Blain: What Is Everyone Smoking When It Comes To Asset Bubbles?

Authored by Bill Blain via MorningPorridge.com,

“It was worth being a bubble, just to have held that rainbow for thirty seconds..”

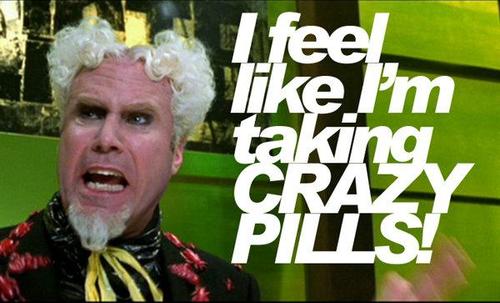

As the Federal Reserve wakes up to “elevated relative risks” and the rest of us scream “bubble”, the real questions are about real value. Why is a Bitcoin worth as much as Renaissance Art? Why is Dogecoin the top performing asset off the year when everyone knows it’s a joke? And when are people going to drink the proverbial coffee?

I am going to be sending US Federal Reserve governor and head of financial stability, Lael Brainard, her second coveted No S**T Sherlock award. This is not an insult – she is a very erudite, clever and talented central banker, but she really could not have stated the downright bleeding obvious any clearer than we she warned yesterday that some asset valuations are “elevated relative to historical norms… [and].. maybe vulnerable to significant declines should risk appetite fall.” (Check it out in the FT: Fed warns of hidden leverage lurking in the financial system.)

Really?

Who knew… ?

“Measures of hedge fund leverage may not be capturing important risks..” or that the pandemic may “stress the financial system in emerging markets and some European countries..” Well… I am very glad someone has finally noticed… To think we all missed it.. (US Readers: sarcasm alert.)

If Lael really wants something to worry about, how about stock market volumes (declining) versus crypto-trading volumes – which topped $1.7 trillion during April. Again, check out the FT: “Crypto trading volumes boom as activity cools on stock markets”. It’s like watching a teething toddler chewing on a live electric cable.. and wondering what will happen next..

Meanwhile… on another planet…

On behalf of the nation, Queen Elizabeth’s Royal Collection owns 144 of Leonardo da Vinci’s drawings; sketches made for paintings, sculptures, maps and designs for devices his fertile imagination concocted. They are beguiling and quite extraordinary.

We really don’t know how many Leonardo drawings there are; only 11 of his multitude of notebooks survive intact. Many more will have been divided. Every so often (as happened in 2016) a few more pages and drawings are found in some forgotten collection left in a suitcase in an attic. One recently discovered da Vinci sketch of St Sebastian sold in auction for $16 million.

Even rarer are his deliberate works of art. There are only some 24 da Vinci paintings. Salvator Mundi, which many still doubt is authentic, sold at auction in 2017 for $450mm. And, no, Leonardo did not offer it in NFT format – nor would he approve giving the NFT owner the right to destroy the original, as has happened with Basquiat. Da Vinci’s painting of Christ is extraordinary, but we will never know that because its apparently on view only to Saudi Prince MBS, hanging on his luxury Yacht.

The interesting thing is – Da Vinci’s art is scarce, it is desirable, it is…. wonderful. And it is definitionally and undeniably valuable.

Dogecoin was dreamt up by two software nerds, Billy Markus and Jackson Palmer, as a joke. Fuelled by the juice of the agave, they spent three hours writing the underlying programme – by taking the original Bitcoin code and replacing Bitcoin with Dogecoin throughout. Bingo! It’s now, Lord forgive us, the top performing “asset” of 2021. There are some tech differences to Bitcoin – apparently you “dig it” rather than “mine” it.

Absolutely nobody thinks Dogecoin is the solution to financial uncertainty or a valid investment proposition, yet is got a market cap of $50 bln! Nobody disputes the only reason to buy Dogecoin is in the expectation you will be able to sell it to the next greater fool at a higher price. The queue of greater fools stretches around the block.

I got a call from No 1 Son earlier this week wondering if Doge is worth a punt. He’s been following the saga of Elon Musk hosting this week’s Saturday Night Live and the widespread expectation he’ll say something to ratchet up the foolishness another notch. Why not? Dogecoin is the epitome of the Zeitgeist stock.

Perusing the newspapers this morning I was delighted to read soon-to-be-jailbird Theranos founder Elizabeth Holmes is using Silicon Valley’s culture of “exaggeration and hyperbole” as a defence against the fraud claims against her. Because every other tech start up lies about its prospects, it was perfectly acceptable for her little lie that her little black box of blood testing marvellocity could do anything to become a massive lie.

I also note Peloton’s problems. Not only have people discovered that there are bikes that can actually be cycled outdoors, and the gyms have reopened, but it also appears their rush to exploit lockdown with their Tread devices resulted in tragedy. And, lets face it, taking a cheap as chips treadmill and jazzing it up with screens and logos was hardly disruptive tech. It was seizing the opportunity

Uber is taking a $600mm backdated hit after being forced to give UK drivers the minimum wage and holiday pay – it will cost the company around $350mm this year. On the back of flat demand for ride sharing and the pandemic, it morphed into a deeply unprofitable food delivery business. On a global basis, UBER lost $360mm Q1 this year and was around $1 bln unprofitable back in the last normal year – 2019.

There is genuine surprise among some young investors the current market seems to have flatlined on their expectations of further massive new tech gains. They absolutely believe in the new, new normal; that disruptive tech stocks don’t need profits – all they need is growth and a really cool and defining mission statement and objectives that trump actual products every time.

Wake up and smell the coffee. (A real one, rather than some digital thingymaboab..)

But let’s go back to the more “serious” cryptocurrencies… I am reminded that ARKK Maven CIO Cathie Wood, (11% of her disruptive tech funds invested in Bitcoin via Greyscale), recently said institutional acceptance of crypto will push Bitcoin up by $500,000. Why? Oh because there can only ever be 21 million Buttcons? Intangible, digitally ledgered, bitcoins are worth so much because they are comparatively rare?

Well… give me the choice of 10 bitcoins or a Leonardo drawing?

I have been resolutely unconvinced by cryptocurrencies since I first encountered them 10-years ago. Interesting, but I didn’t see the why of them. But, very quickly opportunities emerged in illegal trading. I have questioned the basis of every claim that they can transform and improve finance – I still question all these claims. When someone shows me something a bitcoin can do which a dollar can’t (that doesn’t involve the risk of jail-time) I shall be genuinely delighted.

They are generally bunkum. Yes, the transfer of cash is still in the equivalent of the steam age, but it can be done efficiently via umpteen fintech solutions without undermining the primacy of fait money.

It all boils down to the primacy of money. I’ve come to the conclusion the seeds of crypto and decentralised finance stem from the Libertarian agenda that central banks can’t be trusted with our money. I also suspect the technological beauty of Blockchains acted as a lure for clever but naïve developers to invent around. I doubt most crypto barkers care.. they now see crypto as a genuine asset they are going to get rich on.

When people tell me bitcoin is digital gold.. give me real gold every time. When it all goes wrong, I’ll have the yellow metal rather than an inaccessible digital wallet anytime.

But…. The bottom line is you can’t uninvent crypto – but then you can also argue it’s an evolving asset class and market. Bitcoin was merely the first iteration. Its notoriously useless as a transactional store of value – only 8 transactions at a time or something like that. There is a new crypto that promises its blockchain can handle more transactions per second than mastercard. Other cryptonuts say Ethereum is the one to watch..

I’m watching Coinbase – a spectacular flop of an IPO – traded down nearly 40%! But it’s interesting. Its profitable, and it’s got some credibility. As crypto’s continue to evolve, Coin will continue to be seen as a safe place for institutions and retail to trade and hold. I’m thinking of taking a punt… And meanwhile, my Coinbase account is up 30% since I decided to punt on it back in April. There are over 400 cryptocurrencies, and I bet on Ethereum. Yay!

* * *

Tyler Durden

Fri, 05/07/2021 – 07:25

via ZeroHedge News https://ift.tt/3uysZ1a Tyler Durden