Here Comes The Squeeze: Goldman Prime Says Hedge Funds Shorted Tech For 9 Of The Past 10 Days

With the Nasdaq set for its biggest weekly drop since the end of March, when “that” catastrophic 7Y auction sparked reflation fears and hammered tech stocks and duration in general…

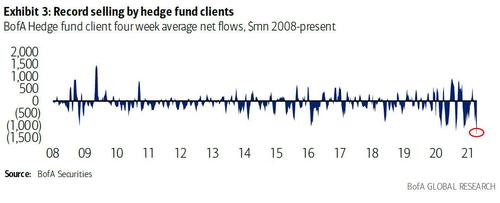

… it will hardly come as a surprise that someone has been puking tech stocks, especially after we reported on Tuesday that in the past 4 weeks BofA’s hedge fund clients had sold a record amount of stocks.

Today, in an update report from Goldman’s Prime Brokerage, we learn just how acute the tech revulsion has been within the hedge fund community.

While superficially appetite for risk was present, with GS Prime writing that its book “was modestly net bought yesterday (+0.5 SDs vs. average daily flow of the past year), driven by risk-on flows with long buys outpacing short sales 1.6 to 1” with “7 of 11 sectors were net bought on the day led in $ terms by Comm Svcs, Real Estates, Consumer Disc, and Utilities” a detailed look reveals that the smart money has now decided to target continued declines in tech.

Indeed, validating the recent horrific price action in tech, Goldman Prime notes that i) Tech stocks were net sold for a 7th straight day (9 of the past 10), and more improtantly, ii) the bulk of this selling was short selling, i.e., the flows were “driven by short sales outpacing long buys 2 to 1.”

As a result of the aggressive selling/shorting, Info Tech’s weighting vs. the SPX now stands at -3.3%, the most underweight level since December. Digging deeper, on an industry group level, Goldman notes that managers are the most U/W Tech Hardware (-5.6%) followed by Semis & Semi Equip (-2.4%) while still O/W Software & Services (+4.8%).

Why does this matter? Because the last time we saw such coordinated hedge fund selling was at the end of April when we noted that “Hedge Funds Sell Stocks 7 Of The Last 8 Days“, a move which we said would precede a major short squeeze and sure enough in the days that followed both the S&P and Nasdaq hit all time highs.

Now that the selling is far more focused in tech – for obvious reasons: reflation fears, taper concerns, WFH trade ending, a coordinatred campaign to crush Cathie Wood, etc. – it is safe to say that tech is about to experience yet another squeeze, something we predicted first yesterday…

We are about to see a major tech short squeeze pic.twitter.com/eLLoW3SQPN

— zerohedge (@zerohedge) May 5, 2021

… and which today’s Goldman Prime data just confirmed.

Tyler Durden

Thu, 05/06/2021 – 11:38

via ZeroHedge News https://ift.tt/3xRy7iQ Tyler Durden