US Futures Dip From Record As Chinese Stocks Soar

US equity futures slipped from record highs, European stocks held steady at the start of a new week and Chinese stocks soared the most in five weeks, as investors awaited a fresh round of corporate earnings with global shares sitting at record highs. The dollar slid following the crypto rout over the weekend. Gold rose and oil was flat.

At 07:30 a.m. ET, Dow E-minis were down 81points, or 0.24%, S&P 500 E-minis were down 10.75 points, or 0.26%, and Nasdaq 100 E-minis were down 46points, or 0.3% after briefly rising above Friday’s close during the European morning. Notable movers included Tesla, Activision Blizzard and PayPal which fell the most in premarket trading. IBM and United Airlines are due to report.

Blockbuster economic data from China and the US last week pushed the MSCI All-Country World Index to another record despite concerns surrounding the spread of Covid-19 variants. New infections in the past week surpassed 5.2 million, the most since the pandemic began, with emerging markets (i.e. India, Brazil) getting hit the hardest.

A pullback in 10-year bond yield from 14-month highs in April has also eased worries about higher borrowing costs, renewing interest in richly valued technology stocks. As Goldman explained over the weekend, the risk of another destabilizing increase in borrowing costs has also subsided, as bond yields have pulled back from recent highs amid rising investor concerns that the peak of the stimulus surge is now behind us. This week traders will look for further confirmation of the private sector’s recovery from the pandemic as the earnings season gathers pace.

And speaking of economic data, it takes a back seat this week to earnings as 79 S&P 500 companies report results this week including Johnson & Johnson, Netflix Inc, Intel Corp, Honeywell and Schlumberger.

“Our current view is that with short-term interest rates set to remain low for the medium term and our expectation that earnings will continue to increase, it is unlikely that the increase in long-term interest rates will trigger an equity market fall,” Russel Chesler, head of investments and capital markets at VanEck Australia, said in a note.

Looking at global markets, the MSCI world equity index climbed to a new peak, up 0.2% despite the weakness in US futures. Europe’s STOXX 600 rose to a record high before easing some gains, up 0.1% at 1105 GMT. Asian shares hit one-month highs overnight.

The Stoxx Europe 600 Index rises 0.2% to 443.27 with 205 members down, 377 up, and 18 little changed. Here are some of the biggest European movers today:

- Juventus shares rise as much as 14%, the most in a year after the Italian soccer club joins some of the game’s wealthiest teams in announcing plans for a new “super league” that could transform revenue streams at the top level of the sport.

- Arjo shares rise as much as 9.6% to a record high, as Swedish business daily Dagens Industri reiterates its recommendation to buy the shares of the medical-equipment maker.

- Danone shares rise 1.2% after Bernstein notes that a sector rotation from consumer staples to those benefiting from economic reopening appears to be finished. The firm also raises the price target for the French food-processing company.

- L’Oreal shares rise 1.3%. The company’s progress with e-commerce will help margins in the years to come, according to Goldman Sachs, which boosts the French beauty-products maker’s PT to a Street high while adding the stock to its “Conviction List.”

- Pantheon Resources shares fall as much as 54%, the most since April 2018, after saying that the Kuparuk formation in Alaska was more “geologically complex” than expected.

- Piraeus shares fall 30% to a record low as it resumes trading after reverse split and par value adjustment, with EU4.784 adjusted opening price.

Matthias Scheiber, global head of portfolio management at Wells Fargo Asset Management cited low interest rates, the rollout of COVID-19 vaccines and the fiscal stimulus package in the United States as reasons for his bullish stance on equities.

“Risk is coming down, volatility is coming down … we see the slow reopening of global economies, the rollout of the vaccine and the huge catch-up in demand so from that perspective it should be positive for economic growth. We had a strong rally in cyclical and value stocks since the start of this year – we would like to see confirmation in the earnings.”

Earlier in the session, Asian stocks rose after a dip in early trading, led by Chinese stocks that had their best day in five weeks. The MSCI Asia Pacific Index is set to climb for the fifth straight session, its longest winning streak in more than two months, amid lower longer-term U.S. Treasury yields. Health care and materials led gains for the gauge, which was up as much as 0.5%.

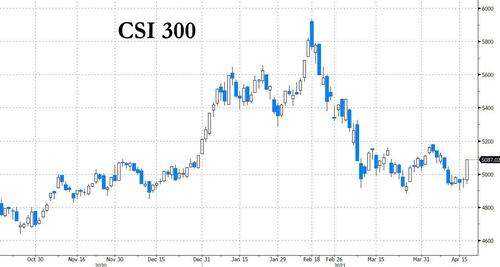

China’s CSI 300 Index closed 2.4% higher to become the region’s best performing major national benchmark amid easing concerns about the health of state enterprise China Huarong Asset Management, the country’s iconic distressed-debt manager which itself is so distressed many speculated Beijing will let if fail. China’s financial regulator on Friday said Huarong had ample liquidity, the first official comments since the company missed a deadline to report earnings. Ebbing fears of contagion drove a rally in Huarong bonds.

Also in China, shares of automakers jumped on Huawei’s plan to invest in car technologies, while electronics firms rose ahead of Apple’s first product unveiling of 2021. Japan’s Topix ended the day down 0.2% as the governors of Tokyo and Osaka considered declaring another virus emergency as infections surge. The country posted a double-digit gain in exports for the first time in more than three years in March, official data showed Monday. India’s Sensex index slid 1.8%, the worst performer in Asia, as daily new coronavirus infections continue to top previous highs.

Wells Fargo Asset Management’s Matthias Scheiber said “We believe we are in the ‘buy the dip’ environment at this moment given that both fiscal and monetary policy are very supportive, so if we would see a correction … we would probably increase the equity position.”

In rates, the benchmark U.S. Treasury yield, which dropped as low as 1.528% last Thursday, was at 1.5782%. Yields were lower by less than 1bp across the curve within spreads likewise little changed; 10-year TSY outperforming bunds by ~2bp while broadly keeping pace with gilts. Treasuries held small gains with S&P 500 futures under pressure despite strong gains for Chinese stocks. Options activity picked up during Asia session, including large trades in 5- and 10-year tenors. Overnight UST options activity included large bearish block trade via Jun21 10-year put spread and 5-year blocks re-jigging a big short position. Another heavy corporate new-issue slate is expected this week, a possible source of hedging flows.

In FX, the greenback fell against all of its G10 peers while the euro rose beyond $1.2030, the highest since March 4, amid news that Pfizer and BioNTech will supply the EU with an additional 100 million vaccine doses this year; Treasuries gained, outperforming bunds. The pound rose for a sixth straight session against the U.S. dollar, as the U.K.’s swift vaccination program and reopening schedule continued to bolster investor confidence. The yen also advanced as renewed tensions between U.S. and Russia spurred demand for haven assets; China rejected criticism from U.S. and Japanese leaders, adding to the risk-off sentiment. Australia’s dollar erased a drop as a rally in iron-ore prices offset weakness fueled by rising U.S.-China tensions.

“We have been highlighting over the past two months that USD could bottom out, in contrast to consensus, and believed that this would be a tactical problem for EM and for certain commodity trades,” wrote JP Morgan’s head of global and European equity strategy, Mislav Matejka, in a note to clients. “We think the risk of a firmer USD, through rising US-Europe interest rate differential, is not finished.”

Matejka also said that, although there is the technical potential for a correction in equities, he would not cut stocks exposure on the six- to nine-month horizon: “We think that it is more likely that we will be raising our year-end targets, rather than reducing them, as we move through the summer,” he said.

In commodities, oil prices fell as rising COVID-19 infections in India prompted concern than stronger measures to contain the pandemic would hurt economic activity. A recent surge in COVID-19 cases could see major parts of Japan slide back into states of emergency, with authorities in Tokyo and Osaka looking at renewed curbs.

Bitcoin was up 1% at around $56,850, nursing losses from Sunday, when it plunged as much as 14% to $51,541.

Looking at the week’s events, economic data is sparse and no Fed speakers scheduled ahead of April 28 FOMC meeting. Instead attention will be on earnings from IBM which are due later in the session. Netflix reports on Tuesday. Later in the week, American Airlines and Southwest will be the first major post-COVID cyclicals to post results. The European Central Bank meeting on Thursday will also be in focus this week. ECB President Christine Lagarde said last week that the euro zone economy is still standing on the “two crutches” of monetary and fiscal stimulus and these cannot be taken away until it makes a full recovery.

Market Snapshot

- S&P 500 futures down 0.1% to 4,172.00

- MXAP up 0.3% to 209.28

- MXAPJ up 0.3% to 697.59

- Nikkei little changed at 29,685.37

- Topix down 0.2% to 1,956.56

- Hang Seng Index up 0.5% to 29,106.15

- Shanghai Composite up 1.5% to 3,477.55

- Sensex down 1.7% to 47,982.83

- Australia S&P/ASX 200 little changed at 7,065.64

- Kospi little changed at 3,198.84

- German 10Y yield fell 0.6bps to -0.268%

- Euro up 0.3% to 1.2024

- Brent Futures down 0.1% to $66.70/bbl

- Gold spot up 0.5% to $1,785.97

- U.S. Dollar Index down 0.40% to 91.19

Top Overnight News from Bloomberg

- Markus Soeder’s bid to lead Angela Merkel’s conservative bloc into September’s German election is gathering pace, with Monday’s imminent announcement by the Greens of their chancellor candidate adding to pressure to end the deadlock

- Russia hit back defiantly after the U.S. warned of “consequences” if jailed opposition leader Alexey Navalny dies on hunger strike, deepening the conflict over the dissident who’s already survived an alleged assassination attempt

- China sought to allay fears it wants to topple the dollar as the world’s main reserve currency as Beijing makes bigger strides in creating its own digital yuan

- Deutsche Bank AG is replacing its global pricing engine for emerging-market currencies in London with one in Singapore, drawn by surging trading in Asia and the increasing importance of the Chinese yuan

- The mania that drove crypto assets to records as Coinbase Global Inc. went public last week turned on itself on the weekend, sending Bitcoin tumbling the most since February

- U.K. house prices surged to a record this month with a tax break on purchases and rock-bottom interest rates prompting a “buying frenzy,” the property website Rightmove said

- The unprecedented oil inventory glut that amassed during the coronavirus pandemic is almost gone, underpinning a price recovery that’s rescuing producers but vexing consumers.

A quick look at global markets courtesy of Newsquawk

Asian equity markets began the week with mostly cautious gains and US equity futures marginally pulled back from record highs with participants tentative ahead of further earning updates this week, and as COVID-19 uncertainty lingered after the number of global cases last week increased by over 5.2mln, which was a record despite the ongoing vaccination drive. However, there were comments from NIH’s Dr Fauci that a decision on whether to resume administering the Johnson & Johnson COVID-19 vaccine could occur as soon as Friday and that he would not be surprised if it is resumed in some form. ASX 200 (+0.2%) was positive with the kept afloat by outperformance in mining-related sectors and with M&A developments providing encouragement following news of a merger between Galaxy Resources and Orocobre, as well as reports that Crown Resorts received an unsolicited proposal on behalf of funds managed by Oaktree Capital. Nikkei 225 (+0.2%) initially swung between gains and losses as pressure from currency inflows was offset by stronger than expected trade data – including the largest increase in exports since November 2017 – and although Japanese stocks eventually improved, Toshiba shares were left in the lurch after CVC was said to plan a delay in submitting a formal proposal to acquire the Co. Hang Seng (+0.8%) and Shanghai Comp. (+1.3%) shrugged off the flat open and the continued US-China verbal jousting, to outperform their regional peers with the Hang Seng extending above the 29k level and strength seen in Chinese automakers after Huawei unveiled its intelligent driving system. There were also constructive comments regarding China Huarong Asset Management in which the CBIRC Vice Head stated the Co. is currently operating normally with ample liquidity and Chinese regulators were also said to have asked some banks not to withhold loans to the Co., while India’s NIFTY (-2.4%) was heavily pressured amid ongoing rampant COVID-19 cases which hit a fresh record high and with the capital of New Delhi said to have less than 100 ICU beds available in the entire city. Finally, 10yr JGBs were slightly higher amid the mild gains in T-notes and a relatively tepid BoJ purchase announcement totalling JPY 500bln mostly concentrated in 3yr-5yr maturities, while Aussie yields were also relatively unmoved after the RBA announcement to purchase AUD 2bln of government bonds.

Top Asian News

- Packer Gets Crown Exit Path With $2.3 Billion Oaktree Offer

- China Stocks Book Best Day in 5 Weeks as Tech, Car Firms Gain

- Top India Homebuilder Drops in Debut After Decade-Long IPO Wait

- Chinese Travel Site Trip.com Rises 4.6% in Hong Kong Debut

European equities kick off the trading week with another mixed/directionless session thus far (Euro Stoxx 50 -0.1%) despite the positive APAC handover, and amidst a lack of fresh catalysts as participants continue to ponder over the rising COVID cases globally alongside the broader recovery with the vast fiscal and monetary support present. US equity futures meanwhile are somewhat varied and have a negative bias, with the ES and NQ flat whilst the cyclically-driven RTY narrowly lags. Analysts at JPM noted that some technical and sentiment indicators are becoming stretched after the recent run higher across stocks. That being said, the analysts say they would not be reducing stocks exposure on a six-to-nine month horizon whilst acknowledging the potential for a technical correction – JPM continue to see dips as buys. Back to Europe, cash markets see no major outlier in terms of performance whilst sectors are similarly mixed, with outperformance seen Travel & Leisure whilst the early gains in the Auto sector, following the 2021 Shanghai Motor Show, faded with the sector now the laggard. Overall the sectors do now portray and over-arching theme. In terms of individual movers, ABN AMRO (+1.4%) trades firmer after the Co. has accepted the payment of EUR 480mln to settle an anti-money laundering investigation. Bayer (+1.4%) is also supported as the US FDA granted Orphan Drug status for Co’s Aliqopa for chronic lymphocytic leukaemia and small lymphocytic lymphoma. Conversely, CNH Industrial (-5.1%) sits at the foot of the Stoxx after it terminated discussions with FAW Jiefang around the On-Highway business, but will still continue with plans to spin-off the unit from 2022 onwards.

Top European News

- HSBC Top Staff to Hot Desk After Scrapping Executive Floor

- Juventus Stock Jumps Most in a Year Amid Super League Plan

- Pfizer, BioNTech to Supply EU With 100M Additional Doses in 2021

- Piraeus Bank Falls 30% After Share Capital Increase Terms

In FX, the Dollar and index have extended declines across the board as US Treasury yields maintain a mild bull-flattening bias, but also on increasingly bearish technical momentum as several Buck/major pairings breach key and psychological levels and the DXY itself breaches 91.500 to probe support around 91.300 within a 91.748-125 band. However, the index and Greenback in general may benefit from underlying bids into 91.000 given that the 100 DMA is in very close proximity at 91.019 today.

- JPY/NZD/AUD – Better than expected Japanese trade data could be helping the Yen compound gains vs its US counterpart, and at this stage 108.00 appears far more achievable than a rebound towards 108.50 where the base of decent option expiry interest resides (1.9 bn from the half round number up to 109.65 to be precise). Meanwhile, the Kiwi and Aussie are taking advantage of their US peer’s predicament to form firmer bases above 0.7150 and 0.7750 respectively ahead of RBA minutes and NZ Q1 CPI on Tuesday.

- CHF/EUR/GBP/CAD – Little sign of Franc buyers getting twitchy about a relatively big rise in Swiss sight deposit balances at domestic banks, as Usd/Chf tests 0.9150 and Eur/Chf eyes 1.1000 even though the single currency has made light work of breaching supposed option barriers at 1.2000 against the Dollar. Elsewhere, Cable is approaching 1.3900 after holding just above the big figure below and the Pound is starting the new week in a much better position vs the Euro after the cross reached circa 0.8719 last Friday, with Eur/Gbp now pivoting 0.8650. Similarly, the Loonie has turned the tables on its US rival to regain 1.2500+ status in advance of Canada’s first Federal Budget since 2019 then CPI and the BoC on Wednesday.

- SCANDI/EM/PM – The Nok and Sek have picked up where they left off last week, on the front foot, with the former outperforming through 10.0000 vs the Eur and latter straddling 10.1000, while most EM currencies are benefiting from Usd weakness bar the Rub that remains below 76.0000 amidst ongoing investor jitters about Russia’s deteriorating international relations and stand-off with Ukraine. Turning to commodities, Xau has taken a bit of a breather before continuing its march to just over Usd 1788/oz with bullish chart impulses embellished by China reportedly allowing banks to import some 150 tonnes of Gold this month and in May.

In commodities, yet another choppy European morning for WTI and Brent front-month futures and within relatively tight ranges as markets await a concrete fundamental catalyst to latch onto. Participants in the interim will continue to balance the geopolitics with vaccination hurdles and rising COVID cases across some economies – with India and Canada recently telegraphing a worsening situation, with the former cancelling UK PM Johnson’s visit whilst its capital New Delhi announce fresh lockdown measures alongside some speculation pointing to India being put on the UK’s travel red list. Note that this comes ahead of next week’s JMMC/OPEC+ meeting in which eyes will be on any need to alter the output quotas set through July, with production set to steadily increase amid a projected rise in summer demand. The geopolitical landscape meanwhile remains mixed but fluid as ever, with sanguine rhetoric initially emanating from the Iranian JCPOA talks, although Tehran later suggested that negotiations still remain difficult. Elsewhere, developments regarding Russia have been abundant with Kremlin-critic Navalny now seemingly attended to by doctors after US has warned Russia there will be “consequences” if the opposition activist Alexei Navalny dies in jail, whilst EU expressed concern regarding Navalny’s health. Further, Russia is reportedly bolstering its warship presence in the Black Sea amid ongoing tensions with Ukraine and Moscow is also poised to announce a US sanctions list. WTI trades on either side of USD 63/bbl (62.67-63.42/bbl range) whilst its Brent counterpart holds its head above USD 66.50/bbl (66.17-95/bbl range). Spot gold and silver meanwhile glean support from the deteriorating Buck with the former now north of USD 1,775/oz (vs low 1,773/oz) whilst spot silver reclaimed USD 26/oz. In terms of base metals, LME copper has been bolstered further above USD 9,000/t amid the softer Buck, reaching a current peak of USD 9,430/t. Overnight, Singapore iron ore futures surged overnight with traders citing demand from the Chinese steel sector.

US Event Calendar

- Nothing major scheduled

DB’s Jim Reid concludes the overnight wrap

It’s quite a strange feeling of pride that I feel today given I’m going to get my first Covid jab this afternoon. Maybe its pride at the human achievement, maybe its pride at doing my civic duty. I’m not 100% sure. By tomorrow morning when I’m likely feeling really groggy I’m sure that pride will fade. I nearly became a vaccine refuser as I tried to drive my car yesterday only to find the battery was dead. A call to the breakdown service has fixed this but its a consequence of lockdown as I’ve hardly used my car for 13 months. Thankfully I needed to make rare use of it yesterday or I wouldn’t have discovered the battery problem until just before my 20 mile drive to the vaccination centre. Anyway lets hope I’ll be well enough to be on EMR duties tomorrow.

In terms of markets a more successful vaccination campaign in Europe over the last couple of week has certainty helped the Goldilocks theme for now and the continent looks on surer footing now. In terms of wider markets even risk parity type trades have seemingly made a comeback of late. Indeed Bloomberg data suggests that the S&P 500 and 30yr Treasuries have now both rallied for a fourth week together for the first time since August 2008. So markets are back to being a bit dull for now but pretty buoyant. However positioning is becoming more stretched which should be watched. Our equity strategists reported over the weekend (link here) that their composite measure of US equity positioning is close to record highs (98th percentile). There remains a notable divide between the positioning of discretionary investors, which has moved up to a new peak (100th percentile), while systematic strategies exposure has also risen, but remains near historical median levels (46th percentile). A reminder that they think there is likely to be a 6-10% pull back (link here) when growth peaks which they think will occur over the next 3 months.

While we wait for such excitement we can all live vicariously through the big moves in Bitcoin over the weekend. After being as high as $64,869.78 this past Wednesday it traded as low as $51,707.51 yesterday down around 15% from Friday’s close. As we type its now at $56,987. It’s difficult to work out exactly why the sudden reversal occurred but the online chatter is linking it to speculation that the US Treasury may soon crack down on money laundering that uses digital assets. The market remains in a frenzy though as Dogecoin rose over 110% on Friday. Remember this coin was set up as a joke and was worth more than $50bn at one point over the weekend.

Asian markets have started the week on the front foot with the Nikkei (+0.24%), Hang Seng (+0.80%), Shanghai Comp (+1.30%) and Kospi (+0.26%) all up. Futures on the S&P 500 are down -0.14% while those on the Nasdaq are up +0.11% benefitting form a decline in 10y UST yields (-1.3bps) this morning. In Fx, the Russian rouble (-0.61%) is under fresh pressure this morning after the US warned Russia of “consequences” if jailed opposition leader Alexey Navalny dies. Indeed the geopolitical risks from the Russia story last week did seep into wider markets a little so certainly one to watch

There’s a reasonably eventful calendar for markets this week, with the highlights including Thursday’s ECB meeting and Friday’s release of the April flash PMIs from around the world. Investors will also be paying attention to the latest earnings releases, with a further 80 S&P 500 companies reporting, as well as the continued path of the pandemic as a number of places such as India have faced a big surge in cases. There have been around 5.1mn cases reported across the globe over the past 7 days, the highest weekly increase since the pandemic began. India contributed north of 1.4mn cases to this increase which is also its largest weekly gain and continues to remain the current epicentre of the virus. Elsewhere both Osaka and Tokyo may go into fresh state of emergency conduction as soon as today. On a more positive note, Dr Fauci has said that he expects a decision on how to resume vaccinating Americans with the J&J COVID-19 vaccine will probably come by Friday and added that “I doubt very seriously if they just cancel” the J&J vaccine. We are also expecting that the European Medicines Agency will issue their recommendation on the J&J vaccine over the week ahead.

From central banks, this week’s highlight will be the latest ECB decision on Thursday, along with President Lagarde’s subsequent press conference. In their preview (link here), our European economists write that a change in the policy stance is unlikely, and that a decision on whether or not to maintain the new faster pace of PEPP purchases will be made after a joint assessment of financing conditions and the inflation outlook at the Governing Council’s next monetary policy meeting in June. However, at this point it’s unclear whether they will maintain that higher pace beyond June. Our economists say that although a latent recovery is building and ‘net-net’ issuance (net issuance, net of ECB purchases) ought to turn favourable for rates markets following the Q1 spike, the ECB consensus is cautious and determined to avoid a premature tightening in financing conditions.

Staying on Europe, another important event will take place in Germany today, as the Green party present their first chancellor candidate in the 41-year history of their party. This is an important one to look out for, as the CDU/CSU’s slump in the polls has put them only a few points ahead of the second-place Greens, so it’s no longer implausible that the next German chancellor could come from the Greens following September’s federal election. Our German economists’ full preview can be found here, but their view is that the odds appear slightly tilted towards co-leader Annalena Baerbock being selected. In terms of the election result, our economists still see a CDU-CSU/Green coalition as their baseline scenario, as they expect the Conservatives to regain polling momentum. Talking of which, it’s also possible that the CDU/CSU will agree on who will be their candidate over the next day as Armin Laschet and Markus Soeder have been having behind close door discussions since Friday to hammer out which of them will be on the ticket come September. Overnight, the headlines have leaned more favourably towards Markus Soeder with CDU lawmaker Christian von Stetten suggesting in an interview yesterday that Laschet’s leadership bid would be rejected by the CDU/CSU caucus in a vote on Tuesday if the issue isn’t resolved before then.

On the data front, it’s a lighter week ahead, with the main highlight likely to be at the end of the week with the flash PMIs for April. This will give us an initial indication of how global economic performance has fared at the start of Q2, and there’ll be particular attention on the price gauges as well as investors stay attuned to any signs of growing inflationary pressures. In terms of central banks, there are a few other decisions alongside the ECB, with Canada, Russia and Indonesia all deciding on rates. However, there won’t be any Fed speakers as they’re now in a blackout period ahead of their own meeting the week after.

Earnings season kicks up another gear this week, as 80 companies from the S&P 500 report along with a further 54 from the STOXX 600. Among the highlights include Coca-Cola and IBM today, before tomorrow sees reports from Johnson & Johnson, Procter & Gamble, Netflix, Abbott Laboratories, Philip Morris International and Lockheed Martin. Then on Wednesday we’ll hear from ASML, Verizon, NextEra Energy, and Thursday sees releases from Intel, AT&T, Danaher, Union Pacific and Credit Suisse. Finally on Friday, there’s Honeywell International, American Express and Daimler.

To quickly recap last week, risk markets in Europe and the US continued to set new records as US government yields fell but Europe’s mostly rose possibly due to being past peak European pessimism now vaccine deployment is accelerating. The S&P 500 rose +1.37% on the week (+0.36% Friday), finishing at yet another record high. The index has risen for four straight weeks, the first time that has happened since August. The weekly move was broad based as sectors such as materials, healthcare, and real estate all led gains while technology shares also continued to improve as the NASDAQ rose +1.01% on the week. The tech-concentrated index is within a third of a per cent of its all-time highs. Market volatility has calmed over the last few weeks and this past week the VIX volatility index fell -0.4pts to 16.3 – the lowest levels since the pandemic started. European stocks rose to their own record highs as the STOXX 600 gained +1.20% over the week, with the CAC (+1.91%) and FTSE 100 (+1.50%) outperforming other bourses.

US 10yr yields finished the week -7.9bps lower (+0.4bps Friday) at 1.580% – the third weekly drop in yields over the last four weeks. 30yrs are four in four as discussed at their top. The week’s move was driven by the drop in real yields (-12.4bps) which overcame the increase in inflation expectations (+4.5bps). European rates were more mixed with 10yr bund yields gaining +4.1bps last week and UK gilts falling -1.0bps. There was also a tightening of peripheral spreads in parts of southern Europe as Italian BTPs (-2.1bps) and Spanish bonds (-2.5bps) tightened against 10yr bunds, while Portuguese bonds (+7.9bps) widened.

In terms of economic data from Friday, US housing starts in March was ahead of schedule with 1.739mn (vs 1.613mn expected) new construction after 1.457mn recorded in February. The preliminary University of Michigan consumer sentiment index for April showed a less-than-expected rise to 86.5pts (vs. 89.0pts expected) from 84.9pts. Meanwhile in Europe, new EU car registrations for March was up +87.3% after being down -19.3% in February. The final Euro Area CPI reading for February was +0.9% m/m and +1.3% y/y in-line with earlier estimates.

Tyler Durden

Mon, 04/19/2021 – 08:01

via ZeroHedge News https://ift.tt/3tCmqdu Tyler Durden