Banks Start Freaking Out About Soaring Inflation, Which May Not Be “Transitory”

For the past few months we – unlike the Fed – have been warning readers that the US is about to get by a wave of soaring prices the likes of which have not been seen since the early 1970s (see “”Buckle Up! Inflation Is Here!”). And while two weeks ago we noted the even “Companies Are Freaking Out About Soaring Costs“, sellside analysts had retained composure, with most comforting their clients that whatever inflation we get will be transitory (despite occasional luminaries such as Jeff Gundlach saying that the Fed and banks may well be wrong about the “transitory” narrative).

Well, as of this week, the analyst narrative has taken a sharp U-turn, starting with JPMorgan which yesterday admitted that there are an increasing amount of articles that illustrate rising inflation expectations, “even if those measures are not captured by official government releases” to wit:

-

Rental Companies Buy Up Used Cars as Chip Crisis Get Worse (BBG Terminal)

-

Demand is outpacing supply of new vehicles – why that’s bad for shoppers but good for investors (CNBC)

-

Tourists in Hawaii Are Driving U-Hauls Because Rental Cars Are So Expensive (CNN)

-

Lumber Prices Break New Records, Adding Heat to Home Prices (WSJ)

And while JPM has long been in the “transitory” bandwagon, the bank’s strategist Andrew Tyler admits that in a crack to the party line, his view “is that we’ll see inflation expectations continue to move higher over the summer, as we see improving macro data (NFP, CPI, PPI, and Retail Sales the most topical).”

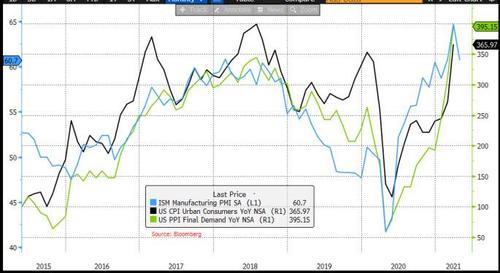

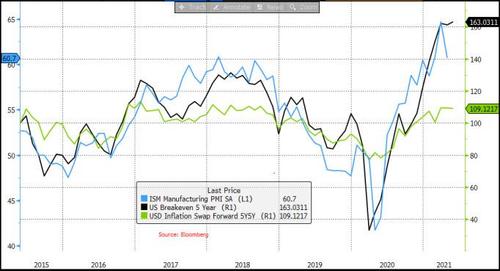

To help investors formulate their own inflation expectations – especially amid rising strains on the global supply chain created by COVID – he presents out the following charts:

LAD vs. KMX vs. IYT vs. SPX

ISM vs. CPI vs. PPI

ISM vs. 5Y BREAKEVENS vs. 5Y5Y INFLATION SWAPS

5Y BREAKEVENS vs. BLOOMBERG COMMODITY INDEX [BCOM]

As Tyler accurately concludes, “one of the biggest questions is how long this persists” adding that the answer to that question may help investors determine whether to update models with lower growth/margin expectations or to look through this seemingly one-time event (which may not be as one-time as so many say it will be). His advise for investors who need to hedge inflation exposure in their portfolios, he recommends adding commodities or commodity equities: “our favorite play is Energy.”

* * *

Goldman next picks up where JPM leaves off, with the bank’s Chris Hussey pointing out the obvious: “a combination of slowing growth and rising inflation” – i.e. stagflation, “is an unfavorable one for forward looking assets like equities.” And while he also falls back on Goldman economists’ macro view which expects inflation “to be benign over the near-term, and are less concerned about the prospect of an overheating economy”, a more nuanced industry breakdown reveals a far more dismal picture, with Hussey noting that Goldman analysts now focus on soaring input cost inflation and supply chain pressures across retail and housing. Consider:

-

Auto parts retail. Kate McShane believes Autoparts Retailers should be able to realize pricing power as they fulfill rising demand for do it for me (DIFM) projects in a re-opening economy in “Improving DIFM outlook + inflation pass-through ability.” Most Auroparts demand comes from must-have fix-it projects (non-discretionary), providing retailers with the ability to sustain prices. The group is also trading at a sharp discount to historical valuation levels — presenting a disconnect between valuation and fundamentals.

-

Grocers. By contrast, Kate McShane believes Grocers will struggle to pass rising food inflation onto its customers as promotions return to the industry following a pandemic hiatus in “Margin Pressure Potential in Grocery from Inflation and Competition.” The grocery competitive landscape did not change much during the pandemic giving us little reason to believe that the category will not become promotional again.

-

Housing. Strong housing demand and shortage of available homes should keep house price growth firm — potentially boosting core inflation in the shelter category through higher rent inflation, writes Ronnie Walker in a May-2 economics note “Housing on Fire.” And Sue Maklari remains bullish on bellwether homebuilder PHM following last week’s results as we believe the company should have the pricing power to offset rising lumber and labor cost.

* * *

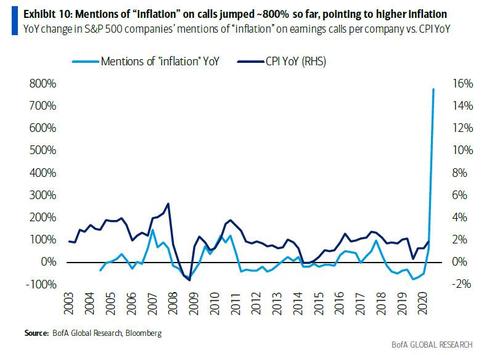

If that wasn’t enough, yesterday Bank of America made ripples across trading desks when in its summary of the third week of earnings season, the bank’s strategist Savita Subramanian, she noted that mentions of “inflation” have quadrupled YoY, and after last week, mentions have exploded nearly 800% YoY.

And the punchline from her report:

“on an absolute basis, mentions skyrocketed to near record highs from 2011, pointing to at the very least, “transitory” hyper-inflation ahead.”

Yes, this is a top 4 bank saying the US is facing “transitory hyperinflation.” Because when one thinks hyperinflation, “transitory” is what comes to mind.

In any case, digging into the actual data, BofA finds that by category, mentions of pricing (+36%) and transportation (+35%) rose the most, followed by materials (+28%), while labor-related mentions rose the least (+9%). And to further substantiate her point, Subramanian has pulled some of the most memorable “reflation” and “higher prices” remarks from recent conference calls:

-

FAST (Industrials): “we are experiencing significant material cost inflation, particularly for steel, fuel and transportation costs.”

-

GIS (Staples): “Looking ahead, as we experienced higher inflationary environment, our first line of defense will continue to be our strong holistic margin management cost savings program. In addition, we are taking actions now and in the coming months […] to drive net price realization that will benefit our FY2022. “

-

CAG (Staples): “we’re seeing input cost inflation accelerate in many of our categories and across the industry.”

-

LW (Staples): “while the pandemic-related effects on our supply chain were the primary drivers of our cost increases, we also realized higher costs due to input cost inflation in the low single-digits. We expect that rate will begin to tick up in the coming quarters as edible oil and transportation costs continue to increase.”

-

STZ (Staples): “similar to previous years, we’re expecting substantial inflation headwinds in the low to mid-single-digit increase range, largely related to glass and other packaging materials, raw materials, transportation and labor costs in Mexico. “

-

PPG (Materials): “we experienced a significant acceleration of raw material and logistics cost inflation during the quarter. Coming into the year, we were expecting an inflationary environment and had prioritized selling price increases across all of our businesses. This has helped us achieve solid price increases year-to-date. With a higher inflation backdrop, we have already secured further selling price increases and are in the process of executing additional ones during the second quarter. “

-

DOV (Industrials): “What we are going to fight against between now and the end of the year […] is inflationary input costs between raw materials, labor, and price/cost.

-

[…] the way it’s looking we may have to intervene on price again in certain of the businesses over the balance of the year.”

-

TEL (Tech): “I would expect our margins to modestly improve as we work our way forward here into the third and fourth quarter based on some of the actions that are underway and our ability to combat some of the inflationary pressures out there. […] Certainly, we’re feeling the biggest inflation right now is on the freight side. The freight inflation has been significant. And as we battled through there and there’s a variety of reasons for that including higher air freight and so forth in terms of that. And that’s not unique to TE. Certainly, I think that’s been as well publicized across the overall supply chain. […] labor cost is not a major issue on the inflation side, but labor availability in certain places that are still being more impacted by COVID continues to drive some inefficiencies.”

-

CMG (Consumer Discretionary): “So, all of that is very, very manageable and we feel like if there is going to be significant increased inflation because of market-driven or because of federal minimum wage, we think everybody in the restaurant industry is going to have to pass those costs along to the customer.”

-

ALLE (Industrials): “This guide incorporates pricing actions to offset direct material inflation, as well as reflecting our supply chain capability to mitigate industry challenges on supply and electronic component shortages. We anticipate that these challenges will persist for the balance of the year, and we will continue to monitor and adapt to changing market conditions.”

-

WHR (Consumer Discretionary): “The global material cost inflation in particular in steel and resins will negatively impact our business by about $1 billion. We expect cost increases to peak in the third quarter.”

-

PNR (Industrials): “All inflation remains high. We have instituted a number of selling price increases across the portfolio that we expect to help mitigate inflation in the second half of the year.”

-

TSCO (Consumer Discretionary): “Compared to our initial outlook for the year, our forecast does reflect higher transportation costs and product inflation. We experienced increasing pressures from these factors during the first quarter and expect them to continue to be a headwind throughout 2021.”

-

POOL (Consumer Discretionary): “We previously said that inflation would be in the 2% to 3% range but now believe it will be in the 4% to 5% with some products into double-digits. We don’t anticipate any of this getting hung up in the channel so that will provide a tailwind for the year. Considering that most of our – most of the cost of constructing a new pool or remodeling an existing pool is tied up in labor we don’t anticipate this inflation having a meaningful effect on demand as it relates to nondiscretionary products such as chemicals, inflation has simply passed through again with no real effects on demand.”

-

LUV (Industrials): “Outside of salary, wages and benefits, the largest drivers of our sequential cost pressure are flight driven cost increases and landing fees, employee, customer and revenue related cost, and maintenance expense…”

-

HON (Industrials): “Yeah, that’s definitely a watchout item for the year. And for us, inflation is taking hold. There’s no doubt about it. We knew it. We see it. It’s real. And if you don’t stay on top of it, the two areas where – and this is not a surprise – steel, semiconductors, copper, ethylene, those are the four elements that we saw substantial inflation in Q1. [..] I can tell you that we stood up a pricing team, which has been in place since the beginning of the year. We’re quickly taking actions and we are staying ahead of it. And we’re going to continue to monitor what happens and stay ahead of it. But it’s a watchout item. I don’t think things are going to abate. The short cycle is definitely hot. We all read the same articles around semiconductors and what’s going on there, and I think we’re going to have to just stay ahead of it. But we do expect an inflationary environment this year. And we’re going to stay ahead of it. That’s our commitment.”

-

CE (Materials): “We’re certainly feeling the inflationary factor. I think, the good news is we anticipated this coming back in the fourth quarter of last year already and started moving prices […] So, although it is an inflationary pressure, we’ve been able to push that through in our pricing and basically maintain the same level of variable margin.”

-

KMB (Staples): “The biggest reason being that our pricing actions and the benefits of that will be coming through the P&L in the second half. In terms of input cost inflation, that is ramping in the first quarter, and the second quarter. We expect that, it will peak and then moderate and, in some cases, come down a bit in the second half.”

-

MDLZ (Staples): “In terms of inflation, there is more inflation coming. And so, profitability is great in Q1. We believe we are going to hit the numbers as we had originally in mind. But the higher inflation will require some additional pricing and some additional productivities to offset the impact, which I believe at this point is absolutely manageable given that all these positions are pretty much hedged for 2021.”

-

SHW (Materials): “On the cost side of the equation we now expect raw material inflation for the year to be in the high-single-digit to low-double-digit range, a significant increase from the low- to mid-single-digit range we communicated in January. And let me just begin by reiterating a little bit what John and Al have been saying. This whole area of raw material inflation is a transitory issue for us. It’s not new for us. We’ve demonstrated an ability to manage through this many times in the past, and we’ll get through this as well.”

-

WM (Industrials): “We do expect that inflation will kick up a little bit, and so we’ll get some help. And we’re typically a beneficiary of higher inflation.”

-

PKG (Materials): “We also anticipate continued inflation with freight and logistics expenses as well as most of our operating and conversion costs. However, energy costs should improve as we move into seasonally milder weather.”

-

MMM (Industrials): “We are also raising prices, but it’s going to take a little bit of time. The inflation has come in faster. So you’re going to see 75 to 125 basis points of headwind which is the net of price versus inflation and logistics.” “On supply chain disruption, there are two pieces. One is of course the inflation that we’ve told you about which will cost 75 to 125 basis points of headwind between price and inflation and the raw material and logistics costs as well as making sure that we have all the product availability that we have. So that’s the other, I would say, headwind to 1Q.”

-

PHM (Consumer Discretionary): “We have updated our guide in terms of what the inflationary aspect of the sticks and bricks is. We have been at or near 5%, 6%. We’re now 6% to 8%. And depending what lumber does, that could move a little bit even higher than that.”

-

F (Consumer Discretionary): “We’re definitely feeling the commodity headwind, as John said. And inflation, it feels like we’re seeing inflation in variety parts of our industry kind of in ways we haven’t seen for many years. On the other hand, it feels like it’s all due to a lot of one-timers as the economy comes out of lockdown. So I think it’s a bit too early to declare the run rate or where it’s going to be. It’s just too hard to tell from my standpoint.”

-

AVY (Materials): “supply chains have remained tight and input costs have been increasing. As a result, raw material and freight inflation were above our initial expectations. And we have continued to see costs rise as we entered the second quarter We now expect mid to high single digit inflation for the year with variations by region and product category.”

-

IDX (Health Care): “I would say on the inflationary front, it’s kind of spotty for us. I mean remember we’re a little further down the food chain. We don’t buy a lot of giant quantities of base material. We buy things that have been converted, so it does have a little bit of a lag for us. And so we see the same things others are seeing where we buy lots of metals. There’s some inflationary pressure; electronics, a few other places but we’re navigating around those on the freight side. That’s certainly a challenge both on the price, frankly more on the availability side. […] We’re no different than anybody else trying to find sea containers, trucking, trains, port facilities that have to unclog all of those things. Our model helps us. Our folks help us. I think as we go further out, the inflationary pressure, I actually think that’s going to ramp up a bit for everybody.”

-

SWK (Industrials): “As many of you follow, steel and resin represent the two largest commodity exposures and they have been impacted by rapid spot market increases as the global supply chain response to the surge of demand and temporary supply gaps. This dynamic has occurred across many of our key commodities, components, finished goods that we purchase. We now expect inflation headwinds to approximate $235 million, which is up $160 million versus our previous outlook of $75 million.”

-

MAS (Industrials): “We have seen significant inflation in raw materials, namely copper, zinc, and resin, used in both our paint and plumbing businesses as well as increases in freight costs. All in, we expect our raw material and freight costs to be up in the midsingle-digit range for the full year for both our Plumbing and Decorative segments, with inflation likely reaching high single-digit levels in both segments in the third and fourth quarters.”

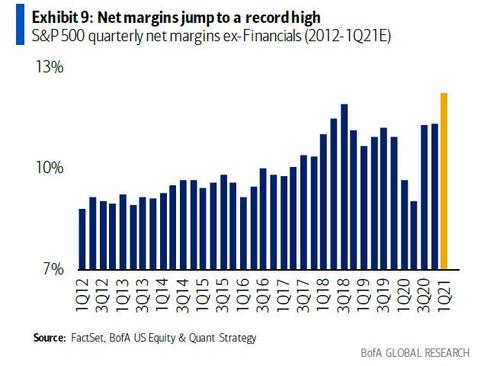

Last but not least, perhaps the most surprising finding by BofA, is that despite all the mentions of inflation coming from raw materials, transportation, and supply chain issues, S&P 500 non-Financial net margins jumped to a record level in 1Q. Of the 11 sectors, Real Estate and Utilities are expected to see lower margins YoY.

While we don’t know whether the coming “hyperinflation” will be transitory or not, but one thing we are certain of – if prices indeed enter their Zimbabwe phase, profit margins for the broader market will soon hit a record, only in the wrong direction.

Tyler Durden

Tue, 05/04/2021 – 12:40

via ZeroHedge News https://ift.tt/3nTuc0j Tyler Durden