S&P Futures Flat Ahead Of Earnings Deluge; Nasdaq Drops As Tesla Looms

S&P futures were flat, Nasdaq futures dipped ahead of FAAMG earnings while European stocks clawed their way higher on Monday and Asia rose as world markets began the week in a relatively upbeat – if quiet – mood following further signs last week that economies are recovering rapidly. There were no major moves, however, as investors refrained from taking on large positions ahead of this week’s Federal Reserve meeting, US GDP print and corporate earnings barrage.

At 7:30 a.m. ET, Dow e-minis were up 30 points, or 0.09%, S&P 500 e-minis were down 3.75points, or 0.08%, and Nasdaq 100 e-minis were down 48.75 points, or 0.37%.

Nasdaq 100 futures dropped to as much as 0.4%, reversing earlier gain of as much as 0.1%, as big technology stocks retreated ahead of first-quarter results later this week, while Treasury yields rose. Nasdaq was also weaker following a weekend report that investors had pulled a whopping $6BN from the QQQ ETF in the past five days, the most since the dot com bubble burst.

High-flying firms, including Amazon, Facebook, Alphabet and Microsoft slipped between 0.2% and 0.4% in premarket trading. Tesla edged higher as analysts expect the electric automaker to report a rise in first-quarter revenue when it reports after markets close following record deliveries for the period.

Of the 123 companies in the S&P 500 that have published results so far, 85.4% have reported earnings above analysts’ estimates, with Refinitiv IBES data now predicting a 33.9% jump in profit growth.

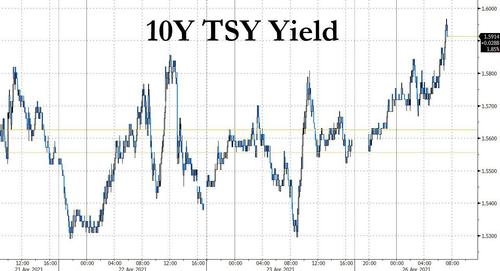

With risk bid, safe havens including the dollar and government bonds were under pressure while copper, seen as a barometer of growth, surged to the highest in a decade. The U.S. 10-year rate bounced back from its 50-day moving average, underscoring the reflation trade is still alive, but remained below the 1.60% level, sustaining a risk-on bid for global assets including emerging markets.

Global stocks have been basking in a massive rally – the MSCI world index has suffered only three down months in the past 12 and is up nearly 5% this month and 9% for the year as investors bet on a rapid post-pandemic economic rebound turbocharged by vast government and central bank stimulus. General sentiment remained bullish to start the week, with Wall Street hitting another intraday record-high on Friday and European shares not far off record highs in early Monday trading.

However, as we noted over the weekend, sellside analysts are turning increasingly bearish and say stocks look a little too confident and that the rally will run into hurdles after setting such a lightning pace and with so much of the recovery and fiscal stimulus splurge already priced in. Analysts at Goldman Sachs, Morgan Stanley, Deutsche Bank and now, JPMorgan, have warned of some turbulence ahead, after a rally that has taken the S&P 500 and Dow to fresh records this year

“The real crux of the issue, however, is what’s in the price. The year-to-date rally has increasingly eliminated upside to our targets,” noted Morgan Stanley strategist Andrew Sheets. “Across four major global equity markets (the U.S., Europe, Japan and emerging markets), only Japan is currently below our end-2021 strategy forecast.”

That did not prevent investors from bidding risk up, however, and the broader Euro STOXX 600 was just barely in the green while Germany’s DAX rose 0.22%. Britain’s FTSE 100 climbed 0.21%. European stocks were little changed Monday, as gains for banks and travel companies offset losses for carmakers and technology companies. Here are some of the biggest European movers today:

- IMI shares gain as much as 7.9% to the highest since July 2014 after the company raised guidance for FY21 and announced a GBP200m buyback in first-quarter update.

- Hensoldt shares rise as much as 18% in Frankfurt after Italy’s Leonardo agreed to buy a 25% stake in the German defense company for EU606m, or about 23 euros a share.

- Tate & Lyle shares climb as much as 7%, the most since early November, as the company explores selling a controlling stake in its primary products business.

- Kuehne + Nagel shares rise as much as 3.2%, extending its record high, after reporting first-quarter results that were “stunning,” according to Vontobel.

- AMS shares fall as much as 5.1% to the lowest since Aug. 2020 after Credit Suisse double downgrades to underperform from outperform, citing concern over the chipmaker potentially losing two out of three sources of business with Apple.

- Philips shares drop as much as 3.4% following the company’s first-quarter results. Analysts say investor responses to the beat and guidance raise are tempered by a reported quality issue in a component used in some sleep and respiratory products.

Earlier in the session, Asia stocks rose as investors continued to keep a close eye on the ongoing earnings season globally and U.S. data for clues on economic recovery. The MSCI Asia Pacific Index rose 0.6% led by tech and material shares.

India shares were among the biggest gainers with the S&P BSE Sensex Index up about 1%. As the index on Friday capped its third consecutive weekly decline amid a surge in Covid-19 infections, funds such as Fidelity International and Invesco were seeking opportunities to add stocks, seeing India’s vaccination campaign and less-disruptive lockdown measures as offering some support.

Meanwhile, China’s CSI 300 Index closed down 1.1% after rising as much as 0.9%, as investors await a key gathering of the country’s top leaders expected to take place this week for signals on liquidity policies. Consumer staples and financial stocks led the loss, with Kweichow Moutai and China Merchants Bank among the biggest drags on the gauge. The gauge’s decline came after a bumpy rebound in recent weeks that has set April up for the first monthly rise since January. The rebound may have some lasting power, according to CSC Financial, which recommends investors hold onto shares rather than cash ahead of a five-day May holiday that starts this weekend. The recent strength in stocks was partly due to lower borrowing costs after China’s first-quarter economic growth slightly missed analysts’ estimates, the brokerage’s analysts including Zhang Yulong wrote in a Monday note. Chinese authorities are stepping up effort to support the country’s small firms, with the banking regulator urging five large lenders to boost loans to the sector by more than 30% this year. Traders are also closely watching the Politburo meeting expected to be held this week for clues on liquidity conditions and broader economic policies in the months ahead. Foreign investors bought a net 3.2 billion yuan of A shares via the trading link with Hong Kong, less than half of their purchases on Friday. However, total trading volume in Shanghai and Shenzhen jumped to the highest since March 9 at 868 billion yuan. The Shanghai Composite also slid in the afternoon to close 1% lower. Hong Kong’s Hang Seng Index lost 0.4%.

Japanese shares eked out gains with the Topix rising 0.2%, rising for the second day in three, despite Tokyo and other prefectures imposing a state of emergency. SoftBank Group and Fast Retailing provided the biggest boosts to the Nikkei 225 Stock Average. Railway operators and machinery makers gave the most support to the Topix. Both gauges completed a weekly drop of more than 2% on Friday. “From a global perspective, we’re in a risk-on market,” said Tetsuo Seshimo, a fund manager at Saison Asset Management Co. in Tokyo. “With easy monetary policies sustained, the upward trend in global equities is the main scenario.” Despite today’s advance, Japanese shares may fall behind globally due to the nation’s slow pace of vaccinations and the impact of restrictions on the economy, Seshimo said. A new state of emergency started Sunday for Tokyo, Osaka and two other prefectures due to rising infections. Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management, said further gains may face headwinds as coronavirus-driven sentiment causes Japan’s equity market to fall behind the U.S. and Europe. “Japanese equities will likely rebound, but apart from solid U.S. data, the market is devoid of fresh leads and the upside will remain tough,” Akino said.

In Vietnam, the stock benchmark fell 2.6% after the country’s Health Minister Nguyen Thanh Long said the risk of Covid-19 spreading in the country is “very high and worrying.” New Zealand’s stock market was closed for a local holiday.

“While positive surprises have supported the stock market, the trend on earnings is even more important,” David Kelly, chief global market strategist at JPMorgan Asset Management, wrote in a note. “Investors will continue to watch the earnings season with 181 of the S&P 500 companies set to announce their first-quarter results this week.”

In bond markets, government debt yields rose as investors dumped safer assets. The U.S. 10-year Treasury yield rose 3 basis points to 1.59% trading near highs of the day, cheaper by more than 3bp at long-end, ahead of this week’s front-loaded auction cycle which includes 2- and 5-year note sales Monday. FOMC rate decision on Wednesday is week’s main event after the auction cycle. 10-year yields around 1.59%, higher by 3.6bp vs Friday’s close, are ~1bp cheaper vs bunds and gilts; S&P 500 futures are down 0.1% after cash gained 1.1% Friday. Peripheral spreads widen with 30y Italian yields rising to 1.83%, highest since Sept. 2020.

In currencies, the dollar extended a two-month low, heading for the biggest monthly loss since November. The euro was steady after touching a two-month high of $1.2117 while European government bonds were lower, with the periphery underperforming bunds The Bloomberg Dollar Spot Index is at a crossroads and chances are the euro’s performance will define the outcome. The pound advanced; the U.K. economy will see “very rapid growth at least over the next couple of quarters,” Bank of England Deputy Governor Ben Broadbent told the Telegraph in an interview. The Australian dollar was the top performer among G-10 currencies amid strong gains in stocks and iron ore. Norway’s krone fell against most G-10 peers as oil declined ahead of a key OPEC+ meeting later this week

In commodities, oil retreated amid concern demand from India may fall after the nation reported a million new coronavirus cases in three days. WTI fell 57 cents to $61.57 per barrel and Brent eased 57 cents to $65.64. Gold climbed 0.1% to $1,779 an ounce. Copper surged to the highest in a decade on expectations supply will tighten as the global economic recovery gains traction. Prices have climbed amid a broad rally across industrial commodities from iron ore to aluminum.

Bitcoin reversed a weekend loss, and soared back to $54,000 after dropping as low as $48,000 late on Sunday.

First-quarter U.S. gross domestic product data due later in the week is likely to show activity probably returned to pre-pandemic levels, analysts said. “We estimate that the economy will close the output gap and rise above potential in the second half of this year,” ANZ economists wrote in a morning note, suggesting more upside for shares. “(Europe) cannot match this, but as 2021 progresses into 2022, the growth differential to the U.S. will narrow,” they added.

Market participants are also watching out for any fresh developments on Biden’s tax plan after reports last week said he would seek to nearly double the capital gains tax to 39.6% for wealthy individuals. Investors will also be looking forward to the two-day Federal Reserve meeting beginning on Tuesday and the first-quarter gross domestic product numbers later this week to gauge the pace of economic recovery.

Market Snapshot

- S&P 500 futures little changed at 4,169.75

- STOXX Europe 600 little changed at 439.41

- MXAP up 0.5% to 209.21

- MXAPJ up 0.5% to 702.13

- Nikkei up 0.4% to 29,126.23

- Topix up 0.2% to 1,918.15

- Hang Seng Index down 0.4% to 28,952.83

- Shanghai Composite down 0.9% to 3,441.17

- Sensex up 1.2% to 48,474.08

- Australia S&P/ASX 200 down 0.2% to 7,045.56

- Kospi up 1.0% to 3,217.53

- German 10Y yield rose 0.8bps to -0.251%

- Euro little changed at $1.2097

- Brent Futures down 1.2% to $65.31/bbl

- Gold spot up 0.2% to $1,780.59

- U.S. Dollar Index down 0.10% to 90.77

Top Overnight News

- The Federal Reserve is expected to begin trimming its $120 billion in monthly asset purchases before the end of the year as the U.S. economy recovers strongly from Covid-19, according to economists surveyed by Bloomberg. That’s a bit earlier than forecast in the March survey

- Italy’s Prime Minister Mario Draghi goes to Parliament on Monday to present details of his 235 billion-euro ($284 billion) plan to re-engineer Italy’s economy that will be a test of the European Union’s post-pandemic recovery fund

- China’s economy continued to boom in April from the record growth in the first quarter, with strong exports and rising business confidence supporting the recovery. That’s the outlook of an aggregate index combining eight early indicators tracked by Bloomberg, which remained unchanged from March in strong expansionary territory

- JPMorgan Asset Management and BlackRock Inc. are betting that a strong economic recovery in the U.S. and elsewhere may start hurting parts of the bond market despite the recent slide in benchmark Treasury yields

- Life insurers in Japan, some of the world’s biggest debt investors, say they will hold off on aggressive purchases of U.S. sovereign bonds due to the risk of another rout and more currency volatility

- Bitcoin is on track for its biggest gain since Feb. 8 as it rose by more than 10% after earlier dropping

A quick look at global markets courtesy of Newsquawk

Asia-Pac equity markets traded tentatively albeit with a positive tilt as the major bourses in the region and US equity futures lacked firm commitment heading into month-end, as well as this week’s key events including the BoJ and FOMC meetings, as well as US GDP and Chinese PMI data. ASX 200 (-0.2%) was rangebound as strength in mining names and the top-weighted financials sector helped offset the headwinds from a snap 3-day lockdown in Perth and neighbouring Peel region, while Nikkei 225 (+0.4%) shrugged off early jitters from the reinstatement of the state of emergency for four areas including Tokyo and following the ruling LDP’s failure to win in three by-elections which is seen as a blow to PM Suga ahead of the general election later this year. Hang Seng (-0.4%) and Shanghai Comp. (-0.9%) traded with mild gains initially as participants digested earnings and with China to begin a month-long campaign promoting consumption in May, with the initial advances led by outperformance in health care and strength in mining stocks as mainland commodity prices hit fresh record levels; however, as the session progressed and European participants entered the fray the indices came under pressure. Finally, 10yr JGBs were subdued and broke beneath Friday’s tight ranges to test the 151.50 levels amid a similar subdued trade in T-note futures and with demand sapped as participants await the BoJ which kick started their 2-day policy meeting today.

Top Asian News

- Blackstone Offers $1.1 Billion to Buy 26% of India’s Mphasis (2)

- Hedging Trades Push Yuan-Forward Sales to 2015 High in March

- Chinese Firms Are Listing in the U.S. at a Record-Breaking Pace

- China’s Biggest IPO This Year Looks to Be in Renewable Power

Major bourses kicked the week off in another lacklustre fashion and the region remains choppy within a narrow band (Euro Stoxx 50 Unch). US equity futures meanwhile reflect the indecisive tone across the market, with the ES and YM flat whilst the tech-laden NQ (-0.2%) and cyclically-led RTY (+0.5%) see a mild divergence as participants gear up for a risk-packed week – which entails the FOMC and BOJ decisions, President Biden’s American Jobs plan speech to Congress, US Q1 GDP, Chinese official PMIs, the JMMC/OPEC+ meetings, and the peak of US earnings season with some 180 S&P 500 companies reporting. Back to Europe, the below-forecast April Ifo German Survey failed to immediately spur price action with desks suggesting that the data reflects a combination of delayed lockdown impact and reopening hopes – although a strong H2 rebound does remain valid. Sectors in Europe are mixed but it is difficult to discern a particular risk profile or an overall theme. Travel & Leisure sees a firm performance as the vaccination drive in the west remains robust whilst NYT also suggested that the EU is reportedly set to allow vaccinated US tourists to visit this summer – in turn lifting the Spanish IBEX (+0.7%) amidst its heavy exposure to the sector – with its top-performing stocks including IAG (+3.6%), Merlin Properties (+2.5%) and Aena (+2.2%). Banks and Basic Resources also see a solid performance thus far amid the higher intraday yield environment and the surge in base metals, namely copper. The downside meanwhile sees Autos (-0.7%) bearing the brunt of the chip shortages – with Volkswagen (-1.3%) suggesting its Q2 productions are poised to be more affected than in Q1. In terms of individual movers, Tate & Lyle (+6.4%) resides as one of the top Stoxx 600 performers as the Co. has started preparations for a break-up or spin-off of its primary products unit which generated over GBP 1.8bln in revenue last year. Analysts believe the unit could be valued north of GBP 1.2bln. On the flip side, Leonardo (-3%) sits on the other side of the spectrum after purchasing a 25.1% stake in Hensoldt (+4.4%) for EUR 606mln.

Top European News

- Nestle Eyes Nature’s Bounty Acquisition to Boost Vitamin Sales

- Philips Raises Sales Forecast as Focus Narrows to Health

- EQT’s Software Firm SUSE to Seek $500 Million in Frankfurt IPO

- EU May Allow Vaccinated U.S. Tourists This Summer, NYT Says

In FX, the Aussie is forming a stronger base around 0.7750 vs its US counterpart and has bounced firmly against the Kiwi in the absence of many NZ participants due to the ANZAC market holiday. Indeed, Aud/Nzd is back in the high 1.0700 area after a few forays under 1.0750 last week amidst a sharp rally in copper prices to decade highs on the LME and strength in iron ore alongside other Chinese metals overnight. Nevertheless, Nzd/Usd is back on the 0.7200 handle as the Greenback continues to flounder in broad terms, with the DXY unable to reclaim 91.000+ status where 2 MA levels lie in very close proximity (100 day and week at 91.024 and 91.056 respectively) between 90.894-679 extremes ahead of notoriously volatile US durable goods and a double dose of T-note supply (Usd 60 bn 2 year and Usd 61 bn 5 year sales). Hence, Cable has rebounded from sub-1.3900 again, albeit with assistance via the Eur/Gbp cross that is back down around 0.8700 after eclipsing last Friday’s peak by a pip, but effectively forming a near triple top having reached 0.8719 on April 16 as well.

- JPY – No clear breach of 107.50 for the Yen has not really altered the overall bearish trend in Usd/Jpy as the subsequent high fell a few pips shy of 108.00 compared to 108.15 on April 23 and 108.84 this time last week. Thus, the headline pair remains offered and a sell into upturns as the clock ticks down to the BoJ and Fed.

- CAD/EUR/CHF – A downturn in oil prices awaiting OPEC+ has taken some sapped some of the Loonie’s post-BoC momentum, but Usd/Cad has also bounced following a probe through 1.2450 and a lack of impetus the break beyond the half round number convincingly. Similarly, the Euro popped above 1.2100, though without enough conviction to stay there or build much on the March 3 apex at 1.2113 that prefaced a fall to circa 1.1704 by the end of last month, with a somewhat mixed German Ifo survey hardly helping (business climate, current conditions and expectations all missed consensus, but former 2 readings above previous prints). Elsewhere, the Franc marginally softer between 0.9146-22 and 1.1063-49 parameters vs the Dollar and Euro respectively as sight deposits at Swiss banks held fairly steady in the latest week.

- EM – The Lira did not glean much encouragement from an uptick in Turkish manufacturing sentiment, but Usd/Try has recoiled from 8.4840+ to test 8.3000 amidst the aforementioned pull-back in crude and what looks like a correction perhaps aided by official intervention in defence of 8.5000. Meanwhile, the Rand may be deriving support over 14.2500 from the SA Health Ministry pledging rigorous pre-vaccine assessments and monitoring after jabs once it restarts the J and J study.

In commodities, WTI and Brent front-month futures are pressured in early European trade with the former testing USD 61/bbl to the downside at the time of writing (vs high 62.31/bbl) and the latter hovering around USD 65/bbl (vs high 66.26/bbl). The crude complex continues to adjust to the fluid supply/demand dynamics, with India’s dire COVID situation raising demand concerns, both on a domestic front and internationally as the so-called “double-mutant” (B.1.617) is cited as the fuel behind the latest surge in cases and deaths – with some also expressing concerns over its resilience to vaccines, although no official studies nor announcements have yet been made on this front. Meanwhile, eyes remain on geopolitics as Iranian JCPOA talks are reportedly going the right way, although Tehran sticks to its guns for economy-crippling sanctions to be removed before any meaningful progress can occur. Turning to OPEC, both the JMMC and OPEC+ meetings are seemingly going ahead this week, with the latter suggesting a non-zero chance of a tweak to the quotas set through to July – and although expectations are currently skewed towards no change in policy, it is worth being cognizant of the fact that OPEC+ has surprised at almost every meeting this year thus far. Elsewhere, spot gold and silver trade uneventfully moving in tandem with the Dollar, with the former in a tight band around USD 1,780/oz whilst spot silver trades on either side of USD 26/oz. Turning to base metals, copper prices have been tearing higher once again with LME copper extending gains above USD 9,500/t and hitting 10yr highs amid a weaker Buck alongside some supply-side concerns as Chilean port workers called a strike today, with miners also threatening strike action amid the government’s move to block a pension bill; for reference, Chile accounts for around 25% of the global copper supply.

US Event Calendar

- 8:30am: March Durable Goods Orders, est. 2.5%, prior -1.2%; -Less Transportation, est. 1.6%, prior -0.9%

- 8:30am: March Cap Goods Orders Nondef Ex Air, est. 1.8%, prior -0.9%; Cap Goods Ship Nondef Ex Air, est. 1.5%, prior -1.1%

- 10:30am: April Dallas Fed Manf. Activity, est. 30.0, prior 28.9

DB’s Jim Reid concludes the overnight wrap

I’ll be honest with you I’m a little down this morning. I reached a big golf final last year at my club and 2 lockdowns and 2 weather cancellations later I lost the final on Saturday. Since lockdown ended I’d been playing really well and thought I finally had the game cracked. In 35 years of playing the sport I should have realised that this is never the case. I slumped home and managed to catch the end of the Liverpool game. Desperate for a win, they conceded and drew in the 95th minute. I must admit that this nearly tipped me over the edge and I could have quite easily sobbed. Then I was in charge of the kids for the rest of the day. Did that make me feel much better? No! They were the opposite of therapeutic.

To take my mind off a golf swing that collapsed in the wind and under pressure, It’s a busy week ahead for markets. The Federal Reserve (Weds) and the Bank of Japan (Thurs) are both making their latest policy announcements with the former the obvious focal point for the week. On top of that, there are an array of earnings releases, including 180 companies in the S&P 500. Tesla today might be one of the more headline grabbing ones but to be honest there are plenty of them. Meanwhile President Biden will give his first speech to a joint session of Congress (Weds) and finally, there are some important data releases, including the first look at Q1 GDP for the US (Thurs) and the Euro Area (Fri).

Outside of this the Covid pandemic will remain in the spotlight as the number of global cases rose at their fastest weekly pace yet last week. India has seen fresh record cases over the weekend with around 350k new daily positive tests and a million over 3 days. There have been reports that’s various models are predicting this could hit over 500k per day this week which will gain huge headlines. While Indian case loads are so high there will be concerns about the unevenness of the global recovery and the ability of variants to escape. So this is undoubtedly a big story.

Overnight, Asian markets have started the week on the front foot with the Nikkei (+0.66%), Hang Seng (+0.08%), Shanghai Comp (+0.19%) and Kospi (+0.62%) all up. Futures on the S&P 500 are also up +0.08% while yields on 10y USTs are up +1.3bps to 1.573%. In Fx, the US dollar is trading down -0.17% this morning. Later today we will hear from Italian PM Mario Draghi on details of his plans to utilise EUR 222bn in EU grants and loans. From what we know so far 40% of the plan’s resources are destined for the impoverished southern region and a large chunk of spending is also slated for infrastructure, modernising and expanding Italy’s rail system.

Turning to the latest on the pandemic, overnight, the US has said that it will be sending raw materials for the AZ vaccine to India and will step up financing aid for Covid-19 shot production. The US is also said to be considering sending India its stockpiled doses of the AZ vaccine, currently unapproved for use in the US. The US has around 20mn doses of the AZ vaccine in stock. This comes as the vaccine uptake is slowing in the US with the 7-day average of vaccine doses administered falling to 2.8mn compared to a record 3.4 million on April 13. Meanwhile, the EU has said that it will allow US tourists who have been fully vaccinated to travel to the continent this summer. Singapore and Hong Kong have also reported that they will open their highly anticipated two way travel bubble on May 26.

Back to week ahead and going through some of the main highlights in more detail now. The biggest scheduled event on this week’s calendar for markets will be Wednesday’s Federal Reserve meeting and Chair Powell’s subsequent press conference. In their preview (link here), our US economists write that this meeting should largely serve as a status check of the economic recovery relative to the substantial forecast upgrades that the FOMC unveiled at their March meeting. And in the press conference, they expect Powell will likely continue his subtle shift in tone in a more optimistic direction. Nevertheless, given the remaining gaps in the labour market and the focus on seeing actual rather than forecasted progress, April is too soon for the return of taper talk, and they expect those discussions to heat up during the summer instead.

The other major central bank deciding on rates is the Bank of Japan (tomorrow), when it will also be releasing its quarterly Outlook Report. According to our economist (link here), the BoJ will retain its current policy stance next week, having only just fine-tuned their framework after the policy assessment last month. For the Outlook Report, the expectation is that it will raise the overseas growth projections, but the main focus will be on the new figures for FY2023, where our economist is looking for a real GDP growth forecast of 1.2% and core CPI inflation forecast of 1.1%.

In the political sphere, this week will see President Biden give his first speech to a joint session of Congress on Wednesday. We’re expecting a number of measures to be discussed, including the American Families Plan, which is expected to include fresh proposals on childcare and education. This sits alongside the American Jobs Plan, that Biden has already unveiled, where he proposed investing over $2tn in infrastructure and other priorities, to be financed through higher corporate taxes.

The current earnings season moves into full flow this week, as 180 companies in the S&P 500 report, along with a further 113 from the STOXX 600. Among the highlights include Tesla today, then tomorrow, we’ll hear from Microsoft, Alphabet, Visa, Novartis, Eli Lilly, Texas Instruments, UPS, Amgen, Starbucks, Raytheon Technologies, General Electric, HSBC, 3M and UBS. Wednesday then brings Apple, Facebook, Qualcomm, Boeing, Sanofi, GlaxoSmithKline, Santander, Ford, Lloyds Banking Group and Sony. On Thursday, releases include Amazon, Mastercard, Comcast, Merck, Thermo Fisher Scientific, McDonald’s, Bristol Myers Squibb, Royal Dutch Shell, Caterpillar, Total, American Tower, Twitter, NatWest Group and Samsung Electronics. Finally on Friday, there’s Exxon Mobil, Chevron, AbbVie, Charter Communications, AstraZeneca, BNP Paribas and Barclays.

Finally, there are also a few highlights among this week’s data releases, with the initial estimates of Q1 GDP coming out for numerous countries, including the US, the Euro Area, Germany, France and Italy. It’ll also be worth watching out for the weekly initial jobless claims data from the US, as that’s one of the most timely indicators we get, and has fallen to a post-pandemic low this last week, so it’ll be interesting to see if that decline is sustained.

To recap last week, markets in Europe and the US fell back from their record highs as a mix of geopolitical risk, accelerating global Covid-19 cases and generally long investor-positioning weighed on risk assets. The S&P 500 fell back a marginal -0.13% on the week, despite a strong rally on Friday (+1.09%). It was the first weekly loss for the index after four straight weekly gains. Cyclicals sectors continue to underperform their growth counterparts as banks (-0.81%) and energy (-1.78%) stocks trailed the NASDAQ’s -0.25% weekly loss. However the mega-cap NYFANG index (-2.04% on the week) saw greater losses following poor earnings numbers from Netflix (down -7.50% on the week). The VIX volatility index rose +1.1pts to 17.3, which is only the second weekly rise in the implied volatility index since the start of March. European stocks fell back from their own record highs as the STOXX 600 lost -0.78% over the week, with the FTSE MIB (-1.45%) and DAX (-1.17%) underperforming other bourses.

US 10yr yields finished the week -2.2bps lower (+2.0bps Friday) at 1.558% – the fourth weekly drop in yields over the last five weeks. The global benchmark is now -18.3bps lower than the March 31 closing highs of 1.74%. The week’s move was driven by the drop in inflation expectations (-3.1bps) which overcame the smaller rise in real yields (+1.0bps). European rates were more mixed with 10yr bund yields gaining +0.5bps last week and UK gilt yields falling -2.0bps, while yields on OATs rose +9.0bps. In FX, the dollar index fell back -0.76% on the week – the third weekly loss in a row and it now sits at its lowest levels since March 2.

In terms of economic data from Friday, global flash PMIs showed continued momentum as the composite PMI for the euro area rose to 53.7 from 53.2 last month. Euro area services PMI returned to expansionary status with a 50.3 reading from a 49.6 level last month. Germany’s composite figure edged back slightly to 56 from 57.3 with marginal drops in both the services and manufacturing readings, while the composite PMI in France rose to 51.7 from 50 in March. The US Markit PMI composite rose to 62.2, the highest reading since the series began in 2009, fueled by new orders and output prices.

Tyler Durden

Mon, 04/26/2021 – 07:57

via ZeroHedge News https://ift.tt/3xjq7a9 Tyler Durden