Saxo: Absolute Equity Valuations Enter New Territory

Authored by Peter Garnry, Head of Equity Strategy at Saxo,

Summary:

Global equities look expensive in absolute terms against history on both trailing and forward-looking metrics, but when they are compared against government and credit bonds the valuations look only a bit stretched. However, some pockets of the equity market such as US technology and bubble stocks look very expensive also on a relative basis and we do have real concerns at current levels that investors are paying too much for future growth. Overall, we maintain a positive view on equities.

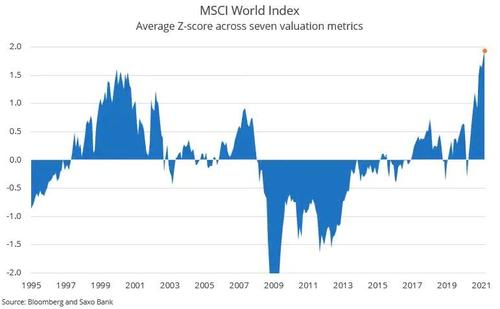

Equity valuations measured across seven different valuation metrics have reached an all-time high in March 2021 which begs a discussion of equity valuations more generally. Are equities expensive and should we be worried?

Based on 12-month trailing valuation metrics the MSCI World Index has almost reached 2 standard deviations above the historical average since 1995. Since these metrics look back 12 months they are of course being inflated by the hit to earnings and cash flows due to the Covid-19 pandemic.

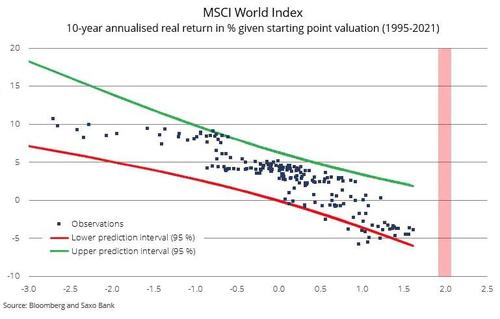

The equity market is operating under high expectations that earnings will bounce back which should help the valuation index to come down somewhat. Our model of z-scores on valuations can be linked to future returns (see second chart) and here we see a downward sloping relationship indicating that higher valuations come with lower future real rate returns (nominal returns on equities adjusted for inflation). Investors are today paying prices for earnings power that have tilted the probability towards negative real rate returns over the next 10 years.

But the prediction interval is quite large (> 7%-points) at these positive z-scores and thus the equity market could still from current levels generate a positive real rate return.

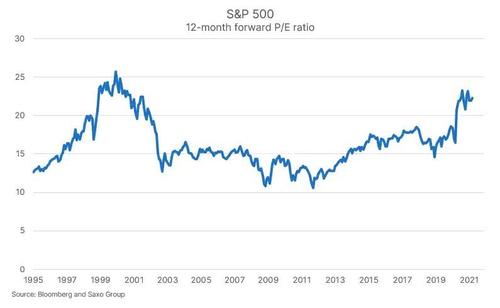

Equity valuations do not live in isolation

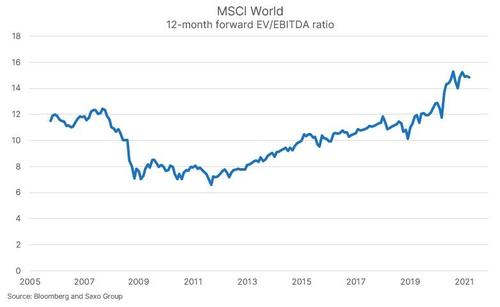

While the trailing valuation metrics are a bit distorted for a couple of quarters more, the forward-looking metrics are less impacted by sudden changes in earnings power. Here we also observe US equities and global equities being expensive in an absolute perspective with US equities close to the same levels as in 2000 during the dot-com bubble.

However, with bond yields also at record low levels it is not strange that we observe high equity valuations as equities interact with other asset classes, and more specifically the bond market. The current free cash flow yield on global equities is 4.7% which is still attractive compared to the global bond market and as a result we are still positive on the equity market although the inflationary pressure could quickly change the picture.

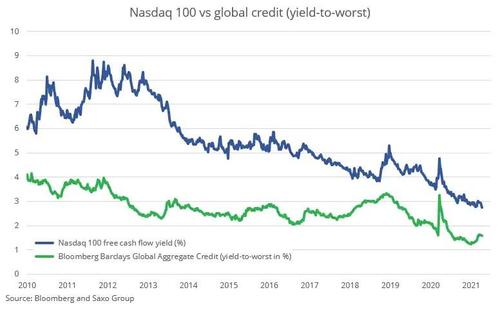

If we compare the popular Nasdaq 100 Index with corporate investment-grade bonds, then we see that US technology stocks have been a lot more expensive in absolute terms and in relative terms to credit bonds. The current free cash flow yield on Nasdaq 100 is 2.8% and is thus much more expensive than global equities which is a result of higher profitability and return on capital, combined with much higher growth rates.

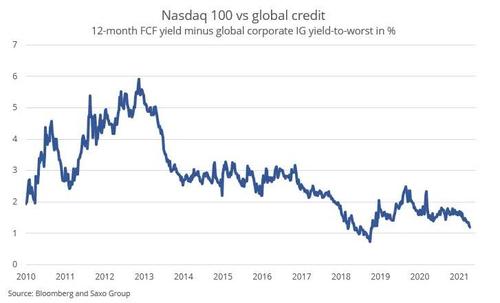

The spread between the free cash flow yield and the global credit yield is coming down again to levels not seen since October 2018. This is reflecting a very strong outlook for credit quality and earnings growth driven by large fiscal stimulus.

When we look at Nasdaq 100 and compare it to credit bonds and the global equity market there are reasons to begin being worried about whether investors are paying too much for future growth.

* * *

We had a listener of our podcast commenting on our free cash flow comments that we have been making over the past year. The person had two objections to our methodology, 1) we are not adjusting for stock options which are massively used by technology companies to attract talent and reduce the cash burn rate, and 2) we are not adjusting free cash flow for acquisitions which many technology companies are doing instead of investing in R&D themselves.

The first objection is true, and the free cash flow should be corrected by stock options and warrants. But how big a difference does it make? Many of the largest constituents in the Nasdaq 100 Index have stock options corresponding to around 1-4% dilution of the current outstanding shares and thus including this dilution would make the metric more correct, but it would not alter the overall conclusion.

The second objection is interesting. Industry practice suggests to only subtract capital expenditures from the operating cash flow to get to the free cash flow (the cash flow that is available for acquisitions, debt reduction, buybacks of own shares, or dividends), because it is more stable and provides a more realistic picture of the underlying free cash flow generation. Large acquisition or divestments would make the free cash flow yield very volatile and clutter the analysis. The adjustment for acquisitions makes sense if an investor could expect acquisitions to be consistent, but that is very rare for most companies and as such we acknowledge the potential adjustment, but we do find it adds value for the investment decision process on equity indices.

Tyler Durden

Thu, 04/15/2021 – 06:30

via ZeroHedge News https://ift.tt/3tlhoSv Tyler Durden