Fund Manager Arrested, Charged With Fraud, After Using Client Funds For His “Race Car Hobby”

Stop us if you’ve head this one before: a hedge fund manager was arrested and charged with fraud for spending client funds to keep up with his own personal habits and live a lavish lifestyle.

Are you stunned? Haven’t heard anything like this in…months? Days? Need the dirty details of yet another story about fraud on Wall Street? Well, here they are.

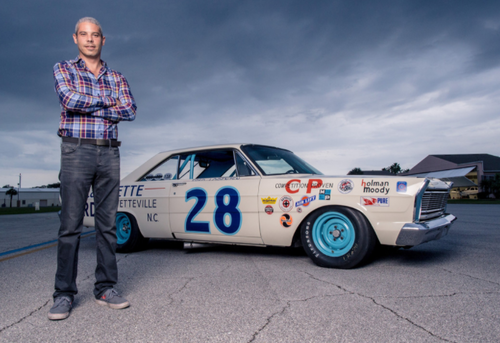

44 year old Andrew Franzone was charged last week with defrauding investors of almost $40 million, some of which he diverted to buy an aircraft hangar for his private race car collection. He was arrested in Fort Lauderdale on Thursday, according to a U.S. Department of Justice release.

The release says he touted his fund as a “multi-strategy investment program … focus[ed] on three unique asset classes: the preferred stock market, the option market, and the private investment portfolio” and that he “assured investors that FF Fund was focused on trading in the preferred securities and options markets, which afforded its investors access to quarterly liquidity, and that FF Fund had a track record of consistent positive trading returns since its inception in August 2010.”

The DOJ alleges his representations about the fund’s liquidity and strategy were “largely fabricated”:

Instead of engaging primarily in preferred securities and options trading that ensured the FF Fund’s liquidity, FRANZONE instead diverted more than 80% of FF Fund’s capital to high-risk, illiquid private investments, many of which were either worthless or significantly impaired. FRANZONE also misappropriated FF Fund’s assets to fund his own personal business interests, including the purchase of an airplane hangar, and lied to investors about FF Fund’s performance and assets under management.

Through these and other fraudulent misrepresentations and omissions, FRANZONE induced over 100 investors to invest more than $40 million in FF Fund. Despite showing investors positive trading returns as late as 2019, FF Fund was unable to fulfill redemption requests in early 2019 and is currently in the process of being liquidated.

Manhattan U.S. Attorney Audrey Strauss said: “Andrew Franzone allegedly promised his clients access to his successful liquid trading strategy and consistent, positive trading returns. As alleged, those promises were lies. Franzone lied about his fund’s investments and performance, and he lied in promising clients that they had could readily access their invested capital. While his investors lost money, Franzone enriched himself. We will continue to work with our law enforcement partners to protect investors from these types of deceptive practices.”

USPIS Inspector-in-Charge Philip R. Bartlett said: “Mr. Franzone allegedly misled investors to believe his fund was liquid and he could cover their redemption requests, in a scheme to lure them in to investing in his hedge fund. This should be a reminder that greed has no boundaries and does not care about a favorable portfolio. Postal Inspectors remind all investors to thoroughly check offers, and if they sound too good to be true, keep your money in the bank.”

Franzone’s affinity for racing was even featured in the Wall Street Journal back in 2016.

He has been charged with “one count of securities fraud, which carries a maximum potential sentence of 20 years in prison, and one count of wire fraud, which carries a maximum potential sentence of 20 years in prison.”

Tyler Durden

Sun, 04/25/2021 – 16:35

via ZeroHedge News https://ift.tt/3ex8hYu Tyler Durden