Yuan Forward Sales Surge To Highest Since 2015

Another month, another gaping discrepancy between Chinese FX reserve data and actual yuan cross-border flows.

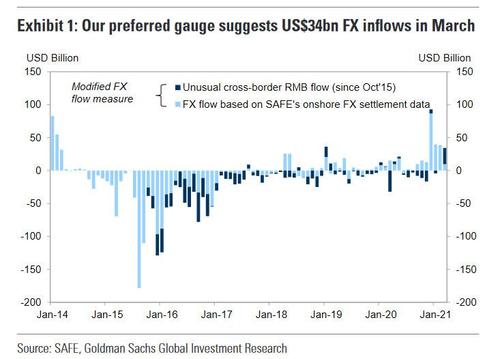

In the same month that PBOC data revealed that FX reserves stood at US$3,170bn in March, $35BN lower than February (granted mostly on valuation effect, which when netted out implies that FX reserves declined by $4bn), Goldman has calculated that net FX flows were actually $34BN into the Chinese economy.

According to Goldman’s Maggie Wei, in March, there was $2BN in net inflows via onshore outright spot transactions,and US$7BN in net inflow via freshly entered and canceled forward transactions, while a separate SAFE dataset on “cross-border RMB flows” shows that domestic banks saw net RMB receipt of $25BN from onshore to offshore. Combining the three, Goldman’s “preferred” FX flow measure suggests a total of $34BN inflows in March, which while slightly slower than February, was a mirror image of the picture implied from FX reserve data.

Digging deeper into the numbers reveals that FX inflows related to the goods trade surplus remained strong at $26BN in March, even higher than the single month goods trade surplus at $14bn in March. The FX conversion ratio for net goods trade surplus in Q1 2021 stood at 81%, higher than 45% in Q4 2020. Services trade related FX outflow in March was modestly higher at $6BN, vs $2BN in February.

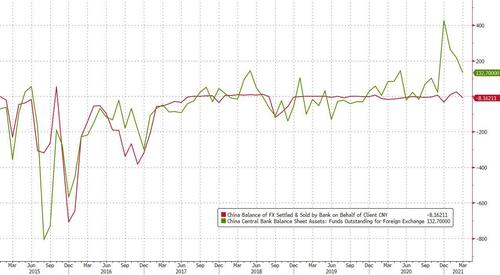

FX inflows notwithstanding, China’s net foreign exchange settlement, which the US Treasury considers a more comprehensive proxy for intervention because it includes the activities of China’s state-owned banks, and surged to about $180 billion last year, remained persistently wide compared to the modest decline in PBOC FX assets. As a reminder, historically these two data series have tracked each other closely but a striking divergence emerged since last November.

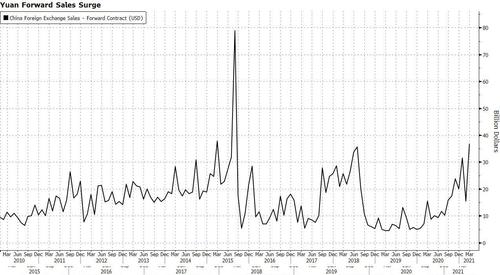

Commenting on China’s FX shennanigans, Bloomberg’s Ye Xie notes that yuan forward transactions surged as corporates hedged their currency exposure, with settlement data showing that yuan-forward sales surged in March to the highest since 2015 as China’s currency weakened during the period. “The increased trading of currency derivatives is a healthy development, suggesting Chinese companies have become more prudent managing their currency exposure” according to Wang Chunying, spokeswoman for the State Administration of Foreign Exchange.

As Xie summarizes the above, hedging activities soared since October when regulators cut the reserve requirement to make it less costly to sell the yuan in forwards. It may have helped lower currency volatility. Separately, the settlement data showed net foreign currency inflows continued last month, albeit at a slower pace, as strong exports offset small bond outflows.

Tyler Durden

Sun, 04/25/2021 – 23:00

via ZeroHedge News https://ift.tt/3gCF7d4 Tyler Durden