21 Remarkable Stats For ’21

In his latest Flow Show report, Bank of America’s Chief Investment Strategist, Michael Hartnett has compiled 21 remarkable statistics for 2021, which we republish below.

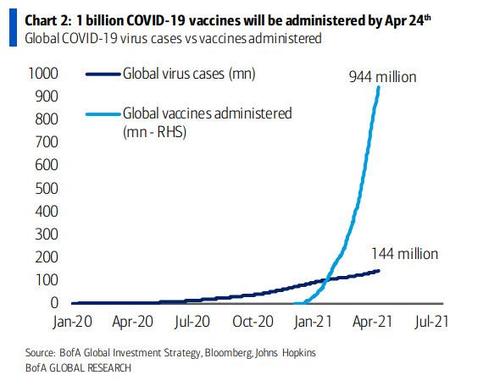

1 billion: COVID-19 vaccines will be administered as of 24th April 2021

3 million: global deaths from COVID-19.

60 million: global deaths from all causes in 2019; global births 140 million.

14 million: US job gains since May’20, follows 22 million lost during COVID-19 pandemic.

$30 trillion: global policy stimulus in ’20 & ’21 ($17tn fiscal + $13tn monetary).

201: central bank interest rate cuts since Feb’20 (989 since GFC).

$1 billion: central banks purchased $1bn of financial assets every hour since Feb’20 ($21tn since GFC).

$0.4 trillion: QE in ‘22, down from $3.4tn in ’21 & $8.5tn in ’20.

$78,591: US national debt per taxpayer in ’25 (debt to equal $27tn).

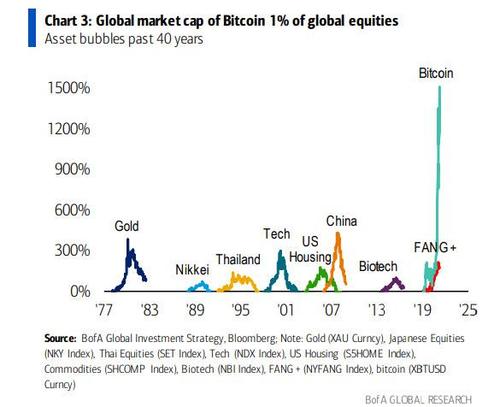

1%: global market cap of Bitcoin & other cryptocurrencies ($2.3tn) as % of global equities ($112tn) and bonds ($118tn).

$4.5 trillion: issuance of US Treasuries in ’21 set to easily exceed GDP of Germany.

Q1’21: worst first quarter return ever for 30-year Treasury, worst for IG bonds since 1980, worst for gold since 1982.

$51 trillion: gain in global equity market cap since Mar’20 lows (fastest/largest rally all-time).

$8.2 trillion: market cap of Apple ($2.2tn) + Microsoft ($1.9tn) + Amazon ($1.7tn) + Google ($1.5tn) + Facebook ($0.9tn) = all Emerging Markets ($8.2tn, population 6 billion).

1557: # of stocks in MSCI ACWI index (3042 constituents) currently in bear market (20% below their all-time high).

29%: US bank stocks record 29% above 200dma

$602 billion: inflow to global stocks past 5 months exceeds inflow of prior 12 years ($452bn).

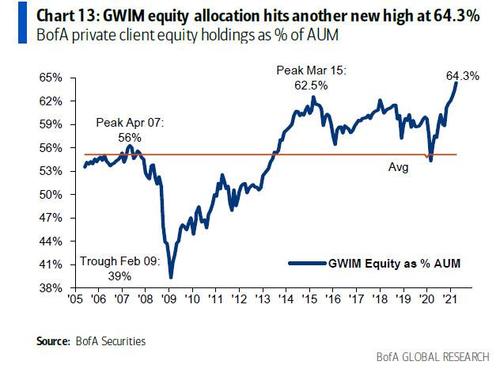

64.3%: BofA private client allocation to equities at record highs

64.7: ISM manufacturing PMI highest since 1984.

59%: YoY gain in BAC credit card data (barometer for US consumer spending – week ended April 10th).

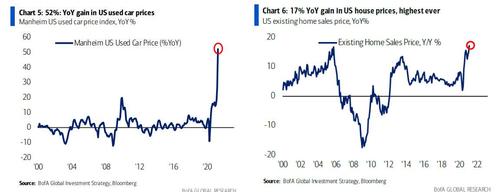

52%: YoY gain in US used car prices & US house prices +17% YoY highest ever …both lead barometers for US inflation.

Tyler Durden

Fri, 04/23/2021 – 15:30

via ZeroHedge News https://ift.tt/2QuPHs7 Tyler Durden