China: Still Recovering, But Losing Steam

By Raphie Hayat of Rabobank

Still recovering, but losing steam

Summary

-

China’s economic growth surged to 18.3% y/y, broadly in line with expectations

-

A big part of this is due to the lower base in Q1 2020

-

Although the overall first quarter growth was driven by production, more recent data suggests that services are taking over, while production growth is slowing

-

We think the recovery will lose steam as the initial pent up demand dies out and because policy support is being scaled back

-

Moreover, trade will not help economic growth as much as it did in the past few months as China’s trading partners are slowing coming out of the pandemic and are requiring less working-from-home and other coronavirus-related exports from China.

-

That is why we stick to our GDP forecast of 7.7% this year

-

Despite the relative positive short term outlook, we remain gloomier for the long term as China’s ageing population, high debt load, weakening productivity growth and increasing international tensions will keep growth below the levels of the past 15 years

Services are taking over

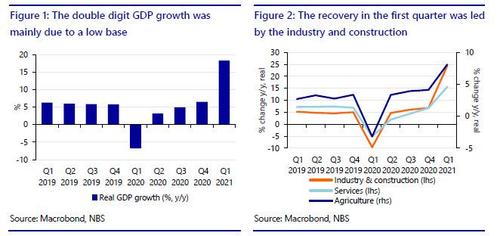

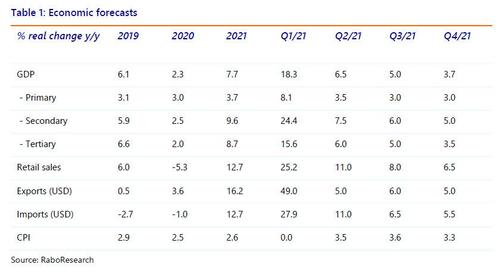

China’s National Bureau of statistics (NBS) released Q1 GDP figures, which showed that GDP growth accelerated to 18.3% y/y, up from 6.5% y/y in Q4 2020 (figure 1). This was broadly in line with the Bloomberg consensus of 18.5% y/y although higher than our own estimate of 16.3% y/y. The main driver of the first quarter growth was industry and construction, which grew by 24.4% y/y, while services grew by 15.6% y/y (figure 2). However, the monthly data suggests that services growth has taken over, while production growth is coming down.

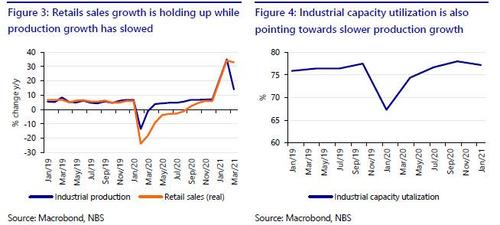

Industrial production growth has moderated to 14.1% y/y in March (down from 35.1% y/y in January/February) while real retail sales growth has kept pace at 33% y/y (slightly down from 34% y/y growth in January/February). Admittedly, retail sales suffered more and longer than industrial production during the initial outbreak of the coronavirus in China, which means base affects play a more prominent role for retail sales than production (figure 3). However, a high frequency indicator such as cinema box office sales corroborates that domestic demand is holding up. Cumulative daily cinema box office sales were CNY 1.56 bln for the first 14 days of April, which is comparable to the CNY 1.54 bln level over the same period in 2019. Meanwhile, industrial capacity utilization has come down a bit, from 78% in Q4 2020, to 77.2% in Q1 2021 (figure 4). Another indicator that points to slower industrial activity going forward is fixed asset investments, which slowed to 25.6% y/y in March, from a 35% y/y increase in January/February (figure 4). Investment activity is a better indicator of businesses confidence in the future and is also more sensitive to the monetary policy stance (on which we will come back later). Taken together, this indicates that services have taken from industry as the growth driver, at least in the short term.

Unemployment is falling, but it’s of limited use as an indicator

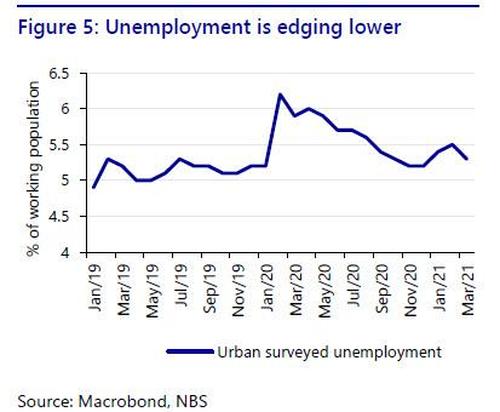

The surveyed urban unemployment rate came in at 5.3%, edging lower from 5.5% February, which is in line with the over economic recovery picture (figure 5).

However, official unemployment figures do not adequately take into account the 300 mln rural migrant workers in China (which is about a third of China’s labour force) that are not counted as unemployed if they are not officially registered as an urban resident (because of the hukou registration system that). The flipside is that underlying improvements in the labour market are not seen in the unemployment figures as well (if rural migrants without hukou do go back to work, that will not be counted as a reduction in unemployment as they were not counted as being unemployed in the first place). In any case, official unemployment figures do not give an accurate picture of China’s labour market, so retail expenditure related data matters more to gauge the health of the economy.

Trade reflects asynchronicity between China and the rest of the world

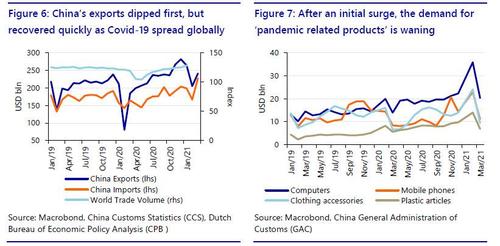

From the trade side, we have already seen data coming out weaker than expected on the export side and stronger than expected on the income side in March. Namely, March Chinese exports grew by 30.6% y/y, and imports by 38.2% y/y in March, which means China’s net exports declined substantially to 14 bln USD (down from 38 bln USD in February).

This partially reflects the fact that China was the first country in the world to experience the coronavirus outbreak, a couple of months before the virus spread to the rest of the world. As such its exports dipped initially due to supply side effects (since factories wore closed), but rebounded shortly after as China contained the virus relatively quickly, while the rest of the world was going closing down (figure 6). Now that the rest of the world is slowly starting to open up again, the initial boost for Chinese products is diminishing. In addition, China has benefitted from an initial surge in demand for ‘pandemic related products’ such as those related to working from home (computers, laptops and mobile phones) and protective equipment (such as face masks). That demand seems to be coming down (figure 7), which is reflected in the headline trade figures.

We expect China’s exports to moderate further in the coming months as its trading partners slowly move back to normal and will require less products related to containing the coronavirus and working from home. That means net exports will likely be less of a driver for economic growth in China for the rest of the year.

What do we expect for the coming year?

For the coming quarters, we expect consumer demand growth to moderate as a considerable part of the “pent up demand” has already come to fruition, while production growth will slow. In addition, reduced policy support from the monetary as well as fiscal side will keep a lid on economic growth. From the fiscal side, Chinas recent government budget targets a fiscal deficit of 3.2% of GDP, which is relatively conservative. From the monetary side, China’s recent Five Year Plan targets growth of the money supply (M2) to be in line with nominal GDP growth, while there have been reports that China’s central bank (the PBoC) has asked banks to cap lending at 2020 levels. Indeed, there are already hints that credit growth is slowing. Total Social Financing (TSF, a measure of broad credit growth in China) has dropped from 13.3% y/y in February to 12.3% in March, the lowest growth rate in TSF since April 2020. We think this reduced policy support will keep a lid on economic growth this year.

Altogether this GDP report and the observations above mean that we have not adjusted our GDP growth forecast for this year (7.7%).

The main downside risks to our short term outlook are (i) increasing tensions between China and the US, EU, Japan, Australia or India. Such tensions could lead to sanctions on Chinese businesses and tariffs on Chinese exports, which will cut into China’s economic growth. In addition, the recent rise in SOE and corporate defaults could lead to financial instability. Finally, an unexpected resurgence of the coronavirus (for example via a new strain) will lead to containment measures again and hurt domestic demand.

One possible upside risk is that China’s coronavirus restrictions are wound down faster than we currently envisage, boosting domestic demand quicker and more than we expect. China’s coronavirus restrictions were one of the toughest globally, but have now come down to below most G7 countries, while coronavirus cases are not materially increasing anymore. In that sense, similar to other countries, containment measures remain a key element to watch for the short term outlook.

Long term outlook

Our longer term outlook remains that economic growth will slow significantly in China (to 4% by 2025). As we recently argued (here), China is facing an ageing population (which is actually projected to start shrinking from 2030 onwards, according to US Census data), a very high debt load (335% of GDP), increasing tensions with several countries (which will hurt exports as well as limit needed imports) and weak productivity growth.

Tyler Durden

Sun, 04/18/2021 – 20:20

via ZeroHedge News https://ift.tt/3duAfop Tyler Durden