Apollo Joins Exodus To Florida As New York Tax Hike Drives Out Wealthy

The authors of a Bloomberg report claiming the trend of financial services firms moving from New York to Florida was rapidly starting to reverse couldn’t have been more wrong. Barely two weeks after the New York State legislature passed a state budget that saddled the wealthiest New Yorkers with an effective tax rate north of 50%, the highest in the nation…

…more financial firms and their wealthiest employees are bidding the Big Apple adieu. Earlier this week, Bloomberg reported that Guggenheim’s Scott Minerd was preparing to move to Miami as the firm moves to dedicate more resources to South Florida.

And now, Bloomberg has followed that earlier report up with another high-profile departure: Apollo Global Management, newly free of its founder Leon Black, was considering opening additional offices in South Florida, specifically in Miami and West Palm Beach, as well as elsewhere in the US and Europe. The decision to “expand” its physical presence its the result of a survey of employees about where they would prefer to work as part of a strategy to attract a broader talent pool, a spokesperson for the firm told Bloomberg.

Apollo, which has 1,729 employees worldwide, is just the latest financial services firm to commit to a more open ended “open working” plan as workers in the US start their journey back to the office. This contrasts with Goldman and JPM, which are already summoning front-office workers and analysts back to the office (now that we all know how Goldman CEO David Solomon feels about working from home).

As far as moving to Florida, Goldman is reportedly polling employees to figure out which workers in various front-office investment-banking and capital markets positions might be willing to relocate to Miami.

Hedge fund titan Steven Cohen is reportedly looking to move his new firm, Point72 Asset Management, to Florida despite his recent purchase of the New York Mets (he also recently took a massive hit on the sale of a New York condo). Elliott Management, and even the mighty Citadel, are looking to Florida as well.

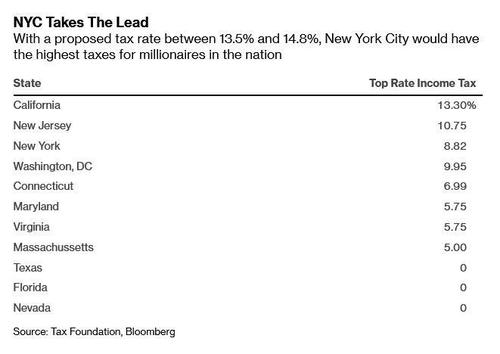

While Apollo said it has no plans to pull back from New York, even Bloomberg acknowledged that the newfound flexibility brought on by remote work is making low-tax locales like Florida and Texas more appealing. Under the new $212 billion state budget, the top tax rate on wealthy Americans would temporarily increase to 9.65% from 8.82% for single filers earning more than $1.1 million. Income between $5 million and $25 million would be taxed at 10.3% and for more than $25 million it would be 10.9%. The new rates would expire in 2027. And with New York City residents also paying city taxes, the combined top rate for the highest earners would be between 13.5% and 14.8%, surpassing the 13.3% rate in California, currently the highest in the nation, as we reported previously.

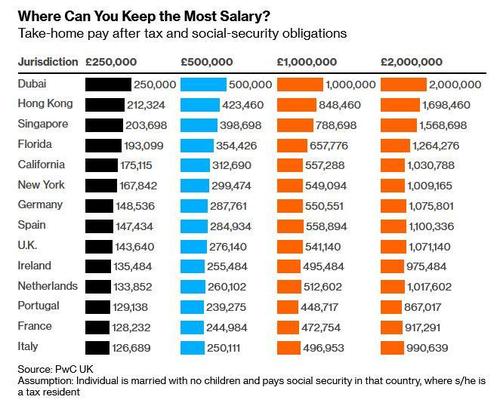

Lump in Federal Taxes and the increases would mean that the richest New Yorkers would be hit with a combined marginal rate of 51.8% — higher than levels in some European countries.

Tyler Durden

Sat, 04/17/2021 – 18:30

via ZeroHedge News https://ift.tt/3v41vjL Tyler Durden