Ether Hits Record Highs As Bonds, Big-Tech, & Bullion Sink Ahead Of Fed

Crypto was higher on the day (as was the dollar and commodities) but for big-tech stocks, bonds, and bullion it was “sell, Mortimer, sell”…

The cash open sparked chaos in Small Caps and a dump in big-tech stocks. Small Caps were puked after the European close. S&P and the Dow manage to scramble back into the green (dumping into the red in the last 5 seconds), Small Caps were best and Big-Tech Nasdaq 100 the biggest loser…

Here’s the chaos at the cash open in Small Caps…

CCC-rated junk bonds plunged to their lowest spread since 2008, below 500bps…

Source: Bloomberg

Treasuries were sold ahead of tomorrow’s FOMC…

Source: Bloomberg

With 10Y back to recent resistance…

Source: Bloomberg

Notably, the 10Y yield has held its 50DMA support for 4 straight days…

Source: Bloomberg

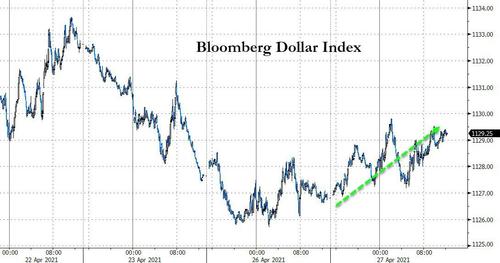

The Dollar managed gains today…

Source: Bloomberg

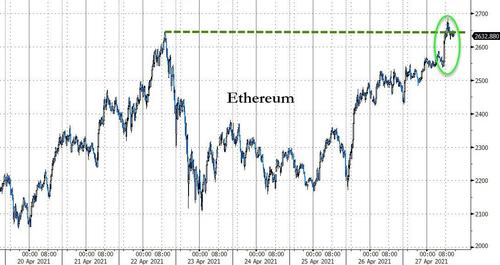

ETH jumped to a record high today…

Source: Bloomberg

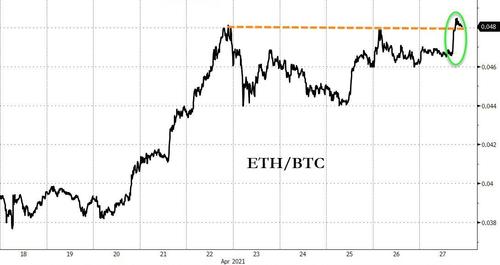

ETH broke out relative to BTC too…

Source: Bloomberg

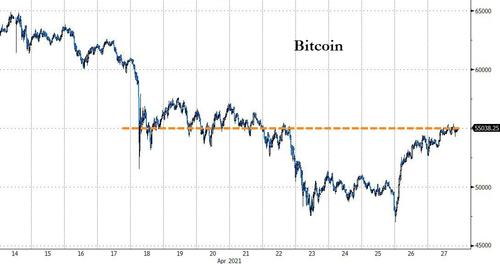

Bitcoin also rallied, back to $55,000 – before last week’s plunge…

Source: Bloomberg

Commodities were up for the 11th straight day…

Source: Bloomberg

Gold dipped ahead of The Fed…

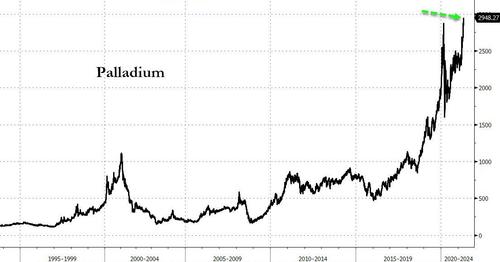

But, Palladium rose to a new record high…

Source: Bloomberg

Copper continued to surge back near record highs…

Source: Bloomberg

WTI rose back above $63 ahead of tonight’s API report (after the OPEC+/JMMC ‘no change’ report)…

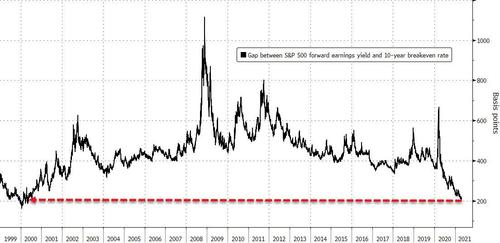

Finally, in case you were thinking of dipping your toe back in the warming waters of monetary exuberance and buying equities, it is worth considering that stock investors stand to receive too little return for the level of risk they take, according to Mike Wilson, chief U.S. equity strategist at Morgan Stanley.

Source: Bloomberg

Wilson drew the conclusion in a report Monday that compared an earnings-based yield on the S&P 500 Index with an inflation gauge: the 10-year breakeven rate, or the gap in yield between fixed-rate and inflation-indexed Treasury notes. The resulting equity risk premium narrowed this month to 2.06 percentage points, the smallest since May 2000, according to data compiled by Bloomberg. “There’s low probability that it will” fall further, Wilson wrote.

Tyler Durden

Tue, 04/27/2021 – 16:01

via ZeroHedge News https://ift.tt/3ns3Mma Tyler Durden