Futures Rise Ahead Of Blockbuster Payrolls As Commodities Soar

S&P futures rose overnight alongside European and Asian market in another quiet session, as commodities smashed higher ahead of a blockbuster jobs report (whispers of a 2MM+ print) which will cap a series of strong economic reports this week. Global stocks headed for their first weekly gain in three with MSCI’s world index rising about 0.1% and on course for a 0.4% gain this week amid a surge in commodity prices. Copper joined iron ore and steel by hitting a new all-time record as expectations that rebounding economies will spur a boom in global demand, while the Bloomberg Commodity Spot Index jumped to its highest level since 2011.

At 730 am ET, Dow e-minis were up 80 points, or 0.22%, S&P 500 e-minis were up 9.00 points, or 0.22%, and Nasdaq 100 e-minis were up 31.50 points, or 0.23%.

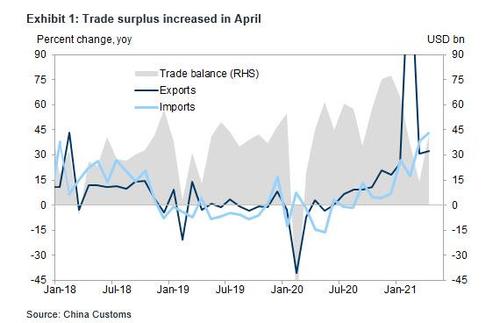

Sentiment was bolstered by China’s latest trade data which showed exports rose well ahead of expectations and imports saw the fastest growth since 2011 on the back of soaring commodity prices.

In premarket trading, most stocks traded in a tight range with mega-cap growth stocks such as Microsoft, Apple, Amazon.com and Facebook rising between 0.2% and 0.6%. Economically sensitive cyclical stocks also firmed, with Boeing up 0.4%, Goldman Sachs Group rising 0.5% and Chevron gaining 0.1%.

Traders now turn to Friday’s payrolls numbers, which are expected to show a million jobs added in April after rising by 916,000 in March. The data, due at 8:30 a.m. ET, is also expected to show that the unemployment rate fell to 5.8% from 6.0% and average hourly earnings dropped by 0.4% – the first annual decline in history – after a 4.2% increase in March.

“The U.S. employment report is bound to be the center of attention today,” said UBS chief economist Paul Donovan. “It’s not just going to be the overall employment data that will be of interest, but the patterns of employment by state and by industry that will be useful in assessing the direction of the U.S. economy.”

“The dilemma investors are facing right now is that while strong U.S. economic data is positive news, the accelerating growth is increasing the risk of an overheating economy and the Federal Reserve being forced to hike rates early,” said Milan Cutkovic, market analyst at Axi. It’s also why some have warned that a jobs number above 2 million could lead to a waterfall in risk.

European stocks traded near session highs after dripping earlier following comments from ECB Governing Council member Martins Kazaks became the latest to hint at an imminent taper when he said the European Central Bank could decide to scale back its emergency bond-buying program as early as next month if the euro-area economy doesn’t deteriorate. Kazaks, who also heads Latvia’s central bank, said the ECB’s pledge to keep financing conditions favorable remains key to determining how much support the 19-nation bloc needs to recover. “If financial conditions remain favorable, in June we can decide to buy less,” Kazaks said in an interview on Thursday. “Flexibility is at the very core of PEPP.

The Stoxx Europe 600 Index rose 0.5% to 443.2 with miners, industrials and financial services the best performing sectors. Miners lead gains after copper hit an all time high. Miners with copper exposure like Rio Tinto, Glencore, BHP, Anglo American already advanced. Other copper miners that may also gain includes, TECK, FM CN, SCCO, CS CN, CMMC CN, ERO CN, LUN CN. Here are some of the biggest European movers today:

- Adidas shares jump as much as 8.8%, the most intraday since November, after the German sportswear maker reported 1Q results and increased its sales forecast for the year, impressing analysts.

- Meggitt shares jump as much as 16%, the most since Nov. 9. A report that aerospace company Woodward is working with advisers on a possible deal for the U.K. firm appears to make sense strategically, Jefferies writes in a note.

- KGHM shares soar as much as 6.2%, to the Polish copper producer’s highest since its 1997 debut, as the metal price jumps to a record. And Warsaw’s benchmark WIG20 index rises as much as 2%, fueled by KGHM’s gains.

- Siemens shares rise as much as 3.3% after the German industrial group’s results topped expectations, with analysts noting strength across the board.

- Rubis shares fall as much as 7.2% after Oddo BHF cuts the energy storage and distribution company to neutral from outperform, citing “limited” upside after recent gains.

- Klepierre shares fall as much as 5.4% after the French real-estate company lowered its FY net current cash-flow guidance due to longer-than-expected Covid-19 lockdowns.

Asian stocks also rose, heading for their first weekly gain since mid-April, as a rally in semiconductor-related shares helped offset a late sell-off in China. The MSCI Asia Pacific Index advanced for a second day. Chip-related stocks including TSMC and Tokyo Electron contributed heavily to the day’s gains, while game console developer Nintendo and Sony Group were among the biggest drags after the Kyoto-based studio warned of component shortages and announced a conservative profit outlook. China stocks slumped in the afternoon and notched their worst week since mid-March, as worries that the U.S. is maintaining investment limits in some Chinese companies outweighed better-than-expected growth in export data. Concerns the Biden administration will keep the investment bans imposed under former U.S. President Donald Trump add to investors’ worries of rising geopolitical tensions faced by China as Beijing halts its high-level economic dialogues with Australia. In addition, India’s Covid-19 outbreak remains a key risk investors should watch, as cases there have kept growing and could prompt a national lockdown, Yeap Jun Rong, a market strategist at IG Asia Pte wrote in a note. India reported a record 412,262 new infections and 3,980 deaths on Thursday, with experts saying that the reported figures likely underplay the real toll. That said, a mathematical model prepared by advisers to Prime Minister Narendra Modi suggests the country’s outbreak could peak in coming days

Chinese stocks notched their worst week since mid March, pushed lower by a slump in tech shares after news that the U.S. will likely maintain limits on investments in certain Chinese firms. The benchmark CSI 300 index fell 1.3% to close at 4,996.05 points on Friday, extending the week’s decline to 2.5%. Information technology firms were the worst performers, with Will Semiconductor falling 9.9% in Shanghai while Advanced Micro-Fabrication dropped 6.6%. A subgauge of that sector fell by the most in nearly two months. Consumer staples also extended recent declines this week, with former investor darlings like Kweichow Moutai and Anhui Gujing leading the retreat on concerns that were few catalysts ahead that could lift the sector. “There is still lots of profit-taking pressure in the sector and valuations are still very expensive,” Li Liangxu, a fund manager at Guangdong Ronghao Asset Management, said by phone. “Sell offs in heavyweight stocks like Moutai are far from over.” Friday’s selloff comes after a similar decline a day earlier after news that the U.S. will back a proposal to waive intellectual-property protections for Covid-19 jabs sent shares of Chinese vaccine makers tumbling. In Hong Kong, tech stocks also fell, with the Hang Seng Tech Index nearing the lowest this year. Meituan was set to fall for an eighth straight day, on track for its longest losing streak since the company went public in 2018. Alibaba was down as much as 1.2% while Tencent slid 1.7%.

In rates, yields were within a basis point of Thursday’s closing levels as trading activity simmered ahead of April jobs report. U.S. stock futures are higher with commodities, weighing slightly on bonds. Treasury 10-year yields around 1.575% outperform bunds by ~1bp with gilts keeping pace; dunds dipped after the abovementioned taper comments from ECB’s Kazaks who said a June decision to slow bond buying is possible. German curve bear flattens slightly, USTs and gilts bear steepen; ranges are tight ahead of today’s payrolls release. Peripheral and semi-core spreads widen with long-end Italy underperforming.

In FX, the safe-haven dollar sank to its lowest level this week against a basket of major peers on Friday ahead of the jobs report, as firmness in global stock markets boosted risk appetite.the Bloomberg Dollar Spot Index was on the back foot and the dollar traded mixed versus its Group-of-10 peers. European currencies were the top performers, while commodity currencies underperformed despite higher metal prices. The euro rose to a one-week high of 1.2089 after ECB Governing Council member Martins Kazaks said the central bank could decide to scale back its emergency bond-buying program as early as next month if the euro-area economy doesn’t deteriorate. The pound gained as the Bank of England’s upgraded forecasts filtered through and as investors awaited results from Scottish parliamentary elections. Australia’s April 2024 sovereign bond, the target maturity for the central bank’s yield control, surged on short- covering, sending yields to a record low of 0.06%. The yen was little changed against the dollar, with traders staying on the sidelines ahead of U.S. non-farm payrolls data. Japanese bonds were narrowly mixed.

In commodities, it was all about metals again as copper soared to an all-time high as optimism about a global rebound from the pandemic spurs a surge across commodities markets. “Get ready for payrolls, they could be huge,” Chris Weston, head of research at broker Pepperstone in Melbourne, wrote in a note for clients. “The commodity space is the talk,” and financials are the “bull play” going into the payrolls report, he said. Gold headed for a 2.5% weekly gain, the most since December, as the weaker dollar and easing Treasury yields propelled the precious metal, an inflation hedge, above the key $1,800 an ounce psychological level to last trade at $1,813.54.

Looking at the day ahead, and the aforementioned US jobs report for April will be the main highlight for markets. Central bank speakers include ECB President Lagarde, the BoE’s Broadbent and Haldane, and the Fed’s Barkin.

Market Snapshot

- S&P 500 futures up 0.12% at 4,199.25

- STOXX Europe 600 up 0.43% to 442.91

- MXAP up 0.3% to 207.00

- MXAPJ up 0.4% to 693.62

- Nikkei little changed at 29,357.82

- Topix up 0.3% to 1,933.05

- Hang Seng Index little changed at 28,610.65

- Shanghai Composite down 0.7% to 3,418.87

- Sensex up 0.5% to 49,204.20

- Australia S&P/ASX 200 up 0.3% to 7,080.83

- Kospi up 0.6% to 3,197.20

- German 10Y yield rose 0.6 bps to -0.219%

- Euro up 0.18% to $1.2087

- Brent Futures little changed at $68.07/bbl

- Gold spot up 0.3% to $1,820.71

- U.S. Dollar Index down 0.18% to 90.79

Top Overnight News from Bloomberg

- survey of economists. Imports climbed 43.1%, a sign of strong domestic demand and soaring commodity prices, resulting in a bigger-than-expected trade surplus of $42.85 billion for the month

- One of the biggest Brexit battlegrounds between the European Union and the U.K. now has a price tag: at least $2.4 million a day. That’s how much any move by the European Union to cut off access to London’s dominant clearinghouses for derivatives could cost traders in euro interest rate swaps, net of buying, according to an estimate from Albert Menkveld, professor of finance at Vrije Universiteit Amsterdam, who has sat on advisory panels to European regulatory authorities

- A large option bet on quicker rate-hikes by the Federal Reserve got bigger this week, even as officials pushed back against hawkish expectations. The wager — now carrying a notional value of $40 billion — is focused on a possible surprise at the annual August symposium in Jackson Hole, which has been used in the past by central bankers to signal changes in monetary policy

- One of the constants in the currency space is for euro-yen options to trade at a premium for downside protection. As the pair’s volatility skew flattens, it remains to be seen whether we are looking at a game changer or a move that will be seen as another opportunity to fade lifetime range extremes.

- A rising appetite for risk across a variety of asset markets is stretching valuations and creating vulnerabilities in the U.S. financial system, the Federal Reserve said in its semi-annual financial stability report

- The Reserve Bank of Australia released an upbeat outlook for the economy showing trajectories for growth and unemployment that suggest it’s on track to drive faster pay gains and inflation back toward its 2-3% target

- China’s exports rose more than expected in April and imports climbed, reflecting strong domestic and international demand and surging commodity prices

- Voting has finished in crucial British elections set to shape the future of the U.K., in the first electoral test for Prime Minister Boris Johnson’s government since the coronavirus pandemic struck. Counting of ballot papers will take place over the coming days in contests for the parliaments of Scotland and Wales, the Mayor of London and English local councils

- Copper soared to an all-time high, topping the previous record set in 2011, on expectations that rebounding economies will spur a boom in global demand. Oil headed for a second straight weekly advance as investors bet on rising energy demand amid a broad rally in commodities

- Japan is set to extend a virus state of emergency that includes Tokyo to the end of May, public broadcaster NHK reported. A mathematical model prepared by advisers to Prime Minister Narendra Modi suggests India’s coronavirus outbreak, which saw record cases and deaths Thursday, could peak in the coming days

Asian equity markets traded mostly higher following the late ramp up on Wall St. and encouraging trade data from China, but with gains capped ahead of the key risk US NFP jobs data and as increased US-China hawkish rhetoric contributed to the tentativeness. ASX 200 (+0.3%) was lifted by strength in mining names after gold prices reclaimed the USD 1800/oz level and with Dalian iron ore prices at record highs, while the latest RBA Statement on Monetary Policy saw upgrades to the central bank’s economic growth forecasts with GDP seen at 9.25% in June and 4.75% in December this year. Nikkei 225 (+0.1%) was kept afloat after yesterday’s outperformance although upside was limited as Japan braces for an extension of the state of emergency for four key areas including Tokyo and with the government seeking to add Aichi and Fukuoka to the emergency declaration. Hang Seng (-0.1%) and Shanghai Comp. (-0.6%) benefitted from firm Chinese Caixin Services and Composite PMI data in which the former printed a 4-month high, while the latest Chinese trade data mostly topped expectations. However, risk appetite in the mainland was affected by the hawkish US-China rhetoric in which sources noted that top US and Chinese trade negotiators may hold talks soon to review the Phase 1 trade deal and that the Biden administration is likely to go ahead with former President Trump’s China investment ban, while there were also comments from President Biden that the Chinese are “eating our lunch” economically and officials noted that Secretary of State Blinken is to keep pressure on China in his UN speech today. Finally, 10yr JGBs were flat amid the mild positive mood across stocks and after the choppy lead in T-notes, while firmer demand at the enhanced liquidity auction for 2yr, 5yr, 10yr and 20yr JGBs was also largely ignored by prices.

Top Asian News

- Buyers Remorse Afflicts China’s Stock Traders Seeing Losses

- Taiwan Central Banker Says Currency Policy Faces ‘Turning Point’

- Huarong Wired Funds for Offshore Bond Coupons Due Friday

- Billionaire Li Ka-shing Bets on Southeast Asia’s Tech Startups

- Asia Is Exception as Emerging Markets Start to Look Fragile

Major European bourses trade mostly positive but off best levels at the time of writing (Euro Stoxx 50 +0.3%) as the initial optimism seen at the cash open turned more into a cautious tone as the US labour market report looms. The initial downside across the European equity complex coincided with comments from ECB’s Kazak who suggested that a decision on slowing down bond purchases is possible in June, although the comments do not make it clear as to whether a slow-down equates to a return to the pre-March pace, or a more pronounced decrease. US equity futures meanwhile remain caged heading into the US labour market report with the main contracts largely unchanged. Back to Europe, the DAX (+1.0%) remains the outperformer as Adidas (+8%) and Siemens (+3%) remain elevated post-earnings – with the former upgrading its guidance – whilst the FTSE MIB (-0.1%) is the laggard after outperforming yesterday. Sectors in Europe are mostly firmer with Basic Resources outperforming as base metal prices remain firm, closely followed by Oil & Gas whilst the Personal and Household Goods sector is propped up by Adidas. Autos meanwhile gave up some gains as the continued chip shortage remains a grey cloud over automakers, with Volkswagen (-1%), Renault (-0.7%), Stellantis (-0.1%) all subdued but BMW (+0.9%) bucks the trend after stellar earnings – with deliveries of electrified vehicles more than doubling – although the Co. warned that the rising cost of raw materials could dampen earnings ahead. The Construction/Manufacturing sector remains the laggard with rising costs of materials eating into margins. In terms of individual movers, Meggitt (+11%) rose around 15% at the open amid a report suggesting that Woodward is working with banks on a potential deal with Meggitt named as a potential target.

Top European News

- ECB’s Kazaks Says June Decision to Slow Bond-Buying Possible

- Siemens Lifts Guidance as China-Led Recovery Gains Momentum

- British Airways Owner Subdued on Impact of U.K. Travel Restart

- BMW Expects to Hit High End of Margin Goal Despite Rising Costs

- U.K.’s Johnson Wins Historic By-Election on Brexit, Vaccine Bump

In FX, not the best performing major or even the biggest mover, but certainly volatile in the run up to monthly US jobs data that often keeps currency moves relatively contained. However, reports of a big buy order in Eur/Usd on a break of 1.2070 saw the headline pair extend above the 100 DMA to post a new w-t-d peak circa 1.2090, and given the timing of the spike could well have been linked to or sparked by comments from ECB’s Kazaks on the prospect of scaling down the pace of QE from June – see 8.15BST post on the Headline Feed for more details, analysis and some context. 1.2100 may cap further Euro gains for psychological reasons and the fact that 1.4 bn option expiry interest resides at the strike, but by the same token 1.4 bn between 1.2050-40 and 1.8 bn from 1.2035-25 should provide support over NFP and into the NY cut.

- GBP – The Pound is actually topping the G10 ranks, and in truth has been relatively resilient around 1.3900 vs the Dollar for a while, albeit unable to breach 1.3950 and revisit highs around 1.4000 or maintain momentum against the Euro to breach resistance ahead of 0.8600 in the form of the 50 DMA. In terms of Sterling fundamentals, not much independent impetus from the BoE or somewhat mixed UK PMIs, so Cable and the Eur/Gbp cross have been moving on external and seasonal factors in the main, with some attention to latest Brexit developments as the NI protocol stand-off and fishing dispute rumble on.

- USD – Although the Greenback remains mixed overall, losses vs key DXY components are accumulating to nudge the index further below 91.000 and away from recent recovery highs as the countdown to NFP continues and expectations build for a consensus beating headline number. Hence, the Buck may be prone towards a deeper setback as the bar has risen and the Fed, bar more hawkish factions stick to an accommodative stance awaiting substantial progress towards inflation and full employment policy goals. Returning to the DXY, 90.963-742 covers trade so far.

- CHF/NZD/JPY/AUD – The Franc is consolidating off fresh peaks vs the US Dollar and Euro near 0.9058 and 1.0936 respectively in wake of a better than forecast Swiss sa jobless rate, while the Kiwi has faded ahead of 0.7250 against its US rival following firmer Q2 NZ inflation expectations overnight and the Yen has not been able to keep its head above 109.00 against the backdrop of moderately higher US Treasury yields and 1.2 bn option expiries from the round number up to 109.10. Similarly, the Aussie has waned into 0.7800 where 1.2 bn expiry interest resides even though robust Chinese trade data and Caixin PMIs may offer some incentive to resolve differences on tariffs and subsidies that have resulted in suspension of dialogue between the 2 sides.

In commodities, WTI and Brent front month futures remain choppy within a contained range yet again amid a lack of fresh catalysts heading into the US labour market report alongside further central bank commentary. The geopolitical landscape also remains little changed thus far, although a US official did note that the pace of talks would need to speed up in order to reach a deal in the coming weeks re. Iran, adding that the sides are not in the final stages of discussions yet. Meanwhile, eyes remain on the COVID situation in India, although concerns are seemingly under control as far as the crude markets go, whilst reports yesterday suggested that Indian state refiners placed orders for regular supplies from Saudi Aramco for June following a dip in May. WTI Jun reside around USD 64.50/bbl (vs a 64.44-65.24 range) whilst Brent Jul meanders USD 68/bbl (vs a 67.86-68.65 range). Moving on, spot gold and silver are on stand-by for the Tier-1 US data but hold onto a lion’s share of its recent gains with the former above USD 1,800/oz (1813-23 range) and the latter retaining its USD 27/oz handle. Turning to base metals, LME copper continues to gain ground above USD 10,000/t with similar upside price action seen in Shanghai copper and Dalian iron ore, with traders citing Chinese demand upon their return to the markets alongside Dollar weakness. There was also some commentary from the mining giant Glencore’s CEO who suggested that copper prices will need to increase to USD 15,000/t in order to encourage sufficient new supply to meet projected demand, specifically the mining industry would need to generate an additional 1mln tonnes of the metal each year.

US Event Calendar

- 8:30am: April Change in Nonfarm Payrolls, est. 1m, prior 916,000

- 8:30am: April Change in Private Payrolls, est. 938,000, prior 780,000

- 8:30am: April Change in Manufact. Payrolls, est. 57,000, prior 53,000

- 8:30am: April Unemployment Rate, est. 5.8%, prior 6.0%; Underemployment Rate, prior 10.7%

- 8:30am: April Labor Force Participation Rate, est. 61.6%, prior 61.5%

- 8:30am: April Average Hourly Earnings YoY, est. -0.4%, prior 4.2%; Average Hourly Earnings MoM, est. 0%, prior -0.1%

- 8:30am: April Average Weekly Hours est. 34.9, prior 34.9

- 10am: March Wholesale Trade Sales MoM, est. 1.0%, prior -0.8%; Wholesale Inventories MoM, est. 1.4%, prior 1.4%

- 3pm: March Consumer Credit, est. $20b, prior $27.6b

DB’s Jim Reid concludes the overnight wrap

For most of yesterday it was fairly quiet as markets seemed to be in a holding pattern as we all awaited today’s all-important US jobs report. However just as we thought we could go on auto pilot until the big number, some late dovish Fed comments sent US equities higher. The S&P 500 moved from flat 90 minutes before the close to finish +0.82% and only just shy of a new record close. Banks (+1.52%) remain among the leading industries in the S&P, however there was a recovery in some growth sectors as well with tech hardware (+1.29%) media (+1.02%) and software (+0.98%) all bouncing back. The gain in tech saw the NASDAQ rise (+0.37%) for the first time in five sessions after the first four day decline index since mid-October. European indices earlier held steady for the most part, with the STOXX 600 only seeing a modest -0.12% decline, while the DAX was +0.17% higher.

The market seemed to turn higher on comments from Fed Governor Bostic, who indicated that even a very strong jobs number is not going to cause the committee to formally discuss changing the pace of bond purchases. Governor Bostic earlier this year had been more open to talk about the committee thinking about tapering and so his comments seem to highlight a certain cohesiveness from the recent Fed speakers to remain on message. Was this co-ordinated after Secretary Yellen’s comments earlier this week?

Talking of the Fed, they released their semi-annual financial stability report late last night. It’s certainly an interesting one to read as they warn about stretched asset prices and high debts. The paradox is that their actions have been a big part of why we have such conditions. I can’t help think that life becomes a lot harder for the Fed once the economy reopens in earnest and inflation numbers start shooting up – transitory or not.

Looking forward now and that jobs report at 13:30 London time will be the focal point today as markets seek to gauge the strength of the economic recovery. In terms of what to expect, our US economists are looking for strong nonfarm payrolls growth of +1.275m, and a decline in the unemployment rate to a post-pandemic low of 5.7%. Fed Chair Powell has said that they “want to see a string of months” like the March report in order to reach the Fed’s goals, so all eyes will be on whether this report fits that definition. Though of course, even job growth at that level would still leave the total number of nonfarm payrolls more than 7m beneath the pre-Covid peak, and the Fed have been consistent in their message they want to see actual rather than simply forecasted progress. On this point, the weekly initial jobless claims data released yesterday fell to a post-pandemic low of 498k (vs 538k expected) in the week through May 1, but that still leaves it at more than double its pre-Covid levels.

With all that to look forward to, Treasury yields were fairly steady yesterday, with the 10yr yield up just +0.4bps to 1.570%. Real yields were up +2.0bps, though that was mostly offset by a -1.6bps decline in inflation expectations – just the second daily drop in 10yr breakevens in the last 10 trading sessions. And in Europe there was a similar pattern of modest upward rises in yields, with those on 10yr bunds up +0.3bps, though Italian sovereign bonds underperformed once again with the spread of their 10yr yields over bunds widening to a fresh 3-month high of 114bps.

On another theme, the upward march of commodities showed no sign of abating yesterday, with copper prices up another +1.76% to reach a fresh high for the decade, and spot iron ore prices rose above $200/ton for the first time ever. My summer building project at my house looks like it is getting more expensive by the day. Even precious metals surged, with gold (+1.59%) seeing its best day in nearly 2 months, and silver up +3.10%. The main exception to this were oil prices, which pared back their morning gains as both WTI (-1.40%) and Brent crude (-0.97%) ended the session lower. This all came as the US dollar index fell -0.46%, taking the weekly move negative, which would be the 4th in the last 5 if the dollar does not rally today.

Overnight, Asian markets have followed Wall Street’s lead with the Nikkei (+0.08%), Hang Seng (+0.52%), Shanghai Comp (+0.42%), Kospi (+0.72%) and India’s Nifty (+0.85%) all making advances. Besides the positive US equity moves, sentiment is also being helped by decent Chinese economic data with exports in April printing at 32.3% yoy (vs. 24.1% yoy expected) while imports stood at 43.1% yoy (vs. 44% yoy expected). China’s Caixin April Services PMI also printed strong at 56.3 (vs. 54.2 expected). Japan’s final services PMI also increased and was +1.2pts from flash at 49.5. Away from Asia, futures on the S&P 500 are also up +0.10% while Stoxx 50 futures are up as much as +0.68% as they try to catch up with the late rally in US equities yesterday. Meanwhile the rally in commodities is continuing unabated with Copper up another +1.4% this morning to $10,206.

Here in the UK, we are yet to get results of the by election in Hartlepool but the Press Association has reported that Labour has all but conceded defeat after shadow transport secretary Jim McMahon, who led the Opposition party’s campaign to hold the North East town, said it looked clear that Labour had not “got over the line”. If final results indeed confirm a win for Conservatives then this would be first defeat for the Labour party in Hartlepool in almost 50 years. Lots more local election results and the crucial Scottish vote will come through in the hours ahead.

Staying on the UK, the Bank of England kept their policy settings unchanged, in line with expectations, and revised up their growth forecasts from February, now seeing 2021 GDP growth at +7.25% (vs. +5% before). We did get one dissenting vote on QE from chief economist Haldane, who preferred to reduce the target for the stock of UK government bond purchases to £825bn, down from the current £875bn amount. However, there aren’t really implications for markets since Haldane is due to leave the committee after next month’s meeting anyway. Overall, the BoE struck a more optimistic note relative to their forecasts back in February, raising their 2021 growth forecast for the UK to +7.25% (vs. +5% before). Meanwhile on inflation, their forecasts based on market interest rate expectations showed CPI at 1.96% in Q2 2023, and 1.93% in Q2 2024, so slightly beneath their 2% target and suggesting that the market pricing of future hikes is a little too rapid for keeping inflation at target. Finally on tapering, there was a reduction in the pace of purchases, but the size of the total envelope for government bond purchases remains unchanged at £875bn. See DB’s piece on the meeting here.

On the pandemic, the data at a global level continues to show that the latest wave seems to have peaked for now, with the week-on-week growth in cases having peaked on April 28 according to John Hopkins University’s numbers. In terms of the latest on the patent waiver plan, German Chancellor Merkel cast doubts that the idea would garner enough international support to be viable. A German government spokeswoman said, “The limiting factor for the production of vaccines are manufacturing capacities and high quality standards, not the patents”, before going on to say that “protection of intellectual property is a source of innovation.” There was some good news on the production front with Pfizer and BioNtech announcing that they will now be able to make as much as 3 billion doses of its Covid-19 vaccine this year, double their initial estimates, with their international partners expecting to make another 3 billion next year. Moderna announced that the companies vaccine trial amongst teens showed a 96% efficacy rate as the US looks to expand its vaccination program to the younger population. The need for that expansion was emphasised by Colorado’s state epidemiologist announcing yesterday that junior high and high school aged populations (11-17) have the highest transmission rates in the state.

In terms of yesterday’s other data, Euro Area retail sales rose by a stronger-than-expected +2.7% in March (vs. +1.6% expected), and February’s growth was also revised up 1.2 percentage points. German factory orders also surprised to the upside in March, with growth of +3.0% (vs. +1.5% expected), while the UK’s composite PMI for April was revised up to 60.7 (vs. flash 60).

To the day ahead now, and the aforementioned US jobs report for April will be the main highlight for markets. Over in Europe, the data releases include March figures on German and French industrial production, along with Italian retail sales, as well as the UK’s construction PMI for April. Central bank speakers include ECB President Lagarde, the BoE’s Broadbent and Haldane, and the Fed’s Barkin.

Tyler Durden

Fri, 05/07/2021 – 07:59

via ZeroHedge News https://ift.tt/3xW2VyQ Tyler Durden