Bubble, Bubble, But Limited Housing Trouble… For Now

By Laura Cooper, analyst and writer for Bloomberg Markets Live

Global policymakers are weighing in on worrisome inflation. Well, at least on the asset side where signs of housing froth raise financial stability concerns. Just don’t expect rate hikes to pop bubbles – instead watch for regulations.

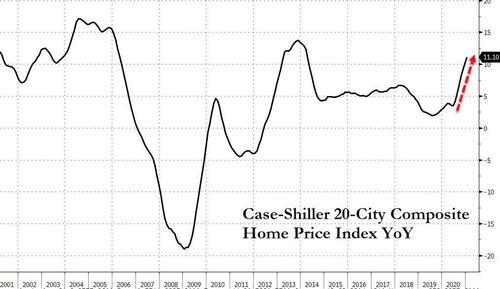

Hot housing activity has been a side effect of the pandemic’s mix of ultra-low rates, tight supply and robust demand.

Buyers outnumbering sellers in February gave U.S. home prices the biggest jump since 2006, despite mortgage rates climbing.

Tax incentives have seen U.K. prices advance while countries from Sweden to Canada and Australia are experiencing double-digit price growth in major city centres. Surging lumber prices aren’t helping.

That has policymakers ramping up stability warnings, although withdrawing stimulus to curb appetite will be a last resort. Instead macro-prudential measures look forthcoming. The Reserve Bank of Australia will release its semi-annual Financial Stability Report tomorrow and with national home prices punching higher, housing will be top of mind, raising downside currency risks. Even hints of hot housing spilling into monetary policy spooked the kiwi dollar earlier this year. Canada could be next.

Concerns stem from pockets of elevated household leverage where ballooning debt burdens raise the threat of broader systemic risks. But with rate hikes exacerbating the challenge and risking economic recoveries, more regulatory measures are likely — with risks dominating in Canada, Sweden and Australia.

Of course, there are reasons for the housing uplift to extend. For one, risk-adjusted returns beat equities and it’s an inflation hedge. But as prices reach eye-watering levels in some regions, watch for governments’ attempt to deflate bubbles before they can burst.

Tyler Durden

Fri, 04/09/2021 – 13:00

via ZeroHedge News https://ift.tt/39XR3SR Tyler Durden