Stocks Panic-Bid Off EU Close After Biden-Induced Breakdown

After solid gains overnight building on the FB and AAPL earnings beats (understatement) but a disappointing miss on GDP (bear in mind that jobless were basically flat and pending home sales also disappointed), everything went to shit as US cash markets opened and stocks puked below pre-FOMC lows. Then that selling was exaggerated when the Biden admin said they would like all gig workers to be employees (whether they like it or not), which sparked another big puke. The European close appeared to stall the selling and dip-buyers rushed in to lift everything back into the green in one-trade. And then, around 1500ET, it all started to slide again, but that didn’t last…

The S&P 500 broke above the psychologically important 4200 level, then plunged to a crucial support level 4170 (vol trigger) and ripped back before fading in the end to close above 4200 at a new record high…

VIX was wild too…

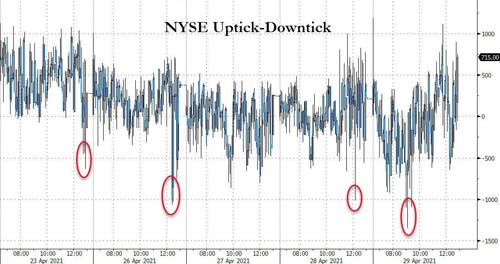

The early puke saw the most widespread sell program in over a month…

Source: Bloomberg

AAPL shocked many with blowout earnings last night, but lost its gains during the day session…

COIN is down 9 out of 11 days since going public…

UBER and LYFT were both battered by Biden’s plan for gig-workers…

Bonds whipsawed just like stocks today (but not as you’d expect) – Treasuries were dumped along with stocks and bid-back along with stocks…

Source: Bloomberg

The dollar managed gains on the day, ramping back to erase post-Fed losses, only to fade once those stops were run…

Source: Bloomberg

Gold ended the day flat amid some more whipsaw action…

WTI surged back above $65 for the first time since mid-March…

And Copper pushed up near $10,000 record highs…

Source: Bloomberg

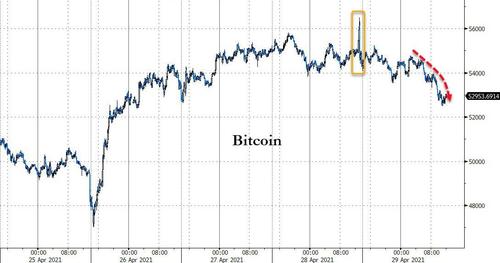

Bitcoin rolled over ahead of a major opex tomorrow…

Source: Bloomberg

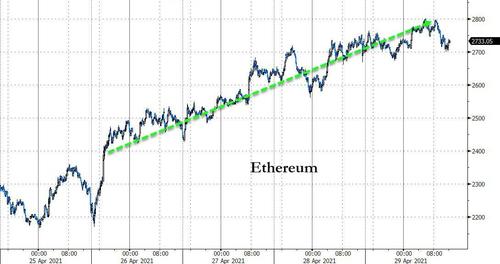

And while Ethereum gave some early gains back, it outperformed, hitting $2800 (record highs) intraday…

Source: Bloomberg

Pushing the ETH/BTC back above 0.05x for the first time since Aug 2018…

Source: Bloomberg

Finally, we note that as stocks have pushed to new highs over the last month (and most notably the last week), demand for downside protection has accelerated (SPY Skew below)…

Source: Bloomberg

Tyler Durden

Thu, 04/29/2021 – 16:00

via ZeroHedge News https://ift.tt/3e4JUmc Tyler Durden