‘Patient Zero’ Of The Bubble Pandemic: Alan Greenspan

Authored by Matthew Piepenburg via GoldSwitzerland.com,

Below, we consider two well-known names in modern markets, former Fed Chairman Alan Greenspan, and current value investing legend, Jeremy Grantham, co-founder of GMO Investment Strategies.

Years ago, I sat down with Jeremy Grantham in an office overlooking Boston Harbor to not only consider an investment in his fund, but to absorb the insights of a blunt-spoken observer of market risk.

Such blunt-speak, as I’ve written elsewhere, is a rare trait among the cadres of otherwise high-profile wealth managers whose incentives and survival are often predicated more upon selling hope than speaking to risk—the equivalent of being a whistleblower among a financial advisory complex driven largely by the gathering of fees rather than the reporting (and managing) of risk.

Almost a decade later, I’m still listening to Mr. Grantham and strongly recommend that others do the same.

A Market Bubble of Epic Proportions

Although it should come as no surprise to anyone who has tracked market history as well as market valuations, Mr. Grantham is one among only a handful of credible portfolio managers who have openly confessed that US markets are (and have been for some time) experiencing a market bubble of “epic proportions.”

In short: This ought to mean something.

As a keen tracker of both markets and market history, Mr. Grantham is no less confident and no less blunt in warning those who will listen that such epic bubbles always, and without exception, lead to equally epic busts.

We, of course, feel no differently, and have been warning of this bubble-to-bust cycle for years—not as “gold bugs” or “doom and gloomers,” but simply as market participants who can both count and read.

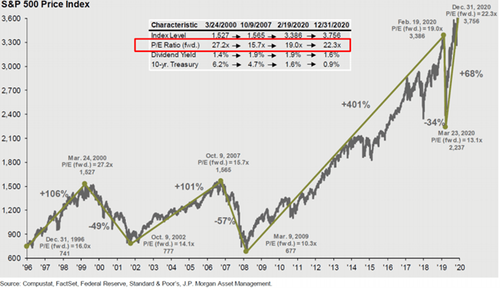

Toward this end, we’ve written at length about the gross over-valuations in risk assets, as measured by every metric known to history.

As for stock bubbles, we’ve examined record-breaking over-valuation signals from price to earnings and price to book valuations to equally scary price to cash flow models.

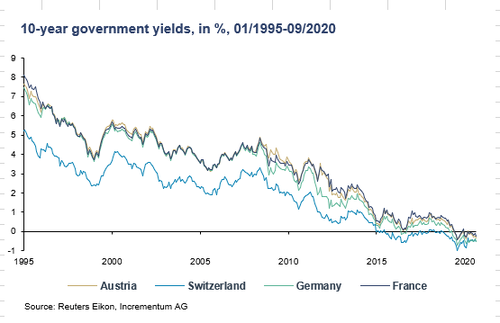

As for bond bubbles, one only has to look at the $18T+ levels of negative yielding bonds in the global market to plainly see bond over-valuation at levels which capital markets have never seen before.

For Mr. Grantham, however, traditional stock valuation tools have never been the most accurate measures of an equity bubble. Instead, and correctly, he points toward the long-term discounted value of future dividend streams as the truest measure of long-term stock valuation.

But as for bond risk, that too is no secret or mystery, yet one which remains eerily ignored in what Grantham (and ourselves) describes as the “market hysteria” of the current moment.

With central bankers now following the lead of Alan Greenspan (the author of the current “everything bubble” and “everything bust” to come) printing trillions of increasingly debased dollars to purchase otherwise unwanted bonds, the net result has been a world in which bond yields are all but extinct creatures.

As we’ll see below, this world without yield has major ramifications for boom-and-bust cycles in risk assets.

For now, however, there is no escaping the fact that we are in the biggest risk asset bubble in recorded history.

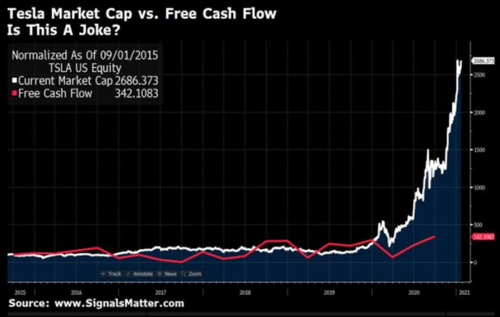

And yet despite such obvious icebergs ahead of us, investors have never been as “all-in” as they are today, chasing mispriced assets in everything from BTC and Tesla to US Treasury bonds as if bear market collapses have become outlawed by central bank magic.

As for Tesla, Grantham, like so many other blunt speakers, sees it as a telling symptom of valuation to the moon (white line below) but cash-flow in the basement (red line):

So, what gives? How did this crazy happen? Become “normal”? Who can investors blame? What can investors do?

How We Got Here: Alan Greenspan’s “Wealth Effect”?

If, like so many others trying to make sense of such madness, you are scratching your heads as to why and how the financial world lost its mind, once again, Mr. Grantham offers some guidance.

As for naming names, Grantham, much like us, can easily point to former Fed Chairman Alan Greenspan as the key architect of the current moral hazard and risk profile—and hence disaster to come—in US risk assets.

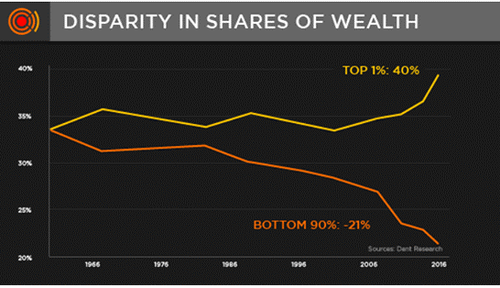

Years ago, Mr. Greenspan spun a tale of fantasy more egregious than Big Tobacco’s former “health affect” claim that cigarettes were good for you– namely the idea that extreme central bank support for stock markets has a “wealth effect” for the real economy.

When the markets tanked for one day in 1987, for example, Greenspan began lowering rates to help Wall Street recover. That pattern of bailing out markets with lower debt costs has since become the religious norm of the Fed under the subsequent mismanagement of Bernanke, Yellen and Powell.

Greenspan’s fantasy policy then, as now, was that lower rates stimulate markets, and that market wealth trickles down to economic health.

Well, there’s a number of problems with such policy fantasy, as facts are stubborn things…

The Greenspan Trickle?

First, it’s one thing to use rate reductions as market “rescue plans” when you are starting from a bond market that offered 16%, or then later 12%, 8% or even 4% yields on long-term sovereign bonds.

But what happens many years (and three Fed Chairs) later, when long term bond yields have been manipulated/ reduced to only 2%?

How much more room is left then to for “command control” central bankers to further reduce rates to save yet another over-valued bull market from crashing to earth?

In short, the Fed is running out of bullets, which means this low-rate bull market is running out of time.

Secondly, the so-called trickle-down “wealth effect” of bubbling stock markets benefiting Main Street economies is an openly failed premise as well as promise.

Does the following chart of income inequality in the US from Greenspan’s veiled wealth-transfer policies look like a balanced “wealth effect” to you?

The simple math and facts confirm that grossly inflated stock market growth had a mere 3%-4% impact on economic growth. In short, a true “trickle” indeed…

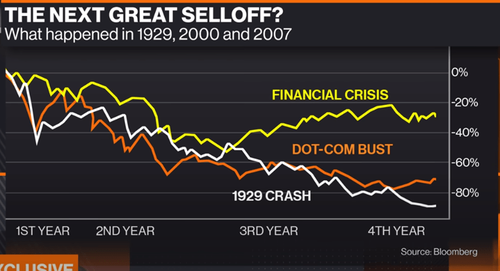

But as Greenspan, and then Later, Bernanke went on book and interview tours to congratulate themselves (while Paul Volker winced—I know this, because I saw him do it), they forgot to mention that despite their support for stock markets, those same markets crashed by 80% in the NASDAQ bubble of 2001-03 and by greater than 50% in the sub-prime bubble of 2008.

So much for the “Fed has your back.”

Greenspan’s Delusion Goes Public

But as we’ve written elsewhere, once the madness of Greenspan lead to a madness of crowds, the consequent animal spirits lead to what Grantham describes as a “state of mild hysteria” in which investor memories tend to get conveniently short.

While Greenspan and Bernanke were bragging of robust markets, for example, they failed to warn those hysterical investors of a little thing called “mean reversion” wherein Fed-stimulated markets always, well…pop.

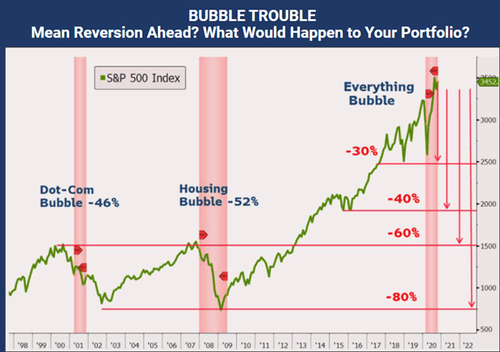

Since Greenspan took office, we’ve already seen two of those “popping moments” with extreme prejudice yet apparently no memory.

Are you ready for the next mean reversion, or do you think Powell (and the MMT crowd) are endeared with magical powers?

Fantasy and delusion (including delusional central bankers), after all, are such comforting investment guides. But let us remind you of what mean reversion can and will look like:

Thus, instead of dividend streams or sound, traditional valuation metrics, markets now are at record, nosebleed highs because investor faith in central bank promises is as delusional as the bankers themselves—and this never bodes well.

Unfortunately, faith in fantasy (unlike true valuation) is impossible to measure, and hence timing/predicting the death of that faith, as we’ve written elsewhere, is an equally impossible task.

That said, once you start to see the large cap wunderkinder stocks like Tesla, Amazon, Google et al seeing massive daily sell-offs, followed by brief recoveries and then more sell-offs, you will know the end is near, and such endings are never pretty.

In the interim, what we can promise, however, is when, not if, the current market faith dies, so too will these “epic market bubbles.”

For now, we are seeing the longest bull market, and hence longest era of open delusion, ever recorded. That creates a great fear of missing out for equally delusional top chasers. But again, this is nothing new.

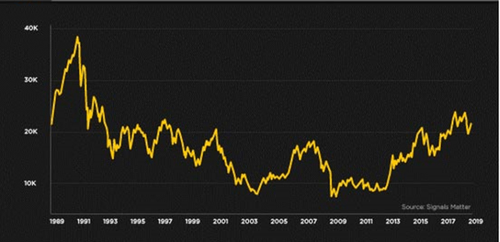

By the time the Japanese Nikkei died in 1989, losing greater than 80% from its tops and from which, some 30 years later, it has yet to recover, investors then were paying 65X earnings despite a prior history of never paying more than 25X earnings in Japan. They were sure their market would never pop; delusion and faith broke new records.

But of course, it did just that: It imploded—seemingly out of nowhere.

In short, trying to measure, and time, just how far crazy can go is a fool’s errand, as it’s impossible to measure foolish investors.

The current 12-year cycle of post-2009 market (and Fed-driven) hysteria can continue, despite ignoring some clear warning signs, like an OTC derivatives market trading 80M shares last February, only to end the year trading 1.15T shares, an open yet ignored sign of absolute insanity, for which the OTC market, as we’ve warned countless times, is the modern poster-child.

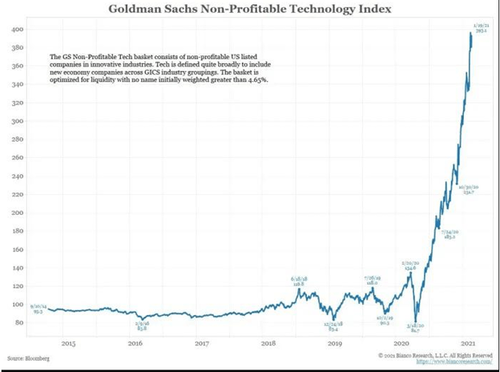

In addition, not even the NASDAQ markets or Cisco-like stocks I traded in the dot.com era (and bubble) of 1998-2001 can compare to the massive levels of over-valuation seen today in popular tech names whose market caps exceed that of GM, despite not making a single dollar of sales, profits or earnings.

Greenspan’s Sales Force

Of course, there will always be the salesmen, hedge fund managers, media bobbleheads, well-versed bankers and sell-side spin-sellers who will forever defend this bubble to keep investors (suckers) all-in, all the time.

To these snake-oil types, we can once again tip our hats to Alan Greenspan, who gave them the tag-line that they needed, namely that the Fed has your back and that fundamentals, or even market risk, no longer matters in a world where paper wealth (driven by central bank fiat paper) has replaced real wealth, and paper risk has been ignored by the headlines.

Such bubble-defenders have come up with all kinds of clever tricks to sell stocks that defy otherwise obvious symptoms of open fraud and dishonesty. Most notably, they point to the lack of yields in the bond markets to tempt more investors into the stock market.

But this comparison, as Jeremy Grantham reminds, is “ludicrous” for the simple reason that the bond market yardstick to which these stock peddlers are referring is an entirely artificial (i.e., Fed controlled) interest rate metric in which yields and rates, for all the reasons we’ve argued elsewhere, have zero correlation to natural market forces.

In short, the stock pushers are comparing bloated stocks to artificially repressed yields, the equivalent of comparing the price of a Ferrari to bag of magical beans. And yet millions of investing “Jacks” are climbing a stock market beanstalk toward a painful end.

Greenspan’s Broken Moral Compass

But Mr. Greenspan’s painful legacy goes even further. The moral hazard which marked his lack of ethics as Wall Street’s mistress as opposed to Main Street’s protector beginning in 1987 has now become the immoral norm of a market seemingly devoid of a moral compass.

The proliferation of SPACs, for example, in which smooth-talkers run around the country raising capital for a 20% carry (fee) and then hand those sucker dollars to hedge funds who take hefty premiums before pumping and then timely dumping the same is just one of countless examples of legitimized theft—much like Elon Musk’s “funding secured” short squeeze of 2018 or his front-running BTC tweet of 2021.

Goldman Sachs, another moral juggernaut (eh-hmmm), has no problem pumping IPOs for a fee that return no profits on a balance sheet.

As for more evidence of outright moral turpitude now accepted as normal market behavior, just consider 1) the price-controlled profile of the COMEX futures market lead by 8 major banks, 2) banks misreporting toxic derivatives exposure, 3) the lies the Fed uses to report CPI inflation, or, and most recently, 4) the Fed’s deliberate hiding of otherwise embarrassing M1 and M2 data from the public.

In short, the only thing we see “tricking down” from Greenspan’s example (he, Milton Friedman and Leo Malemed also helped bring mass leverage to the OTC market) and legacy has a foul smell to it.

Where to Hide from Greenspan’s Monster?

In the decades which have passed since Greenspan became the Fed template and “stimulus” supplier of Wall Street’s post-87 debt (keg) party of free money, repressed rates and hence massive stock and bond bubble-to-burst cycles, where can informed investors find value, safety and a comfortable night’s sleep?

With bond markets resembling a Frankenstein monster of artificial life thanks to a series of central bank lightning bolts (unlimited liquidity and open yield repression), do you still think of bonds as a “safe haven”?

As for value stocks, one would need more than a microscope and calculator to find traces of them today in the unprecedented over-valuation of the S&P or NASDAQ.

But as Grantham reminds, the Emerging Markets, for those wise and patient enough to invest rather than gamble, offers some obvious choices.

Like Grantham, however, we are equally, if not more openly, worried about the inflation that always shadows grotesque levels of rising money supply, to which, again, we can thank the trend begun by Mr. Greenspan and subsequently made legitimate by greater fools like Bernanke, Yellen and Powell.

Regardless of how measured (or mis-measured) by central-bank distorted inflationary scales or cleverly hidden M1 and M2 reporting methods, and regardless of the ongoing inflation vs. deflation debates in vogue today, we see undeniable evidence of grossly declining (debased) currencies in the U.S. and around the world, just one more legacy of the pro-market yet Main-Street-ignored policies unleashed by Greenspan and emboldened by subsequent Fed leaders.

In the end, sadly, the only thing “trickling down” from Greenspan’s “wealth effect” policies have been the debased dollars in your hip-pocket not the Fed “having your back.”

Thanks a lot Alan.

Tyler Durden

Sat, 04/24/2021 – 14:21

via ZeroHedge News https://ift.tt/3tUX3nm Tyler Durden