“Good Days Have Gone”: A Shocked Wall Street Responds To China’s Unprecedented Crackdown On Tech Giants

Following reports that Beijing was looking to scapegoat regulators responsible for initially permitting the ill-fated Ant Group IPO, which was scuttled by the CCP leadership back in October after Alibaba founder and Ant Group Chairman Jack Ma criticized Chinese tech regulation, saying it was “stifling innovation”, at an obscure industry conference, it appears China’s anti-trust regulators are imposing new restrictions on the financial arms of other Chinese tech giants after hobbling Ant.

As Beijing reportedly prepares to slap Tencent with an antitrust fine commensurate with the $2.8 billion recently demanded from Alibaba, news that Chinese regulators had summoned 13 internet companies and ordered them to rectify their digital financial businesses dealt another blow to market sentiment. The wide-ranging restrictions could weigh on credit growth and hurt the prospects of public share offerings by fintech firms, analysts have warned.

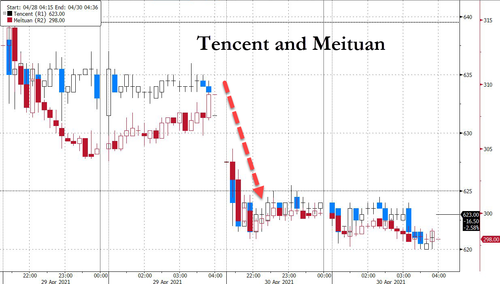

The HS Tech index which includes many Chinese tech firms is down 23% from the February peak as Beijing has vowed to step up scrutiny on monopoly practices in the industry and ordered overhaul of Alibaba’s Ant Group. Meituan, which was the subject of its own antitrust crackdown earlier this week, saw shares fall as much as 3.6%, while Tencent dropped 1.2%. The two companies were the biggest drags on the MSCI Asia Pacific Index.

In Hong Kong, the Hang Seng was down 1.6% at the lows, with Alibaba and Meituan the biggest laggards. The CSI 300 Index, China’s blue-chip index, dipped as much as 0.6% on Friday, which was the last before a five day market holiday next week.

Although it’s now evening in China, the news of the summoning was elaborated upon by a WSJ report published at 0700ET, which confirmed what analysts had widely expected: the PBOC and four other regulatory agencies had told Tencent and the other major firms that their popular finance apps could no longer be used to hawk loans and other financial products. From now on, these companies will be required to stick to payments.

During the nearly three-hour-long meeting at the People’s Bank of China’s Financial Market Department, regulators told company representatives that the bundling of several financial services within a single platform obscured how much money was flowing into the various products, creating risks for the broader financial system, these people said.

Regulators’ push to delink the technology companies’ broader suites of financial products and services from their core payments platforms, if carried out, would deal a blow to a lucrative business model pioneered most successfully by Ant Group Co., the financial-services giant controlled by billionaire entrepreneur Jack Ma.

“In the past, payment was the end of all transactions, but now payment has become the beginning of all transactions,” Ant’s then-chief executive Simon Hu told Chinese media last year.

Since then, regulators—citing the systemic financial risks posed by Ant—have halted a planned initial public offering by the company and pressed it to reorganize itself as a financial institution, subject to oversight by China’s central bank.

Beijing’s anti-trust crackdown on the country’s biggest firms is one of the biggest threats to equity-market valuations in the world’s second-largest economy (and might at least partly contribute to the latest rush for Chinese firms to list in the US).

Here’s what analysts at Wall Street banks are saying about Beijing’s latest move (courtesy of Bloomberg).

Jefferies:

- “Good days have gone. Tier-2 fintech platforms (the 13 companies excluding Tencent financial) grew business rapidly in the past six months, as they have been gaining market share while regulators focused on Ant rectification, but we expect them to slow down in volume growth starting from 2H20.”

- “We reiterate that China has shifted from encouraging personal consumption lending to curbing rapid increases in residential leverage.”

- “Fintech firms will be more difficult to get listed, including overseas and secondary listing, which is also negative for HKEx.”

- ABS issuance by their micro-lending or consumer- financing subsidiaries will be tightened.

- The Global CIO Office (Gary Dugan, chief executive officer)

- The move is “worrying.” “If these restrictions crimp credit growth, it will be bad news for the economy and the equity market.”

Core Pacific

- Investors will be cautious because the detailed policy on each company is not clear enough, since there is just a policy framework at the moment

- Investors may not rush to buy those firms at the moment, given the policy uncertainty on each firm is still high, though the framework itself removes some overhang on the sector

- The impact on Tencent and Meituan, for example, is not clear, while there is a possibility that the two will not need to restructure its fintech business the way Alibaba restructured Ant Group

Bloomberg Intelligence (Francis Chan, analyst)

- “Payment function of big tech apps is the biggest gateway for most fintech products in China, while removing the links could diminish the fintech industry outlook going forward.”

- “It may potentially lead to a shrinkage of overall fintech market.”

With Asian stocks facing a week-long lull in liquidity during the upcoming Golden Week holiday, China tumbled Friday after the latest disappointing PMI numbers prompted questions about whether China’s economic growth might be moderating. After a meeting of the Politburo on Friday, the country’s highest ruling body warned that the current economic recovery remains “unbalanced and unstable” and will require more effort to achieve a “balanced” economy.

But concerns about the short-term outlook for China’s economy might not be the only thing weighing on investor sentiment. Earlier this week, we also received confirmation that the deflationary forces facing the Chinese economy are especially dire. To wit, the latest Chinese census data (somehow leaked to the FT) are expected to show the first annual population decline since record-keeping began in 1949.

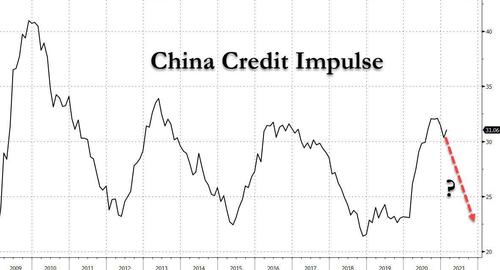

It’s just the latest reminder that China is battling not one but three vicious economic demons. The interconnected issues of insurmountable debts, deflation, and demographics threaten to sap the world’s future growth potential. All of this brings us back to what may be one of the most important near-term factors for markets: China’s credit impulse, which is – for those who aren’t familiar – a measure of changes in public and private credit creation as a percentage of national GDP.

As Washington pushes for the biggest tax hikes in decades, and rising inflation in the US becomes increasingly difficult for the Fed to ignore, China’s credit impulse will play a bigger role in global credit creation – the grease that keeps the wheel of the global economy turning.

Tyler Durden

Fri, 04/30/2021 – 07:26

via ZeroHedge News https://ift.tt/2RgjG6U Tyler Durden