‘Sticker Shock” At The Grocery Store Imminent As Ag Futures Surge Most In 8 Years

Authored by Mike Shedlock via MishTalk.com,

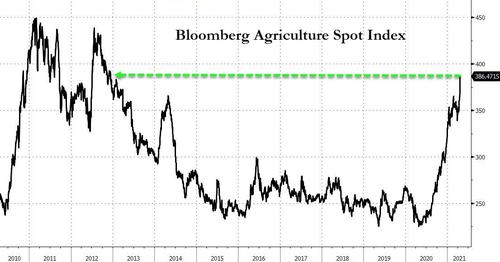

The Bloomberg Agriculture Spot Index surged the most in nearly nine years, driven by a rally in crop futures.

Expect Grocery Shock

With futures surging, Grocery Price Shock Is Coming to a Store Near You.

With global food prices already at the highest since mid-2014, this latest jump is being closely watched because staple crops are a ubiquitous influence on grocery shelves — from bread and pizza dough to meat and even soda.

“The relentless rise in prices acts as a misery multiplier, driving millions deeper into hunger and desperation,” Chris Nikoi, the World Food Programme’s regional director for West Africa, said earlier this month.

It’s “pushing a basic meal beyond the reach of millions of poor families who were already struggling to get by.”

And commodities aren’t the only component in driving up the price of food. Higher freight costs and other supply-chain headaches as well as packaging can all add up. Food and beverage giants are already signaling they’re watching margins. Coca-Cola Co. has flagged higher costs in plastic and aluminum, as well as coffee and high-fructose corn syrup, the key ingredient in soda. Nestle SA, the world’s biggest food company, warned it won’t be able to hedge all of its commodity costs and it’s raising prices where appropriate.

Corn Futures

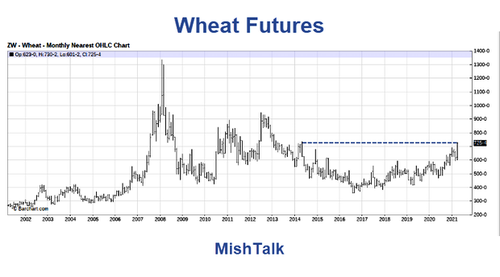

Wheat Futures

Soybean Futures

Live Cattle

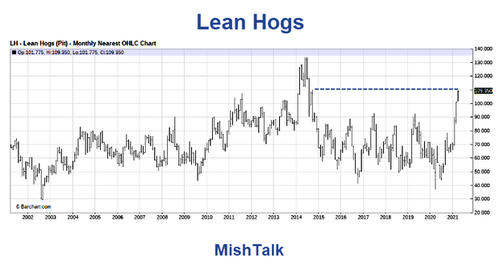

Lean Hogs

Live cattle is at a 1-year high. The rest are at or near 7 to 8 year highs.

The Fed foolishly cheers this. Consumers sure don’t.

Tyler Durden

Mon, 04/26/2021 – 15:20

via ZeroHedge News https://ift.tt/3aFPIjY Tyler Durden