Wal-Mart, Sysco Fine Suppliers As Labor Shortages Cause Surge In Late Orders

From the gas pump to the grocery aisle, Americans have been suffering from “sticker shock” for the first time in years. While the Fed continues to insist that inflationary pressures will be “transitory”, sell-side banks like Bank of America are raising the prospect of economically debilitating “stagflation”. But even though President Biden on Friday refused to acknowledge the increasingly obvious role that expanded unemployment benefits are playing in keeping Americans out of the labor market, labor shortages are having a very real impact on firms that produce packaged food products and other consumer goods.

According to WSJ, labor shortages, supply constraints, high freight costs and exploding commodity prices that are conspiring to make it difficult for vendors to fill customer orders on time. As a result, some of America’s biggest retailers and distributors are resorting to fining their suppliers for late or incomplete orders, creating even more inflationary pressures.

Wal-Mart’s and Sysco’s insistence on fining suppliers that are already struggling isn’t helping to alleviate the situation. But the companies need to ensure they can meet their customers’ demands in a hyper-competitive market, and see few other options.

“The supply-chain challenges are still there,” said Henk Hartong, chief executive officer of Brynwood Partners, which owns Hometown Food Co., the maker of Pillsbury cake mixes and Buitoni pasta. He said wheat costs have soared and shipments for ingredients including vitamin C for Sunny D are running behind: “It’s not just one thing, it’s everything.”

Walmart told suppliers last fall that it would require orders to be 98% full and on time. Suppliers that didn’t comply would be charged 3% of the cost of missing items, according to a September letter from the retail giant viewed by The Wall Street Journal.

“We must improve product availability,” Walmart’s letter said. Spokeswoman Tara House said Walmart wants to save customers time and money by having the products they want online and in stores.

Food-distributor Sysco in February alerted suppliers to fees it would begin assessing in April for partial orders, billing discrepancies and missing data such as nutritional information, according to correspondence viewed by the Journal. Fees went into effect in April. Sysco also told suppliers it expects them to put its orders ahead of those from other customers.

“We believe all our supplier partners subject to these policies have the capabilities to meet them,” Sysco spokeswoman Shannon Mutschler said, adding that this will help restaurant customers as they reopen.

As they weigh their response to these added costs, makers of popular packaged-food products told WSJ that, right now, they’re choosing to eat these additional costs. But pretty soon, they might need to pass them on to customers in the form of higher wholesale prices, which will inevitably lead to more price hikes borne by consumers.

Wise Pies is paying as much as $4,000 to ship a load of its pizzas, President Season Elliott said, compared with around $1,800 in August. Cheese prices have also almost doubled. Wise Pies is using more contractors to make and deliver some of its pizzas, which hurt profit but helped meet demand from distributors and retailers. The company hasn’t raised prices.

“We all want the same thing: to avoid out-of-stocks,” Ms. Elliott said.

Thang Nguyen-Le, CEO of ramen-noodle brand Simply Food, said he is facing fines for delays and worries retailers could switch to competitors if he can’t deliver. He is paying for refrigerated shipping containers and air shipments, though his products don’t require either.

“We’ve got to keep up shelf space even if it’s at a loss,” he said.

A dairy distributor pointed out that high commodity prices are creating shortages that beget even more shortages as they ripple out through the supply chain.

Utah-based distributor Nicholas and Co. was struggling to source milk and cream, so Nicole Mouskondis, the company’s co-CEO, tried to arrange to buy milk from a dairy farmer with excess supplies. But a shortage of resin after winter storms closed chemical plants in the Southern U.S. left milk processors unable to procure the plastic jugs needed to bottle it.

“There’s a domino effect,” said Ms. Mouskondis, whose company supplies restaurants including Subway and Panda Express.

Fines being imposed by retailers are forcing suppliers to find ways to adapt. Some have started ordering even more raw materials, but this in turn can exacerbate shortages. Or for some products, like blue cheese, that require months to make, producers are coming back to them saying that there’s nothing they can do to increase supplies in the near term.

Suzanne Rajczi, CEO of New York-based distributor Ginsberg’s Foods, said she is over-ordering many goods to improve her chances of having products her customers request. She is struggling to source blue cheese, for example, because cheese makers last year reduced inventories of varieties like Gorgonzola and Roquefort, which take months to age. “I can’t make blue cheese any quicker,” Ms. Rajczi said.

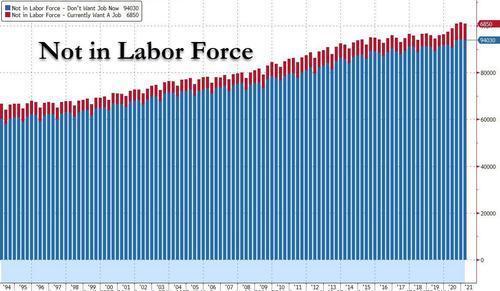

Earlier, a top official from the Chamber of Commerce said that it’s time for the US to end its expanded unemployment benefits, warning that “we need a comprehensive approach to dealing with our workforce issues and the very real threat unfilled positions poses to our economic recovery from the pandemic.”

With so many Americans sitting out of the labor force as they wait for their benefits to run out, confident that jobs will still be there for them when that time comes…

…how can President Biden still insist that it’s not having the effect of artificially reducing the labor pool?

Tyler Durden

Fri, 05/07/2021 – 14:45

via ZeroHedge News https://ift.tt/3f5FsTp Tyler Durden