Transitory? Here Are The Companies Hiking Prices In Response To Soaring Costs

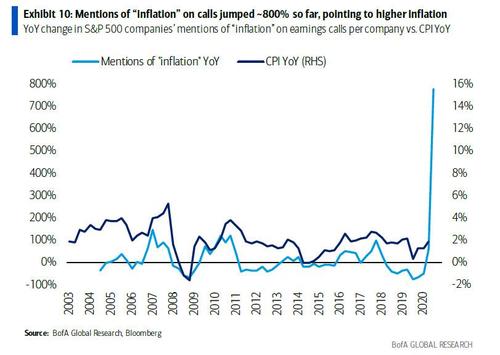

Earlier today we noted that the one thing every company was obsessing during their Q1 earnings call: inflation. As BofA equity strategist Savita Subramanian calculated, mentions of “inflation” quadrupled YoY, and after last week, mentions have exploded nearly 800% YoY. More striking was her observation that as “mentions skyrocket to near record highs from 2011” these point to at the very least, “transitory hyper-inflation ahead.” This is an official statement from a Big-4 bank, not some tinfoil conspiracy blog.

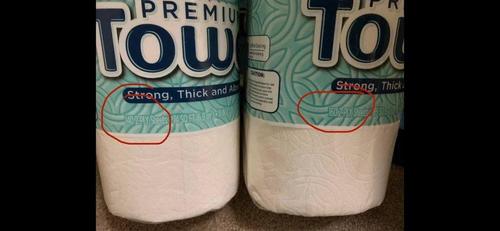

What is more concerning is that not only are companies talking about inflation, they are also responding to soaring input costs by hiking prices either in absolute terms or by stealth shrinkflation.

We presented an example of the latter over the weekend when we showed how Costco was masking nearly 15% inflation by selling a paper roll with 140 sheets for the same price it used to sell 160 sheets.

Of course, once companies realize they can get away with such shrinkflation – and they will because as a member of the Red Flag Deals message board pointed out…

I tried telling the clerk at Costco about this, and they said “who cares, it’s just 20 sheets.”

Will be the typical response.

… the obvious next step will be to no longer bother with such attempts at masking double digit inflation, and to hike prices outright until there is an actual decline in supply, or as TBT predicts, “this is the precursor to real inflation next.” And sure enough, names from consumer giants from Kimberly-Clark to Clorox, Procter & Gamble, as well as food makers such as Hormel, JM Smucker, General Mills, Skippy and Hershey are already doing just that.

But don’t worry, according to the Chairman, “it’s transitory.” Or maybe it won’t be, as increasingly more banks are starting to speculate.

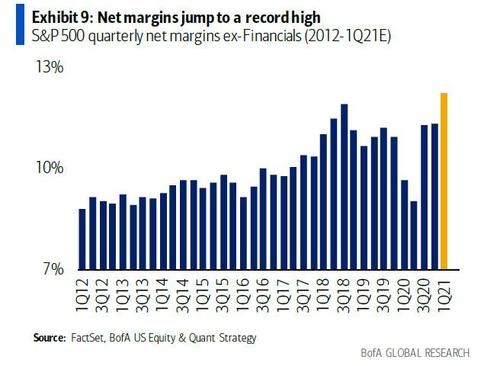

One thing we do know: once companies hike prices, they almost never cut them again. In fact, most companies would rather file for bankruptcy rather than reverse their pricing strategy, especially since among the most striking outcomes of Q1 earnings season are record high profit margins. Well, guess what happens to those margins as input costs continue to soar – either they collapse (and turn negative), or companies hike prices. Guess which choice they will pick.

Finally, courtesy of BofA, here is a list of the companies that have complained in recent weeks about soaring prices most if not all of which have proceeded to pass on price increases to consumers… that would be you dear readers:

-

FAST (Industrials): “we are experiencing significant material cost inflation, particularly for steel, fuel and transportation costs.”

-

GIS (Staples): “Looking ahead, as we experienced higher inflationary environment, our first line of defense will continue to be our strong holistic margin management cost savings program. In addition, we are taking actions now and in the coming months […] to drive net price realization that will benefit our FY2022. “

-

CAG (Staples): “we’re seeing input cost inflation accelerate in many of our categories and across the industry.”

-

LW (Staples): “while the pandemic-related effects on our supply chain were the primary drivers of our cost increases, we also realized higher costs due to input cost inflation in the low single-digits. We expect that rate will begin to tick up in the coming quarters as edible oil and transportation costs continue to increase.”

-

PPG (Materials): “we experienced a significant acceleration of raw material and logistics cost inflation during the quarter. Coming into the year, we were expecting an inflationary environment and had prioritized selling price increases across all of our businesses. This has helped us achieve solid price increases year-to-date. With a higher inflation backdrop, we have already secured further selling price increases and are in the process of executing additional ones during the second quarter. “

-

DOV (Industrials): “What we are going to fight against between now and the end of the year […] is inflationary input costs between raw materials, labor, and price/cost […] the way it’s looking we may have to intervene on price again in certain of the businesses over the balance of the year.”

-

TEL (Tech): “I would expect our margins to modestly improve as we work our way forward here into the third and fourth quarter based on some of the actions that are underway and our ability to combat some of the inflationary pressures out there. […] Certainly, we’re feeling the biggest inflation right now is on the freight side. The freight inflation has been significant. And as we battled through there and there’s a variety of reasons for that including higher air freight and so forth in terms of that. And that’s not unique to TE. Certainly, I think that’s been as well publicized across the overall supply chain. […] labor cost is not a major issue on the inflation side, but labor availability in certain places that are still being more impacted by COVID continues to drive some inefficiencies.”

-

CMG (Consumer Discretionary): “So, all of that is very, very manageable and we feel like if there is going to be significant increased inflation because of market-driven or because of federal minimum wage, we think everybody in the restaurant industry is going to have to pass those costs along to the customer.”

-

ALLE (Industrials): “This guide incorporates pricing actions to offset direct material inflation, as well as reflecting our supply chain capability to mitigate industry challenges on supply and electronic component shortages. We anticipate that these challenges will persist for the balance of the year, and we will continue to monitor and adapt to changing market conditions.”

-

WHR (Consumer Discretionary): “The global material cost inflation in particular in steel and resins will negatively impact our business by about $1 billion. We expect cost increases to peak in the third quarter.”

-

PNR (Industrials): “All inflation remains high. We have instituted a number of selling price increases across the portfolio that we expect to help mitigate inflation in the second half of the year.”

-

TSCO (Consumer Discretionary): “Compared to our initial outlook for the year, our forecast does reflect higher transportation costs and product inflation. We experienced increasing pressures from these factors during the first quarter and expect them to continue to be a headwind throughout 2021.”

-

POOL (Consumer Discretionary): “We previously said that inflation would be in the 2% to 3% range but now believe it will be in the 4% to 5% with some products into double-digits. We don’t anticipate any of this getting hung up in the channel so that will provide a tailwind for the year. Considering that most of our – most of the cost of constructing a new pool or remodeling an existing pool is tied up in labor we don’t anticipate this inflation having a meaningful effect on demand as it relates to nondiscretionary products such as chemicals, inflation has simply passed through again with no real effects on demand.”

-

LUV (Industrials): “Outside of salary, wages and benefits, the largest drivers of our sequential cost pressure are flight driven cost increases and landing fees, employee, customer and revenue related cost, and maintenance expense…”

-

HON (Industrials): “Yeah, that’s definitely a watch out item for the year. And for us, inflation is taking hold. There’s no doubt about it. We knew it. We see it. It’s real. And if you don’t stay on top of it, the two areas where – and this is not a surprise – steel, semiconductors, copper, ethylene, those are the four elements that we saw substantial inflation in Q1. [..] I can tell you that we stood up a pricing team, which has been in place since the beginning of the year. We’re quickly taking actions and we are staying ahead of it. And we’re going to continue to monitor what happens and stay ahead of it. But it’s a watchout item. I don’t think things are going to abate. The short cycle is definitely hot. We all read the same articles around semiconductors and what’s going on there, and I think we’re going to have to just stay ahead of it. But we do expect an inflationary environment this year. And we’re going to stay ahead of it. That’s our commitment.”

-

CE (Materials): “We’re certainly feeling the inflationary factor. I think, the good news is we anticipated this coming back in the fourth quarter of last year already and started moving prices […] So, although it is an inflationary pressure, we’ve been able to push that through in our pricing and basically maintain the same level of variable margin.”

-

KMB (Staples): “The biggest reason being that our pricing actions and the benefits of that will be coming through the P&L in the second half. In terms of input cost inflation, that is ramping in the first quarter, and the second quarter. We expect that, it will peak and then moderate and, in some cases, come down a bit in the second half.”

-

MDLZ (Staples): “In terms of inflation, there is more inflation coming. And so, profitability is great in Q1. We believe we are going to hit the numbers as we had originally in mind. But the higher inflation will require some additional pricing and some additional productivities to offset the impact, which I believe at this point is absolutely manageable given that all these positions are pretty much hedged for 2021.”

-

SHW (Materials): “On the cost side of the equation we now expect raw material inflation for the year to be in the high-single-digit to low-double-digit range, a significant increase from the low- to mid-single-digit range we communicated in January. And let me just begin by reiterating a little bit what John and Al have been saying. This whole area of raw material inflation is a transitory issue for us. It’s not new for us. We’ve demonstrated an ability to manage through this many times in the past, and we’ll get through this as well.”

-

WM (Industrials): “We do expect that inflation will kick up a little bit, and so we’ll get some help. And we’re typically a beneficiary of higher inflation.”

-

PKG (Materials): “We also anticipate continued inflation with freight and logistics expenses as well as most of our operating and conversion costs. However, energy costs should improve as we move into seasonally milder weather.”

-

MMM (Industrials): “We are also raising prices, but it’s going to take a little bit of time. The inflation has come in faster. So you’re going to see 75 to 125 basis points of headwind which is the net of price versus inflation and logistics.” “On supply chain disruption, there are two pieces. One is of course the inflation that we’ve told you about which will cost 75 to 125 basis points of headwind between price and inflation and the raw material and logistics costs as well as making sure that we have all the product availability that we have. So that’s the other, I would say, headwind to 1Q.”

-

PHM (Consumer Discretionary): “We have updated our guide in terms of what the inflationary aspect of the sticks and bricks is. We have been at or near 5%, 6%. We’re now 6% to 8%. And depending what lumber does, that could move a little bit even higher than that.”

-

F (Consumer Discretionary): “We’re definitely feeling the commodity headwind, as John said. And inflation, it feels like we’re seeing inflation in variety parts of our industry kind of in ways we haven’t seen for many years. On the other hand, it feels like it’s all due to a lot of one-timers as the economy comes out of lockdown. So I think it’s a bit too early to declare the run rate or where it’s going to be. It’s just too hard to tell from my standpoint.”

-

AVY (Materials): “supply chains have remained tight and input costs have been increasing. As a result, raw material and freight inflation were above our initial expectations. And we have continued to see costs rise as we entered the second quarter We now expect mid to high single digit inflation for the year with variations by region and product category.”

-

IDX (Health Care): “I would say on the inflationary front, it’s kind of spotty for us. I mean remember we’re a little further down the food chain. We don’t buy a lot of giant quantities of base material. We buy things that have been converted, so it does have a little bit of a lag for us. And so we see the same things others are seeing where we buy lots of metals. There’s some inflationary pressure; electronics, a few other places but we’re navigating around those on the freight side. That’s certainly a challenge both on the price, frankly more on the availability side. […] We’re no different than anybody else trying to find sea containers, trucking, trains, port facilities that have to unclog all of those things. Our model helps us. Our folks help us. I think as we go further out, the inflationary pressure, I actually think that’s going to ramp up a bit for everybody.”

-

SWK (Industrials): “As many of you follow, steel and resin represent the two largest commodity exposures and they have been impacted by rapid spot market increases as the global supply chain response to the surge of demand and temporary supply gaps. This dynamic has occurred across many of our key commodities, components, finished goods that we purchase. We now expect inflation headwinds to approximate $235 million, which is up $160 million versus our previous outlook of $75 million.”

-

MAS (Industrials): “We have seen significant inflation in raw materials, namely copper, zinc, and resin, used in both our paint and plumbing businesses as well as increases in freight costs. All in, we expect our raw material and freight costs to be up in the mid single-digit range for the full year for both our Plumbing and Decorative segments, with inflation likely reaching high single-digit levels in both segments in the third and fourth quarters.”

We can’t wait for all the above companies to cut prices as soon as the “transitory” period is over.

Tyler Durden

Tue, 05/04/2021 – 17:05

via ZeroHedge News https://ift.tt/2Rr3ekE Tyler Durden