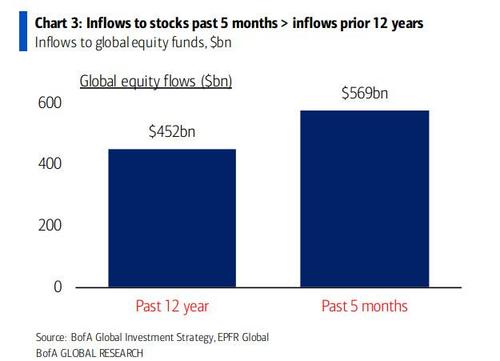

Peak Euphoria: Stock Inflows In Past 5 Months Exceed Inflows From Prior 12 Years

Of all the metrics we have seen in the past year trying to capture the sheer mania and frenzy of the retail rotation into stocks – a process also known as “distribution” because it allows legacy investors to offload to new bagholders – none is better than the following statistic from BofA’s Michael Hartnett, who in his latest Flow Show notes “the big flow to know”, namely that inflows to stocks past 5 months ($576bn) exceed inflows in prior 12 years ($452bn) – and we have retail investors armed with freshly printed stimmy checks to thank for this historic spike.

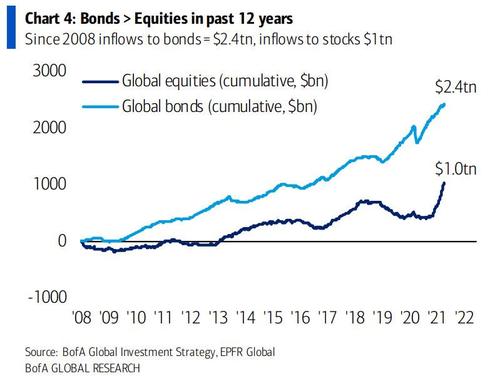

Even with the recent surge, equities have a ways to go before they can catch up to the massive cumulative inflows into bonds which have attracted a total of $2.4 trillion since the first financial crisis.

That said, and as we first noted last week, there appears to be some indigestion at these lofty levels with BofA pointing out the third consecutive week of tech outflow, offset by largest inflow to REITs since Nov’19; largest inflow to bank loans since Apr’17 ($1.2bn).

That said, it’s hard to make a case for a “contrarian sell” here, because while BofA’s Bull & Bear Indicator remains elevated, it has been steady at 7.2 and has avoided a blow off top for now…

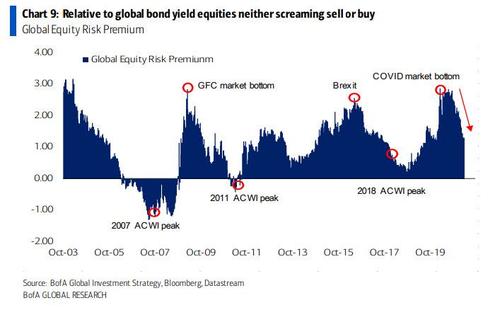

… while relative to global bond yields, Hartnett notes that “equities are neither screaming sell or buy”

If anything, one can perhaps argue that retail investors may be rotating even more toward crypto, as momentum shifts to the best performing asset of 2021, whose breakdown is as follows: bitcoin 100.0%, oil 23.2%, global stocks 7.2%, US$ 2.8%, HY bonds 0.7%, cash 0.0%, IG bonds -3.4%, government bonds -5.0%, gold -8.2% YTD.

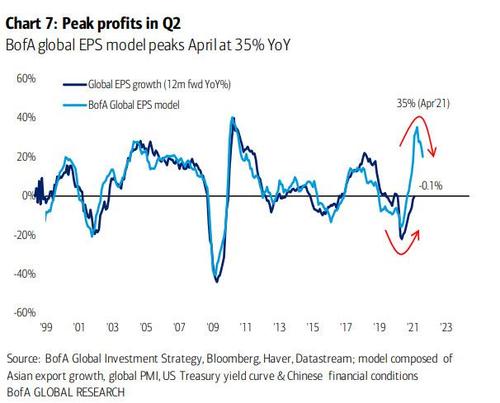

One thing that appears increasingly likely is that Q2 is as good as it gets, with peak profits likely coming this quarter, and setting the economy, profits and stocks for a decline in the second half as both Albert Edwards and Michael Wilson warned previously.

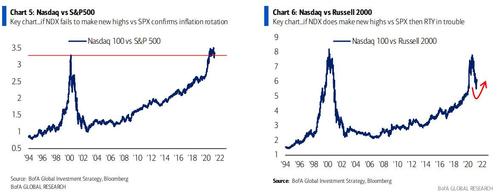

Which brings us to two key charts: the Nasdaq vs the S&P… and vs the Russell, with both noting that if the Nasdaq failes to make new highs against the SPX, this will confirm the inflation rotation while on the other hand, if the Nasdaq makes a new high against the S&P, then Russell 2000 is in trouble.

Which brings us to Hartnett’s 3 investing views (these won’t be new to anyone following his growing recent skepticism):

- vaccine>virus, reopening>lockdown, boom>bust = asset rotation beats asset price rally in 2021;

- 3R’s of rising Rates, Redistribution, Regulation = low/volatile bond & equity returns = sell asset overshoots;

- secular lows is in for inflation & rates = real assets >financial, commodities>credit, RoW>US, small> large, value>growth.

Tyler Durden

Fri, 04/09/2021 – 12:09

via ZeroHedge News https://ift.tt/3s4U4XJ Tyler Durden