Futures Jump On First Day Of May In Quiet Session

S&P and Nasdaq futures, and European bourses were volatile but ultimately rose on Monday to kick off a new month in a quiet session which saw several major markets closed, following a week of record earnings beat which however resulted in big stock drops with investors also keeping an eye on India covid cases and economic data to gauge the pace of recovery.

Trading was subdued with several including Japan, China and the U.K. closed for public holidays. S&P 500 futures added 0.6%, Dow e-minis were up 216 points, or 0.64%, and Nasdaq 100 e-minis were up 40.25 points, or 0.30%. Europe’s Stoxx 600 Index gained 0.4%. The yen weakened, while gold advanced.

With more than 60% of companies already having reported mostly stellar results so far, profits are now expected to have risen 46% in the first quarter, compared with forecasts of 24% growth at the start of April, which however has failed to propel stocks to new highs.

Monday’s mood reversed from last Friday’s surprise selloff as the biggest nasdaq companies reported blowout earnings only to be punished by the market. Some notable premarket movers:

- Megacap FAAMG stocks rose in premarket trading, with Apple, Amazon.com, Alphabet and Microsoft adding between 0.2% and 0.4% after posting largely upbeat results in the prior week.

- Tesla Inc fell 0.9%. Industry sources told Reuters the electric vehicle maker, under scrutiny in China over safety and customer service complaints, is boosting its engagement with mainland regulators and beefing up its government relations team.

- Moderna Inc gained 2.4% after the drugmaker said it would supply 34 million doses of its COVID-19 vaccine this year to the global COVAX program

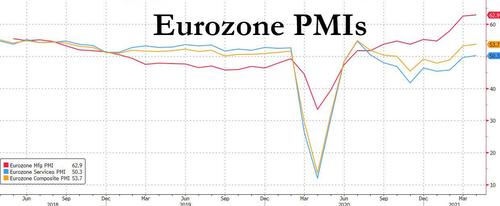

Europe’s Stoxx 600 dipped then reversed after euro zone factory activity growth surged to a record high in April, boosted by burgeoning demand and driving a rise in hiring, although supply constraints led to an unprecedented rise in unfulfilled orders, the latest PMI survey showed. IHS Markit’s final Manufacturing Purchasing Managers’ Index (PMI) rose to 62.9 in April from March’s 62.5, albeit below the initial 63.3 “flash” estimate but the highest reading since the survey began in June 1997.

“The euro zone was late out of the gates in terms of its economic rebound but it does seem to be starting. Looking at where we are now the numbers are encouraging,” said Bert Colijn at ING. “It is a foregone conclusion that Q2 will be much stronger than Q1 was.”

Here are some of the biggest European movers today:

- Mediaset rises as much as 3.2% before paring some of the gains. The Italian broadcaster could be near a deal to resolve a legal dispute with Vivendi, Italian media reported over the weekend. Bestinver says that a solution with Vivendi could be a positive catalyst for the stock.

- Straumann shares climb as much as 2.6% to a record after Vontobel (buy) raises PT to CHF1,570 from CHF1,280 following the Swiss dental-implant maker’s “convincing” 1Q sales and given its longer-term prospects.

- KPN shares drop as much as 4.4% after the Dutch telecom carrier, long considered a potential takeover target, said it rejected two separate, unsolicited approaches. A report saying KPN got a EU3/share offer disappointed some investors, while analysts stressed the difficulties for would-be buyers.

- Siemens Gamesa shares fall as much as 6% after full-year sales forecast missed estimates. While the company topped Ebit expectations in 2Q, its 2021 guidance cut was unexpected given good onshore order volumes in first half, Citi says in note.

Earlier in the session, Asian stocks declined for a second day with the MSCI Asia Pacific Index slid 0.6%, heading to a one-month low as a resurgence in Covid-19 infections continued to weigh on sentiment. Stock markets in Japan, China, Thailand and Vietnam were shut for the holidays. The region’s surging coronavirus pandemic cases remains a concern, with the daily death toll in India hitting a record 3,689 on Sunday. Meanwhile, Singapore had its first fatality due to complications from Covid-19 in nearly two months over the weekend. Taiwan semiconductor stocks and Chinese internet companies were the biggest drags on the market. “A worsening pandemic situation in India cast a shadow over the Asia-Pacific markets, as investors assess the risk of reopening delays and stricter border controls,” Margaret Yang, a strategist at DailyFX, wrote in a note. South Korea’s benchmark erased gains and closed 0.7% lower as short selling resumed after a 13-month ban. Taiwan was the worst-hit market on Monday, with its benchmark falling almost 2%. Asian stocks have underperformed global peers for the past six weeks amid a surge in coronavirus cases

“Interest rates going forward will be led more by expectations on the tapering from the Fed rather than by inflation,” Raffaele Bertoni, head of debt capital markets at Gulf Investment Corp., said on Bloomberg Television.

As we reported overnight, billionaire Warren Buffett warned of rising price pressures and a “buying frenzy” spurred by low interest rates in his latest marathon Berkshire annual meeting. On Friday, stocks were spooked after Dallas Fed President Robert Kaplan (who’s not currently a voter on the rate-setting committee) said signs of excessive risk-taking suggest it’s time to consider fewer bond purchases. His remarks contrast with those of Fed Chairman Jerome Powell. These warnings come as all top U.S. financial officials and Powell are downplaying inflation risks.

A busy week for U.S. economic data is expected to show resounding strength, particularly for the ISM manufacturing survey and April payrolls. Forecasts are that 978,000 jobs were created in the month – with whisper numbers as high as 1.5 million – as consumers spent their stimulus money and the economy opened up more. Such gains could stir speculation of a tapering in asset purchases by the Federal Reserve, though Chair Jerome Powell has shown every sign of staying patient on policy.

“Payrolls should show another near 1 million jobs gain, but that would still leave them 7.5 million below pre-COVID levels,” said Tapas Strickland, a director of economics at NAB.

“Chair Powell recently noted that it would take a string of months of job creation of about a million a month to achieve the substantial progress required to justify tapering QE.”

In FX, the Bloomberg Dollar Spot Index inched lower as most Group-of-10 peers advanced after Friday’s rally in the greenback; the dollar index stood at 91.253 and off a two-month trough of 90.422, though it still ended April with a loss of 2%. The euro was steady at $1.2026 , having backtracked form a nine-week peak of $1.2149 on Friday. It now has solid support around $1.1990 as it shrugs off weaker- than-forecast PMI numbers and 10-year French, Belgian and Austrian yields all rose above last week’s highs as traders unwind haven buying amid thin liquidity; Eurozone April manufacturing PMI 62.9 vs flash reading 63.3. Australia’s dollar oounced from a one-week low a day before an interest rate decision from the central bank and ahead of its quarterly Statement on Monetary Policy later in the week. The front-end of Aussie swaps are fully discounting a rate hike of 15bps by mid-2022, which looks extreme relative to the bank’s latest cash rate guidance, according to Goldman Sachs strategists. The yen slipped to a three-week low against the dollar amid speculation that the Federal Reserve will tighten monetary policy over time while the Bank of Japan retains an easing bias.

In rates, Treasuries opened cheaper at 7am ET amid declines for futures on low volume as overseas cash bond markets were closed. Those losses were pared led by bund futures, leaving U.S. 10-year yields cheaper by ~2bp vs Friday’s close. Treasury yields cheaper by less than 2bp across the curve with front-end outperforming, steepening 2s10s by ~1.5bp; German 10- year yields are cheaper by around 1.5bp vs Friday as month-end demand bid fades. Focus this week is on Wednesday’s Treasury refunding announcement — where most dealers expect auction sizes to be unchanged from February — followed by Friday’s April employment report. On the supply side the dollar issuance slate empty; potential $150b of supply is expected for this month as financing remains cheap with spreads near the lowest in three years.

In commodity markets, gold held to a narrow range around $1,768 an ounce sidelined in part by investor interest in crypto currencies as an alternative hedge against inflation. Oil prices ran into profit-taking on Friday but still ended the month with gains of 6% to 8%. Brent was last up 16 cents at $66.92 a barrel, while U.S. crude firmed 18 cents to $63.76 per barrel.

Ethereum hit a record high on Monday trade above $3,000 for the first time, extending last week’s rally in the wake of a report that the European Investment Bank (EIB) could launch a digital bond sale on the ethereum blockchain network.

Powell is due to speak later on Monday and will be followed by a raft of Fed officials this week. Dallas Fed President Robert Kaplan caused a stir on Friday by calling for beginning the conversation about tapering

Market Snapshot

- S&P 500 futures up 0.5% to 4,193.50

- SXXP Index up 0.3% to 438.73

- MXAP down 0.6% to 205.19

- MXAPJ down 0.7% to 691.51

- Nikkei down 0.8% to 28,812.63

- Topix down 0.6% to 1,898.24

- Hang Seng Index down 1.3% to 28,357.54

- Shanghai Composite down 0.8% to 3,446.86

- Sensex down 0.6% to 48,490.19

- Australia S&P/ASX 200 little changed at 7,028.80

- Kospi down 0.7% to 3,127.20

- Brent futures little changed at $66.82/bbl

- Gold spot up 0.4% to $1,776.60

- U.S. Dollar Index little changed at 91.20

- German 10Y yield up 3 bps to -0.17%

- Euro up 0.2% to $1.2042

Top Overnight News from Bloomberg

- President Joe Biden’s $4 trillion vision of remaking the federal government’s role in the U.S. economy is now in the hands of Congress, where both parties see a higher chance of at least some compromise than for the administration’s pandemic-relief bill

- The European Commission proposed easing restrictions on tourism and leisure travel for those who have been fully inoculated, adding to signs of a gradual return to normalcy as vaccinations gather pace

- Container shipping rates are heading higher again, driven to new heights by unrelenting consumer demand and company restocking from Europe to the U.S. that are exhausting the world economy’s capacity to move goods across oceans

- The booming ETF industry may be set to lure even more cash in the coming years as rich Americans facing higher capital gains taxes look to limit what they owe Uncle Sam

- Pressure mounted on Boris Johnson as the ruling Conservative Party’s polling lead shrank ahead of local elections, and the leader of the Scottish Tories said the U.K. Prime Minister should quit if he’s found to have broken rules over the funding of refurbishments to his apartment

A quick look at global markets courtesy of Newsquawk

Asian equity markets began the week subdued amid key market closures, lack of fresh macro-drivers over the weekend and ahead of this week’s risk events including earnings, central bank updates and US NFP data. ASX 200 (Unch.) traded indecisively although was just about kept afloat by the top-weighted financials sector after big four bank Westpac posted a 256% jump in H1 net and with sentiment initially helped by strong data after AiG Performance of Manufacturing Index rose to its third highest on record. KOSPI (-0.6%) lacked firm direction as the partial lifting of the short-selling ban was counterbalanced by trade data released late last week which showed exports rose by the most in over a decade. The Hang Seng (-1.3%) was heavily pressured amid an ongoing crackdown by China which ordered tech giants to unbundle their financial services as Beijing calls for a stop to companies turning their mobile payment apps into financial supermarkets through the offering of loans and insurance policies. US-China tensions also lingered after the USTR announced it will keep China on its watchlist for IP violations and suggested the new China IP protection law was insufficient, while the absence of Stock Connect trade added to the headwinds due to market closures in mainland China, which alongside Japan, will remain shut through to Wednesday.

Top Asian News

- More Than 40 Hong Kong Stocks Stay Halted for Delaying Earnings

- Singapore Air Raises $1.5 Billion From Sale-Leaseback Deals

- UBS Expects Record IPO Year for India Despite Covid-19 Crisis

- Schlumberger-Backed Arabian Drilling Said to Plan Saudi IPO

European majors kicked the first session of May off with respectable gains across the board before fading earlier upside (Euro Stoxx 50 -0.2%) following on from a more cautious APAC session – with Japanese and Chinese players away until Wednesday. US equity futures meanwhile see varying gains with the cyclically-led RTY (+0.6%) outpacing whilst the tech-heavy NQ (Unch). From a more macro lens, eyes continue to remain on vaccination efforts/COVID developments and their corresponding effects on economic data and subsequently on monetary and fiscal policy. In early hours this morning, the ECB’s VP floated the idea of thinking about tapering emergency measures when 70% of Europe’s adult population (currently under 30%) is vaccinated – with experts suggesting the end of August as a more realistic deadline for this to be achieved. Turning to earnings, overall around 60% of the S&P 500 have reported actual results for Q1 thus far, according to FactSet, who suggest that of these companies, 86% have reported beats on EPS and 78% on revenue. During this week, 133 S&P 500 companies are due to report including three Dow components. Back to Europe, UK’s FTSE is closed on account of the early May Bank Holiday, whilst broad-based gains are seen across the Euro Zone bourses. Sectors are mostly in the green with the exception of Oil & Gas with a modest downside in prices keeping gains in the sector capped – also do note that sector heavyweights Shell and BP are not trading. Overall it is difficult to discern a particular theme or tone via the sectors. In terms of induvial movers, Lufthansa (+2.3%) is firmer after its CEO said the Co. and its Eurowings are aiming to fly to a minimum of 100 locations this summer. Siemens Healthineers (+1.9%) and Siemens Gamesa (-3.8%) see varying performances post-earnings. Finally, KPN (-3.0%) is pressured after rejecting two separate takeover offers, one from EQT/Stonepeak and the other from KKR.

Top European News

- Europe’s Powerful Earnings Fail to Move The Needle for Investors

- The U.K.’s Future May Be in the Hands of Scotland’s Rebel Youth

- Europe Is Casting Aside Double-Dip Slump as Growth Restarts

- Euro-Area Factories Face Unprecedented Supply-Chain Delays

In FX, the Dollar index looks quite comfortable above the 91.000 handle after Friday’s rebound to register a late peak for the week, but is off best levels between 91.190-390 parameters as several components claw back some losses and other majors derive a degree of traction via supportive fundamental and technical impulses. However, trading conditions are relatively thin at the start of the new month due to market closures in various countries, such as Japan (Constitution Day), China (Labour Day) and the UK (early May Bank holiday) awaiting the final US Markit manufacturing PMI, ISM and construction spending before speeches from Fed’s Williams and Chair Powell.

- NZD/AUD/EUR/GBP – All firmer against the Greenback, with the Kiwi holding within a 0.7156-83 range ahead of NZ jobs data on Tuesday and the Aussie hovering around 0.7725 following a bounce from the low 0.7700 area in wake of solid manufacturing PMIs (AIG survey especially) and ahead of trade in the run up to the RBA tomorrow. Similarly, the Euro has drawn encouragement from resilience into 1.2000 rather than somewhat mixed Eurozone manufacturing PMIs or significantly stronger than expected German retail sales, and Sterling seems content after staving off offers within a pip of 1.3800.

- JPY/CAD/CHF – The Yen is retesting support close to a key Fib retracement level that appears to be the only real prop protecting a more pronounced reversal from recent highs and return to 110.00 vs the Buck. Specifically, 109.64 represents a 61.8% bounce in Usd/Jpy from 107.48 low on April 23 to 110.97 apex from March 31 and the headline pair has been up to 109.69, but not convincingly through may Japanese participants are out of action and will not be back until Thursday due to Golden Week. Elsewhere, the Loonie has lost some steam alongside oil prices and is back around 1.2300 in advance of Canada’s manufacturing PMI, while the Franc is fairly flat circa 0.9130 and 1.0985 against the Euro following a strong Swiss manufacturing PMI and weekly sight deposit balances suggesting no intervention even though Eur/Chf has fallen to lows last seen on April 19.

- SCANDI/EM/PM – The tables have turned to an extent for the Nok and Sek, as the former is back beneath 10.0000 vs the Eur amidst the aforementioned downturn in crude and a dip in Norway’s manufacturing PMI before Thursday’s Norges Bank policy meeting, but the latter pares some declines from almost 10.1900 on the back of a marked acceleration in the Swedish manufacturing PMI. Meanwhile, EM currencies are on the back foot vs the Usd and the Try has not benefited from softer then forecast Turkish CPI as it pivots 8.3000, but Gold is outperforming around Usd 1775/oz and flanked by DMAs as the 50 sits at Usd 1744.15 and 100 resides at Usd 1798.34.

In commodities, WTI and Brent front month futures again experience a choppy session with conditions also thin as China, Japan, and the UK are away on domestic holidays. The front-month contracts have thus far printed a USD 1/bbl range apiece with WTI now just under USD 64/bbl and Brent around USD 67/bbl. Prices found a floor in recent trade with news about the EU permitting vaccinated travellers from abroad also supporting sentiment in the complex. However, COVID continues to take its toll on India with the recent string of case increases continuing to mark records. Reports have also suggested that LNG cargoes are said to have been diverted away from India amid its situation. It will be interesting to see whether the developing situation prompts any response from OPEC+ after the group, in essence, opted to maintain its plan to gradually bring back oil to the market. Turning to geopolitics, there was some confusion surrounding the progress in Iranian nuclear talks, but it seems a deal remains in the balance after the US and UK refuted Iranian media reports regarding a prisoner swap and the unfreezing of funds. That being said, talks seem to have made some headway with the Iranian foreign ministry suggesting two deals have been drafted but there is a dispute over some figures and entities on the US list. Elsewhere, the Iranian spokesman also said Tehran is ready to have talks with Saudi Arabia at any level and in any form – one to watch given the two countries reside on either side of the Persian Gulf. Also to keep on the radar, Petrobras could see action from labour unions could impact production in Brazil’s 750k BPD Campos basin. Turning to metals, spot gold and silver benefit from the softer Buck but remain around recent ranges with the former around UDS 1,775/oz and the latter around USD 26/oz at the time of writing. LME and Shanghai copper both see domestic holidays. Finally, Citi expects benchmark iron ore to hit USD 200/t in the upcoming weeks but notes the average price in Q2/Q3 could be around USD 183/t before waning to USD 160/t in Q4.

US Event Calendar

- April Wards Total Vehicle Sales, est. 17.6m, prior 17.8m

- 9:45am: April Markit US Manufacturing PMI, est. 60.7, prior 60.6

- 10am: April ISM Manufacturing, est. 65.0, prior 64.7

- 10am: March Construction Spending MoM, est. 1.7%, prior -0.8%

- 2:20pm: Fed Chair Powell Speaks on Community Development

DB’s Jim Reid concludes the overnight wrap

After what is probably more than 6 months I’m actually going to a restaurant tomorrow night. Reservations are like gold dust here in the U.K. at the moment so my wife and I are very lucky to join a couple who have one. Only a few problems. We have to eat outside, it’s going to be cold, it might rain, and my old school friend who booked it hasn’t replied to me confirming it. The good news is that he reads the EMR so I’m hoping he’ll confirm once this hits inboxes. Unless of course we’ve been replaced by a more exciting couple. In that case I’m keen to shame him. I hope not as my wife and I are like caged tigers waiting for social interaction that isn’t each other at the moment.

After a little bit of consolidation over the last month, bond yields have acted a little like a caged tiger this week with yesterday seeing another big climb higher. 10yr US Treasuries were up as much as +7.8bps intra-day yesterday to 1.686% after being as low as 1.53% intra-day last Friday. It was the highest yields had traded since April 13. However the benchmark rate finished a more moderate +2.5bps higher on the day at 1.634%. This still left the week-to-date rise at +7.7bps, which would be the first weekly increase in yields since the week ending April 2 unless there is a massive rally in bonds today. Real rates (+2.5bps) drove much of the final move as inflation expectations (+0.1bps) were more muted. However, inflation expectations did rise for the 5th straight session (+9.4bps in all over this period), with the 10yr breakeven measure closing at 2.426% – its highest level in just over 8 years. In Europe there was a similarly large selloff, with yields on 10yr bunds up +3.8bps to -0.19%, marking the first time in over a year that they’ve closed above the -0.20% mark, while 10yr French yields (+4.4bps) likewise closed at a 1-year high.

Although rising bond yields seemed to clip their wings a little as the move higher accelerated, US equities still moved to fresh all-time highs yesterday as the combination of strong economic data and better-than-expected earnings releases helped to buoy investor sentiment and fuel fresh life into the reflation trade. By the close, the S&P 500 had gained another +0.68% to end the session above the 4,200 mark for the first time, and the MSCI World index was up +0.39% at its own record high. This positive mood music could be seen across a range of indicators, and Bloomberg’s index of US financial conditions actually eased to its most accommodative level since 2007 yesterday, which just shows the extent to which markets are primed for a strong recovery over the coming months.

A late selloff in Europe meant that indices there ended the session lower with the STOXX 600 closing down -0.26%. Banks outperformed however thanks to the moves higher for yields, and the STOXX Banks index was up +1.16% in its 6th successive daily advance, taking the index to its highest level since the pandemic began. Over in the US, the gains were fairly broad-based with over 78% of the S&P moving higher on the day, though the NASDAQ (+0.22%) underperformed slightly, while the small-cap Russell 2000 (-0.38%) lost ground. US banks (+2.10%) joined their European counterparts in reacting strongly to global yields. Otherwise nearly every industry group outside of the pandemic winners of Software (-0.59%) and Biotech (-1.02%) gained in the S&P. The biggest industry laggard was autos (-3.03%), where Ford (-9.41%) reduced its forecast significantly due to a semiconductor shortage that has caused vehicle production across the industry to stall. They forecasted a -$2.5bn hit to earnings because of the lack of chips, in what they considered the “worst-case”. This is becoming a recurring theme across different sectors.

Elsewhere in earnings, Amazon saw their shares rise +3.2% in after-market trading on strong beats across business segments. Q1 revenue rose +44% and the company offered guidance on sales for the upcoming quarter ahead of analysts’ estimates, with indications that aspects of the pandemic bump in online-sales may endure. Elsewhere in big tech, Twitter saw shares slide over -7% with EPS at $0.16 (vs. $0.12 exp.) on lower revenue guidance even as user growth was in-line with prior estimates. One issue for the company may be the stronger ad revenues seen by competitors Google and Facebook earlier this week.

Overnight in Asia we have seen China’s official April PMIs come in softer than expectations for both manufacturing (51.1 vs. 51.8 expected) and services (54.9 vs. 56.1 expected). Zhao Qinghe, an economist at the statistics bureau said that “some surveyed companies said problems such as chip shortages, poor international logistics, shortages of containers, and rising freight rates are still serious.” He also added that a slowdown in manufacturing supply and demand and rising cost pressures are also issues. These comments on rising cost pressures and chip shortages are likely to get more attention from markets and particularly inflation enthusiasts. In the details of the manufacturing PMI, a sub-index of new export orders for factories eased to 50.4 in April from 51.2 previously, while new orders were at 52. In contrast to the official manufacturing PMI, China’s Caixin manufacturing PMI came in at 51.9 as against 50.9 expected. The statement accompanying the release said that the increase was supported by significant expansion in both manufacturing demand and supply, as “manufacturers stayed confident about the economic recovery and keeping Covid-19 under control.” So a little different to the official release.

Elsewhere, Chinese regulators have imposed wide-ranging restrictions on the financial divisions of 13 companies, including Tencent and ByteDance in an antitrust crackdown.

Asian markets are mostly trading lower this morning with the backdrop of conflicting signals from China’s April PMIs and the continued antitrust crackdowns on tech giants in the country. The Nikkei (-0.52%), Hang Seng (-1.53%), Shanghai Comp (-0.51%) and Kospi (-0.74%) are all losing ground. Futures on the S&P 500 are also down -0.28% and European ones are also pointing to a weaker open. In terms of other overnight data, Japan’s final April manufacturing PMI printed 0.3pt stronger than the flash at 53.6.

There were also a number of important data releases for markets to digest yesterday, even if the overall impact was muted as they came in basically as expected. The main highlight was the news that the US economy had grown at an annualised pace of +6.4% in Q1 (vs. +6.7% expected), leaving US GDP less than 1% beneath its pre-Covid peak in Q4 2019. Meanwhile, the upward revision of +19k to last week’s initial jobless claims data from the US meant that this week’s number of 553k was the lowest since the pandemic began last year, albeit above the 540k reading expected.

Another story yesterday was the continued strength in commodity markets, which has been one of the major themes of the month as pretty much the entire range from metals to agriculture to energy prices have shown sizeable gains in recent weeks. Oil prices rose for a 3rd day running, with both Brent crude (+1.92%) and WTI (+1.80%) prices seeing decent advances, which were in part attributed to data showing road-fuel demand in the UK is nearing the levels seen last-summer and also as large cities in the US announce reopening plans. Meanwhile copper rose above $10,000/tonne in trading at one point for the first time in a decade yesterday, as it closes in on an all-time high set in February 2011 of $10,190 on an intraday basis. The industrial metal finished the day marginally lower (-0.11%), but is up nearly +28% YTD.

Positive headlines regarding the pandemic were another factor supporting sentiment yesterday. Firstly, French President Macron said that the restrictions would be eased from May 3 when restrictions on domestic travel would be lifted, while the nightly curfew would be gradually eased before it’s completely lifted on June 30. Meanwhile in Germany, health minister Spahn said that 1.1m vaccine doses had been administered yesterday, which is a record for the country. And in the UK, the 7-day case average fell to 2,259 yesterday, which is its lowest level since early September when the level of testing was a fraction of its current levels. In the US, NYC Mayor de Blasio said that they planned to fully reopen the city on July 1, though Governor Cuomo pushed back that he would like it to happen even sooner. Chicago’s mayor also announced they would be easing restrictions to allow for more seating capacity at restaurants, bars and other indoor venues. There was some bad news in the US, where Oregon announced a surge in cases, driven primarily by the younger, partially-vaccinated populations. The Governor has responded by increasing the risk-level on many counties to their extremes, shuttering indoor dining among other restrictions.

Elsewhere, emerging markets like Brazil and India are continuing to reel under the severe current wave with total fatalities in Brazil now topping 400k with the country reporting more covid deaths so far in 2021 than in whole of 2020. India has reported a record 386,452 daily infections while daily fatalities came in at 3,498. On the more positive side, BioNTech CEO Ugur Sahin said that he is “confident” the company’s Covid-19 vaccine with Pfizer will be effective against the Indian variant of the COVID-19 virus. He added that the company is evaluating the strain and the data will be available in the coming weeks.

Looking at yesterday’s other economic data, and the European Commission’s economic sentiment indicator for the Euro Area advanced to 110.3 in April (vs. 102.2 expected), which is the highest it’s been since September 2018. Over in Germany, data showed that unemployment unexpectedly rose by +9k in April (vs. -10k expected), while the preliminary inflation reading for April rose to a 2-year high of +2.1% (vs. +2.0% expected). Finally, pending home sales in the US rose by a lower-than-expected +1.9% in March (vs. +4.4% expected).

To the day ahead now, and there are an array of data highlights including the first look at Q1 GDP for the Euro Area, Germany, France and Italy. On top of that, we’ll also get the flash Euro Area CPI reading for April, and the unemployment rate for March. Over in the US, there’s the personal income and personal spending data for March, the MNI Chicago PMI for April and the final University of Michigan consumer sentiment index for April. From central banks, the Fed’s Kaplan will be speaking, while earnings releases include Exxon Mobil, Chevron, AbbVie and Charter Communications.

Tyler Durden

Mon, 05/03/2021 – 07:57

via ZeroHedge News https://ift.tt/3eNT859 Tyler Durden