanding the economics – indeed, the fairness – of the transaction. Moreover, state law, such as in Delaware, may require disclosure of projections used by the boards or their advisors in these transactions.[8] Participants and their advisors are used – and expect – to prepare and disclose projections in acquisitions, including de-SPACs. I fear, though, that participants may not have thought through all the legal implications of these statements under the circumstances of these transactions.

It is not clear that claims about the application of securities law liability provisions to de-SPACs provide targets or anyone else with a reason to prefer SPACs over traditional IPOs. Any simple claim about reduced liability exposure for SPAC participants is overstated at best, and potentially seriously misleading at worst.[9] Indeed, in some ways, liability risks for those involved are higher, not lower, than in conventional IPOs, due in particular to the potential conflicts of interest in the SPAC structure.

More specifically, any material misstatement in or omission from an effective Securities Act registration statement as part of a de-SPAC business combination is subject to Securities Act Section 11. Equally clear is that any material misstatement or omission in connection with a proxy solicitation is subject to liability under Exchange Act Section 14(a) and Rule 14a-9, under which courts and the Commission have generally applied a “negligence” standard.[11] Any material misstatement or omission in connection with a tender offer is subject to liability under Exchange Act Section 14(e). De-SPAC transactions also may give rise to liability under state law. Delaware corporate law, in particular, conventionally applies both a duty of candor and fiduciary duties more strictly in conflict of interest settings, absent special procedural steps, which themselves may be a source of liability risk.[12] Given this legal landscape, SPAC sponsors and targets should already be hearing from their legal, accounting, and financial advisors that a de-SPAC transaction gives no one a free pass for material misstatements or omissions.

What about the Private Securities Litigation Reform Act? Does that provide de-SPAC participants with protections in private litigation that are not available in a conventional IPO? Any answer to that question should note the limits of the safe harbor in the PSLRA. The safe harbor only applies in private litigation, and does not prevent the Commission from taking appropriate action to enforce the federal securities laws. Even if the safe harbor clearly applies, its procedural and substantive provisions do not protect against false or misleading statements made with actual knowledge that the statement was false or misleading. A company in possession of multiple sets of projections that are based on reasonable assumptions, reflecting different scenarios of how the company’s future may unfold, would be on shaky ground if it only disclosed favorable projections and omitted disclosure of equally reliable but unfavorable projections, regardless of the liability framework later used by courts to assess the disclosures. The safe harbor is also not available if the statements in question are not forward-looking. Statements about current valuation or operations have been viewed as outside the safe harbor by some courts, even if they are derived from or linked to forward-looking projections or statements.[13] Nor is the safe harbor available unless forward-looking statements are accompanied by “meaningful cautionary statements” identifying important factors that could cause actual results to differ materially from those in the forward-looking statements.

Despite all of this, it may still be thought that the PSLRA offers something for SPACs not available to conventional IPOs. But that, too, is uncertain at best. The PSLRA was passed by Congress in 1995 to stem what was considered to be a rising tide of frivolous or unwarranted securities lawsuits aimed at operating companies filing routine annual and quarterly reports under the Exchange Act. At the time, companies were thought by some to be reluctant to provide forward-looking information at least in part due to the prevalence of so-called strike suits which, irrespective of the merits of the claim, were usually less costly to settle than to fight in court. Congress provided a safe harbor for forward-looking statements made by established, publicly traded, reporting companies. The safe harbor was intended to provide a defense against such suits and provide grounds for summary dismissal. Congress designed the safe harbor generally to permit and even encourage reporting companies to disclose information about future plans and prospects.[14]

But, lest the safe harbor swallow the entire securities disclosure regime, the PSLRA specifically excludes from the safe harbor statements made in connection with specified types of securities offerings. Three of those exclusions are of note: those made in connection with an offering of securities by a blank check company, those made by a penny stock issuer, and those made in connection with an initial public offering. The statute refers to the Commission’s rules defining “blank check company” and to the Exchange Act’s definition of “penny stock.”[15]

By contrast, however, the PSLRA’s exclusion for “initial public offering” does not refer to any definition of “initial public offering.” No definition can be found in the PSLRA, nor (for purposes of the PSLRA) in any SEC rule. I am unaware of any relevant case law on the application of the “IPO” exclusion. The legislative history includes statements that the safe harbor was meant for “seasoned issuers” with an “established track-record.”[16]

What is the upshot of this? In simple terms, the PSLRA excludes from its safe harbor “initial public offerings,” and that phrase may include de-SPAC transactions. That possibility further calls into question any sweeping claims about liability risk being more favorable for SPACs than for conventional IPOs. To be sure, an “IPO” is generally understood to be the initial offering of a company’s securities to the public, and the SPAC shell company initially offers redeemable equity securities to the public when it first registers to raise funds in order to look for and later acquire a target. However, it is also commonly understood that it is the de-SPAC – and not the initial offering by the SPAC – that is the transaction in which a private operating company itself “goes public,” i.e., engages in its initial public offering. Economically, and practically, the private target of a SPAC is a different organization than the SPAC itself. The information, including financial statements, relevant to evaluating the investment changes dramatically in the de-SPAC because the private target has operations unlike the SPAC; and initial SPAC investors commonly have the right to and do sell or have their shares redeemed.

When Congress passed the PSLRA, the path to becoming a public company was fairly simple and standardized. In the last 25 years, companies have been able to raise increasingly large sums privately, and even provide some liquidity to shareholders while remaining private. Multiple paths to dispersed ownership now exist, including not only SPACs, but also direct listings and dual-track IPO/M&A processes. With the large pool of private capital available and the increase in Exchange Act Section 12(g) registration thresholds, a company can remain private and grow significantly without going through a traditional IPO. With all these changes, the appeal of understanding and developing law around economic substance over form may be greater than ever.

The economic essence of an initial public offering is the introduction of a new company to the public. It is the first time that public investors see the business and financial information about a company. As a result, Congress, markets, analysts, and the SEC staff typically treat these introductions differently from other kinds of capital raising transactions. This heightened scrutiny for a company’s first introduction to the public market applies in other contexts as well – such as a company’s first registration of a class of securities under the Securities Exchange Act of 1934 or an A/B exchange offer. An IPO is where the protections of the federal securities laws are typically most needed to overcome the information asymmetries between a new investment opportunity and investors in the newly public company. To be sure, some elements of the SEC’s regulatory regime reflect a recognition that small or new public companies may not be as able to shoulder the costs of all disclosure requirements as older, larger companies. But it remains true that IPOs are understood as a distinct and challenging moment for disclosure.

If these facts about economic and information substance drive our understanding of what an “IPO” is, they point toward a conclusion that the PSLRA safe harbor should not be available for any unknown private company introducing itself to the public markets. Such a conclusion should hold regardless of what structure or method it used to do so. The reason is simple: the public knows nothing about this private company. Appropriate liability should attach to whatever claims it is making, or others are making on its behalf.

To be clear, in the initial offering by a SPAC, when the shell company is first raising funds to finance all (or more commonly a portion) of its hoped-for acquisition of the yet-to-be-named target, disclosures clearly have a role to play under the federal securities laws. Investors need to know about sponsors and their financial arrangements, the procedural protections of the SPAC structure, and what kinds of returns the SPAC is likely to generate for investors absent a de-SPAC transaction or for those who choose to exit before the de-SPAC is completed.[17] But it also is clear that investors at the time of the initial SPAC filing cannot understand all aspects of the long-term value proposition of the offering, precisely because a SPAC does not have operations or a business plan beyond a search for a target.

Where do we go from here? First, and most directly, all involved in promoting, advising, processing, and investing in SPACs should understand the limits on any alleged liability difference between SPACs and conventional IPOs. Simply put, any such asserted difference seems uncertain at best. SPAC sponsors and targets and their affiliates and advisors should already be providing the public with the information material to the investment opportunities a de-SPAC represents, regardless of how the liability analyses ultimately play out. Liability risk is an important feature of the conventional IPO process. If that risk drives choices about what information to present and how, it should not in my view be different in the de-SPAC process without clear and compelling reasons for and limits and conditions on any such difference.

Second, there may be advantages to providing greater clarity on the scope of the safe harbor in the PSLRA. Congress could not have predicted the wave of SPACs in which we find ourselves. It may be time to revisit these issues. For example, the Commission could use the rulemaking process to reconsider and recalibrate the applicable definitions, or the staff could provide guidance explaining its views on how or if at all the PSLRA safe harbor should apply to de-SPACs. If the Commission or staff pursue that route, however, it would be important to keep the practicalities of SPACs in mind, in addition to other aspects of SPAC structures, relative to conventional IPOs as well as to other forms of achieving dispersed ownership, such as direct listings. Should the SEC reconsider the concept of “underwriter” in these new transactional paths? Is guidance needed about how projections and related valuations are presented and used in the documents for any of these paths?

In closing, I want to make three final points. First, I am not pro- or anti-SPAC. Under federal securities law, the touchstones for all securities offerings remain what they have long been. What disclosures do investors need to make informed investment and voting decisions? How should the SEC, its staff, and private actors weigh the capital-formation costs and benefits of disclosures, procedures, and liability rules? Do particular disclosures, procedures, and liability rules reduce the all-in costs of capital? Information should be cost-effective and reliable, and not materially misleading, in every securities transaction. Investors should have access to that information – and then be allowed to make their own decisions about how to invest or vote.

Second, forward-looking information can of course be valuable. Modern finance and valuation techniques focus on risk and expected future cash flows. Investors and owners commonly view forward-looking information as decision-useful and relevant. That is true for companies being acquired, as well as for companies going public. But forward-looking information can also be untested, speculative, misleading or even fraudulent, as reflected in the limitations on the PSLRA’s liability protections, even when the safe harbor applies. Reflected in the PSLRA’s clear exclusion of “initial public offerings” from its safe harbor is a sensible difference in how liability rules created by Congress differentiate between offering contexts. Private companies that combine with SPACs to enter the public markets have no more of a track record of publicly-disclosed historical information than private companies that are going through a conventional IPO. If there are risks to the use of cost-effective, complete, and reliable forward-looking information in any setting, those risks should be carefully evaluated in light of the goals of the federal securities laws. At the same time, the risk of misuse of such information should also be carefully evaluated in light of the economic realities of the capital formation process.

Third and finally, one of the more interesting and challenging aspects of recent SPAC transactions is that the investors in the SPAC’s first public capital raise often redeem or sell their shares around the time of the business combination. New investors buy these shares in the aftermarket or participate in a new offering by the combined entity. Said plainly, many investors in the SPAC’s own initial offering are not the investors in the ultimate public company’s ongoing business operations. If a major shift in owners is in fact occurring in most or all SPACs as they progress through a de-SPAC, it is the de-SPAC as much as any other element of the process on which we should focus the full panoply of federal securities law protections – including those that apply to traditional IPOs. If we do not treat the de-SPAC transaction as the “real IPO,” our attention may be focused on the wrong place, and potentially problematic forward-looking information may be disseminated without appropriate safeguards.

* * *

Whether SPACs are just a fad, or a new paradigm for taking companies public that will be with us long after COVID is just a memory, remains to be seen. But while the SEC’s repeated prodding likely haven’t had much to do with the recent slowdown in deal flow, at least Biden’s new top cop at the SEC, Gary Gensler, can try and take credit for reining in a bubble that potentially threatened the credibility of American financial markets.

Or, if SPACs blow up en masse, at least Gensler can say precautions were taken and warnings were issued.

Tyler Durden

Fri, 04/09/2021 – 11:01

via ZeroHedge News https://ift.tt/2Qbvcju Tyler Durden