Ferrari Crashes Most In A Year After Delaying 2022 Financial Target By A Year

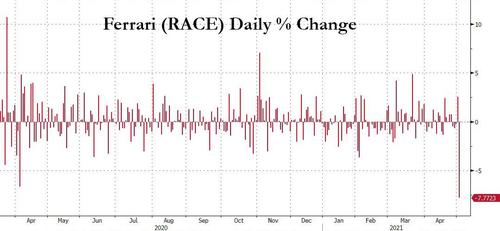

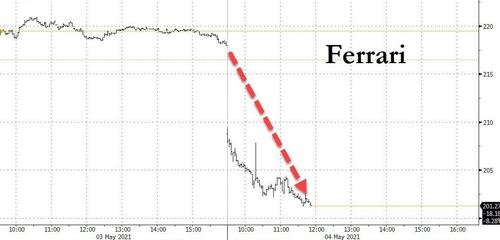

In a world flooded with liquidity, where the backlog to get a new supercar is sometimes measured in years, one would think that ultra luxury carmakers would be soaring. Alas, that’s not the case for Ferrari (RACE) today, whose stock plunged more than 8% in Milan trading, the biggest drop since March 2020, making it the worst performer on the FTSE MIB and the Stoxx 600 Automobiles & Parts Index after the supercar maker delayed by a year longstanding profit targets for 2022 initially set before the Covid-19 pandemic, adding to a roster of challenges for the carmaker that has been without a CEO for almost five months.

As Bloomberg reports, the Italian manufacturer delayed plans to earn at least €1.8 billion ($2.2 billion) EBITDA by 2022, saying it now plans to achieve this and other goals a year later. Chairman John Elkann reset expectations as he keeps searches for a new CEO following Louis Camilleri’s surprise resignation in December.

Elkann, the Agnelli family scion and head of holding company Exor NV, said last month that Ferrari was making good progress in its search for a permanent CEO who will have the “technological capabilities” to lead the lead the company forward.

To some, such as Bloomberg Intelligence credit analyst Joel Levington, Ferrari’s “comments that its financial goals for 2022 are delayed by a year eliminates a well-anticipated overhang,” even if the market did not quite see it that way. “Finding a suitable CEO who can maintain the company’s culture while transitioning toward electrification are meaningful challenges.”

Ferrari would adjust expenditures in response to Covid-19, Elkann said in a statement, which doesn’t give specific figures for the planned change. Adjusted Ebitda rose to 376 million euros in the first quarter, topping analysts’ average estimate of 368.3 million euros. Shipments in the period totaled 2,771 units, up slightly from a year ago.

Ferrari shares had already underperformed in early 2021 after leading the Stoxx 600 Automobiles & Parts Index each of the last three years. Rivals Volkswagen and Daimler have better capitalized on enthusiasm around electric vehicles, although Elkann said during last month’s annual general meeting that Ferrari will unveil its first EV model in 2025.

Jefferies, which has an underperform rating, said that although not unexpected, 2022 targets were postponed by one year “due to Covid” and said the delayed announcement might have raised expectations that targets would be confirmed. That said the bank said the actual quarter was “smooth”, with all numbers “within the usual margin of error of well-guided consensus;” mix/price and “other” (F1 calendar + Maserati engines) main contributors to EBIT with net orders “robust” and order book at record level.

Looking ahead, Bloomberg notes that the next CEO of Ferrari will inherit a company that’s been reluctant to abandon the internal combustion engine. A month before Camilleri stepped down for unspecified personal reasons, he told analysts he didn’t see Ferrari ever shifting to 100% EVs and ruled out the company moving to 50% electric in his lifetime, which long-time Ferrari enthusiasts probably welcomed.

The Stoxx Europe 600 Automobiles and Parts Index (SXAP) fells as much as 3.2%, the region’s second-worst performing sector, on the Ferrari news:

- SXAP was down 3% as of 5:12pm, with Ferrari falling 7.4%, Porsche Automobil Holding -4.8%, Faurecia -3.2%, BMW -2.8%, Daimler -2.4%

- Volkswagen preferred shares down 4.8%, common stock -3.3% ahead of results due Thursday Stellantis falls 1.1% ahead of Wednesday’s 1Q sales

But it wasn’t just the supercar maker that tumbled on Tuesday trading: Daimler ADRs also plunged more than 5% in US trading after Daimler holder Nissan Motor said it would offer 16.4 million shares via BofA and SocGen. The announcement also dragged down Nissan Motor shares 2% to session lows.

Tyler Durden

Tue, 05/04/2021 – 14:10

via ZeroHedge News https://ift.tt/2RpgUfQ Tyler Durden