So It Looks Like Nationalizing Student Loans Has Simply Turned Into One Giant Ponzi Scheme

We’ve all known that nationalizing student loan debt would turn out to be a terrible decision (just as it is when the government nationalizes any industry). We have been saying it on this site for years: it skews the market, offers capital to people who don’t have the means to pay it back and allows universities to price gouge, leading to a lower quality of education.

What we didn’t know was exactly how deep the rabbit hole would go.

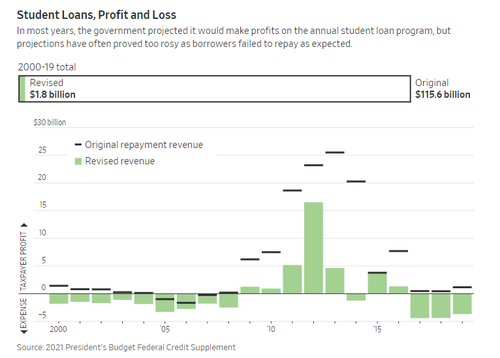

Enter Jeff Courtney, a former JPMorgan executive, to deliver the bad news. He was brought in by Betsy DeVos, then U.S. education secretary, who sought out help from J.P. Morgan in trying to determine how much trouble the program was actually in, since revenues from payments continued to come in below projections.

Courtney arrived at a stunning conclusion, according to the Wall Street Journal: “various administrations and federal watchdogs had systematically made the student loan program look profitable when in fact defaults were becoming more likely.”

Courtney discovered “a growing gap between what the books said and what the loans were actually worth, requiring cash infusions from the Treasury to the Education Department long after budgets had been approved and fiscal years had ended, and potentially hundreds of billions in losses.”

Currently, the budget assumes the government will get 96 cents back on every dollar borrowers default on. Courtney pointed out that in the private sector, that number drops to about 20 cents on the dollar.

He was told by the Education Department that they calculated this number this way by basically running a ponzi scheme:

They told him that when borrowers default, the government often puts them into new loans. These pay off the old loans, and this is considered a recovery, even though in many cases the borrowers haven’t repaid anything and default on the new loans as well.

And so the stark reality is that the government is really going to only recover 51% to 63% of these amounts, Courtney noted.

DeVos commented on the data: “If you accounted this way in the private sector, you wouldn’t be in business anymore. You’d probably be behind bars.”

“Taxpayers could ultimately be on the hook for roughly a third of the $1.6 trillion federal student loan portfolio,” the Journal had previously reported. If Courtney’s calculations are accurate, there could be “big implications” for taxpayers.

If the loans are accounted for properly, he noted, it would force the Federal Government to realize the losses and add hundreds of billions of dollars to the national debt. This, in turn, could cause pressure to shut down or curtail the program in its entirety (something that probably should have been done years ago).

Prior to 1990, the loans were treated, from an accounting standpoint, as an expense. Since then, they have been allowed to incorporate future repayments. Nearly 30 years later, and it seems like anyone can get a student loan for any worthless degree – which they can then turn around with, combine with their stimulus checks, and have enough money to buy themselves a new car or put a down payment on a house.

Courtney’s report found that while federal loans took out in the 1990s were repaid to the tune of 105% on average, that loans since 2006 had been repaid just 73%. It’s almost as if the government is sending the message to the market that debt is okay.

A spokeswoman for the Education Department said the model is based on incomplete data: “One of the many reasons we have a model of record is to ensure valuation of the student loan portfolio is not subject to political interference.”

The Education Department under President Biden “killed” Courtney’s project in late February, denoting that his model won’t be used to value the loan portfolio. Biden officials dismissed the report and said it was “motivated by a political agenda”. Yeah, the political agenda of actual math and proper accounting.

You can read the Journal’s full, detailed write-up, here.

Tyler Durden

Thu, 05/06/2021 – 16:50

via ZeroHedge News https://ift.tt/33zNFdj Tyler Durden