“No Groundbreaking Data Points”: Here’s What Analysts Are Saying About Tesla’s Earnings Report

As we noted yesterday, Tesla posted earnings yesterday that – at first glance – looked to beat estimates. Until, of course, one realized that a majority of the company’s “profit” came from trading bitcoin and selling ZEV credits. You can read our full writeup and analysis on the results here. As we said yesterday, post-results, not even TSLA’s usual cheerleaders were ecstatic about the results: “Everything happened that people thought would happen,” Gene Munster told Bloomberg yesterday. “There’s not a lot of news and it wasn’t a blowout.”

On Tuesday morning, more analysts began to offer their take on the report. GLJ Research’s Gordon Johnson took to CNBC on Tuesday morning to offer up his insights:

“$TSLA is burning money. This is not a viable business model and they are losing share in Europe in China. Their sales in the US were down,” says @Tesla bear @GordonJohnson19 on Q1 numbers. “This is a bad print across the board.” pic.twitter.com/mPUYco2jvw

— Squawk Box (@SquawkCNBC) April 27, 2021

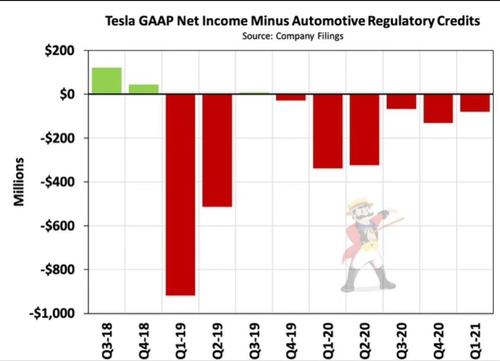

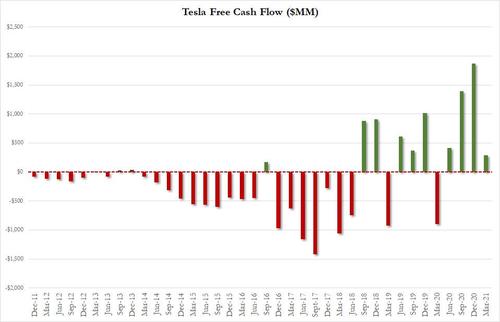

“This is the fifth straight quarter, excluding credit sales, that Tesla has lost money,” Johnson said. “If you exclude the one time credit sales, they lost $181 million this quarter,” he said. “They’re losing more money the more cars they sell.”

Tesla “is burning money”, Johnson continued, debating Loup Ventures’ Gene Munster. “This is not a viable business model and they are losing share in Europe in China.”

Also on Tuesday morning, Bloomberg released a note pointing out that several analysts “were left wanting” as a result of the report. Here’s what Bloomberg reported the rest of the sell side said:

-

Piper Sandler (overweight) says Tesla is “still a favorite,” but adds that there were “no groundbreaking data points” in 1Q

-

Tesla did not shed any light on “make-or-break” topics that could affect the trajectory of shares, including the unveiling of new and/or unforeseen products, analysts Alexander Potter and Winnie Dong write in note

-

As a result, Piper Sandler is “not overly shocked” by the muted reaction to 1Q results, though still regards Tesla as a core holding

-

While the broker reiterates its overweight rating on the stock, it says investors should take note as the next few quarters will be consequential and probably volatile

-

-

Morgan Stanley’s (overweight) view on Tesla remains unchanged by 1Q result and outlook, as it still sees the company as a “must own” in Auto 2.0

-

1Q was a “somewhat ‘noisy’ quarter,” though overall, the Tesla story is little changed, analysts led by Adam Jonas write

-

Free cash flow was higher than consensus but lower than previous quarter and Morgan Stanley’s own forecast

-

Several key questions remain unanswered after the results, including whether we will see the Cybertruck and when will battery shortages affect the growth objectives of Tesla and other EV players

-

-

Jefferies (hold) describes 1Q as a mixed quarter, that was solid on gross margin but “weakish” on Ebit and free cash flow, which were both propped up by ZEV and Bitcoin

-

The Q&A with CEO Elon Musk was uneventful, analysts led by Philippe Houchois write in note

-

Record 1Q order intake on low inventories “supports progress in coming quarters”

-

While Tesla navigates supply chain issues “as well if not better than many peers,” Jefferies says it’s “not getting the benefit of better pricing given its direct sales model”

-

-

Wedbush (outperform) says 1Q was “another solid quarter” from Tesla, and that the focus was now on deliveries for 2021

-

Total revenues were “slightly below bullish expectations,” analyst including Daniel Ives write in note

-

While the delivery/production numbers were already known and beat the Street’s expectations, investors “continue to be laser focused on the profitability picture”

-

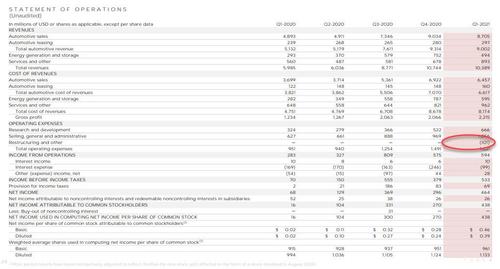

Recall, Tesla reported $594MM in income from operations, but regulatory credits accounted for a whopping $518MM of it, the highest on record and up from $401MM in Q4 2020.

So while GAAP net income was just $438MM, this means that for yet another quarter the company did not generate actual net income without regulatory credits. Add that another $101MM in profits came from “sale of bitcoin”…

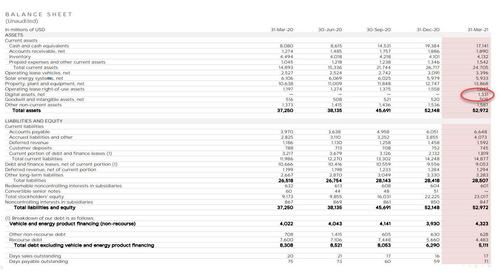

… with TSLA owning $1.3BN in digital assets at the end of the quarter, which means it sold around $272MM of the bitcoin it previously owned.

So in addition to over half a billion in reg credit sales, made $101MM in profits from sale of $272MM in bitcoin (reducing its total from $1.5BN to $1.331BN at the end of the quarter).

And while everyone assumes that this is all bitcoin, it is unclear how much of TSLA’s “digital assets, net” was Dogecoin.

Of course, some will claim that non of this matters, and that TSLA has in fact generated 7 consecutive quarters of profits, although if one strips regulatory credits from GAAP Net Income, this is what one gets.

Discussing its profitability, TSLA said that its operating income improved in Q1 compared to the same period last year to $594M, resulting in a 5.7% operating margin. “This profit level was reached while incurring SBC expense attributable to the 2018 CEO award of $299M in Q1, driven by an increase in market capitalization and a new operational milestone becoming probable.”

On a year over year basis, Tesla said that positive impacts from volume growth, regulatory credit revenue growth, gross margin improvement driven by further produt cost reducstions and sale of bitcoin were mainly offset by a lower ASP, increased SBC, additional supply chain costs, R&D investments and other items. Model S and Model X changeover costs negatively impacted both gross profit as well as R&D expenses.

In terms of Tesla’s financial performance, it’s a case of better-than-expected Automotive Margins and free-cash-flow. The company said of its profit outlook: “We expect our operating margin will continue to grow over time, continuing to reach industry-leading levels with capacity expansion and localization plans underway.”

The company also disclosed that it is on track to start production from Berlin factory in 2021, adding that first deliveries of the new model S should start shortly.

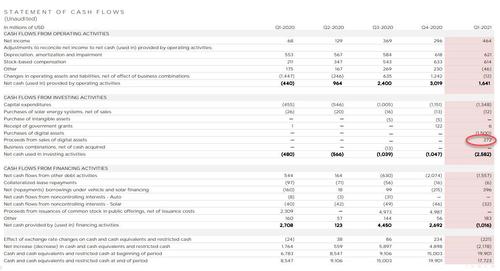

On the cash flow side, TSLA revealed that it had a $1.2BN net cash outflow related to bitcoin in Q1, as well as net debt repayments of $1.2BN offset by free cash flow of $293MM, which was above the estimate of $83MM in cash burn:

Quarter-end cash and cash equivalents decreased to $17.1B in Q1, driven mainly by a net cash outflow of $1.2B in cryptocurrency (Bitcoin) purchases, net debt and finance lease repayments of $1.2B, partially offset by free cash flow of $293M

Tesla said it expects to achieve 50% average annual growth in vehicle deliveries over a multi-year horizon. But the company notes that rate of growth will depend on equipment capacity, operational efficiency and capacity and stability of supply chain.

Tesla’s timeline also remains largely intact. From the shareholder letter:

“We are currently building Model Y capacity at Gigafactory Berlin and Gigafactory Texas and remain on track to start production and deliveries from each location in 2021. Gigafactory Shanghai will continue to expand further over time. Tesla Semi deliveries will also begin in 2021.”

Something else the market may not like is that the average selling point for a Tesla fell 13% in the first quarter. According to the company, this is “because Model S and Model X deliveries reduced in Q1 due to the product updates and as lower ASP China-made vehicles became a larger percentage of our mix.”

Elsewhere, there was no substantive mention of Cybertruck anywhere in the shareholder presentation, just that it’s a product ‘in development’ listed under the Texas plant.

Tyler Durden

Tue, 04/27/2021 – 09:30

via ZeroHedge News https://ift.tt/32QmxWK Tyler Durden