$250 Billion Fund CIO Fears “Hidden Costs” Of Biden’s ‘Faustian’ Policies’ “Darker Sides”

Authored by Tad Rivelle, CIO at TCW,

In the tale of the Miller’s daughter, a once prosperous miller has fallen on hard times. His dilapidated mill, his ramshackle farm can no longer support his family. Despairing, the Miller sets off to town to find work. Lo! Along the way he crosses paths with Mephistopheles, who offers to fix the mill and restore the Miller to a life of riches. The price? Why – Mephistopheles only asks that the Miller turn over the first thing the Miller sees upon returning to his farm. The Miller, elated, realizes that the first thing anyone ever sees on approaching his farm is a beat up old apple tree. The Miller would be happy to do without that worn out fruit tree! Alas, as the Miller returns to his farm, he is shaken by the sight of his young daughter rushing to him with arms outstretched to welcome him from his day away!

Faust makes his pact with Mephistopheles

The very essence of a Faustian bargain is that you get your most troubling problem fixed today but for a price that remains unknowable, for now.

All fiat currencies are ultimately faith based. They are backed by nothing tangible – indeed, “nothing” other than the trust in the society, economy, government, and institutions that “sponsor” the fiat currency. Destroy that trust and a dollar – or indeed any fiat – is literally not worth the paper it’s printed on.

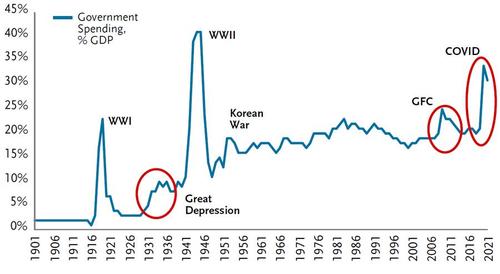

The economic problems of the past year were severe indeed. Absent a policy response that went – as it did – above and beyond anything ever imagined before, our nation, perhaps much of the world too, might have faced social unrest on a scale that could have threatened the credibility of the institutions on which we rely. Yet, while that moment of existential crisis has continued to recede with each vaccination and with nearly every economic release, the twin policy regimes of “lower indefinitely” and “Go Big” fiscal stimulus are renewed and re-affirmed. Do zero rates forever and government borrow and spend programs actually fix the mill? While many of us are “elated” by a Q2 2021 rate of economic growth that will likely be a record breaker, we will not know the ultimate price until Mephistopheles submits his invoice.

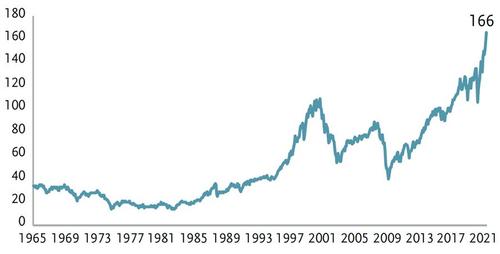

Consider: QE programs are designed to promote asset price inflation. The Fed, operating without such quaint constraints as shareholder consultation or leverage tests, buys trillions of Treasuries and agency MBS so as to suppress their yields. Market interest rates are held lower than they would otherwise be, and over time, cap rates for every manner of asset class follow suit. Thus, the artificially induced asset price inflation. Keeping in mind that assets are places in which our society stores its “dollar surpluses,” asset inflation effectively “sops up” much of the excess liquidity that the Fed creates. Of course, a policy regime that props up capital prices relative to wages is not sustainable and not without consequences for the political market. Indeed, populism would be one of those consequences.

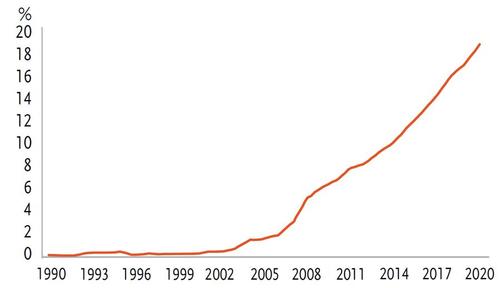

“Zombie” Firms as a Percent of All U.S. Firms

Note: Firm-level data is used to calculate the share of listed firms that are more than ten years old with an interest coverage ratio less than one for three years in a row. Source: Datastream, Worldscope, DB Global Research

Number of Hours an Average Employee has to Work to Purchase S&P 500 Index

Source: Bloomberg, BLS, TCW

In the world of science as in the world of common sense, when a hypothesis does not work empirically, it is discarded. Oftentimes, in the policy world, when the desired effect does not occur, the response is to “double down.” For ten years, at least, we have heard that central banks, fearing deflation, have proposed that the solution can be found in QE, negative rates, LTROs, do whatever it takes, then do more. Inflation, if you haven’t heard, can be “manufactured” by lower rates – for longer – or for lower. Trouble is, artificial prices in the form of unnaturally low rates also have consequences: low productivity “zombie” companies proliferate, the demanded “down payment” to buy that starter home – or any home – rises with the real-estate market, the coupon income received by the prospective retiree on his bank deposits or bond fund plummet. Thus, inefficiency is protected, the young are “forced” to cut back on certain types of consumption to save for their first house, the “old,” too, must cut back so that they have enough saved for their retirement. So, zombie companies pull down average wage growth while consumers cut consumption to afford homes to buy or to fund retirements.

The result? Organic consumption is stymied, suggesting that on balance, QE may be deflationary.

Having failed to launch the private sector to “escape velocity” and failed to drive conventional inflation metrics higher, confidence in the Fed and monetary policy has begun to falter. “New” forms of intervention are now demanded by the political market. And this brings us to the “free lunch” of Federal debt and deficits. Having driven interest rates down towards nothing, the perceived “cost” of deficit spending can be likened to the Miller’s calculus: “Mephistopheles” is offering us a bargain, of the Faustian kind.

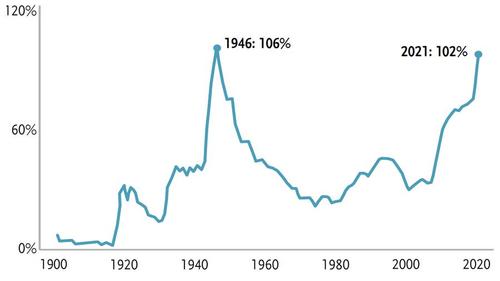

So, if higher asset prices don’t get the growth or inflation job done, surely we can achieve prosperity if we borrow more, tax more, expand entitlements, and issue more public debt? A good skeptic might retort: such policies have been tried in many places, many times, with familiar results: they “bankrupt” their societies. Spending programs financed by public debt remind one of the “tragedy” of the commons problem. And, given that Federal deficits now represent 19% percent of the U.S. economy, what will happen when these deficits are inevitably tapered? And will an economy with artificially high asset prices and artificially low rates, populated by many zombie enterprises, and burdened with heavy private and public sector debt loads, have the wherewithal to carry off a near economic miracle when the deficit spending has run its race?

Indeed, when growth inevitably flags, the proposed solution will likely be yet more fiscal stimulus.

Federal Spending As Percent of GDP is at Post-WWII High

Source: BEA, CBO, measuringworth.com, TCW

Public Debt at its Highest Since 1946

Source: CBO

The upshot is straightforward: should monetary and fiscal policy be perceived as being stuck in a rinse – lather – repeat cycle wherein the inevitable disappointment with each round leads to calls for still more rounds, faith in the power and wisdom of the Fed and the national government will wane. Investors, workers, and holders of dollar assets everywhere will conclude that the mill isn’t going to get fixed by yet another round of QE or public spending. It is that loss of faith in social/governmental institutions that has preceded many an inflationary period elsewhere. What may not be well appreciated is that once the Fed and the Federal government are perceived as the cause of the trust problem, they give up their ability to be the solution to the lack of trust. The Fed protests that it has the tools and the talent to stop inflation when the time comes. But those tools need trust to work, so if an inflation problem stems from a lack of trust, the Fed will find itself powerless, a bit like what can happen to a central bank in an emerging economy.

Don’t think it can happen in a 21st century economy “guaranteeing” the world’s reserve currency? You could be right. Then again, anyone remember when the Carter administration sold millions of ounces of Fort Knox gold and issued U.S. Treasuries denominated in Japanese Yen and West German Deutschmarks in a bid to support the dollar? No? How about when the euro was rescued from a near-death experience catalyzed by a loss of trust in the EU?

Well, here’s hoping that the price of today’s massive policy interventions is limited to that of an old apple tree; but, we fear the hidden costs of policy’s darker sides.

Tyler Durden

Thu, 05/06/2021 – 16:29

via ZeroHedge News https://ift.tt/2SmlR9F Tyler Durden