Gold Surges To Best Week In 6 Months, Crypto Soars As Dollar Crashes

This was not the shitty jobs data you were looking for…

These people think Americans are stupid. https://t.co/d7nqCFBqU1

— Tim Young (@TimRunsHisMouth) May 7, 2021

Or put another way…

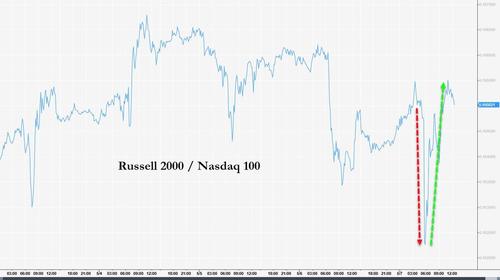

The instant reaction at the payrolls data was Small Caps puked and Big-Tech buying-panic…

But by the end that difference has converged…

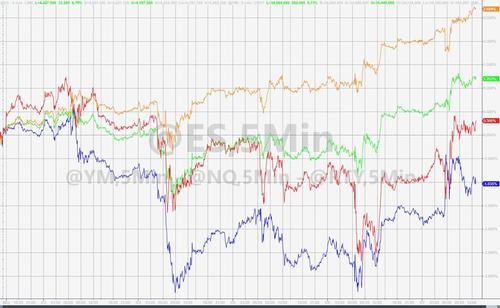

The Dow led the way this week, charging to its best week in two months amid terrible jobs data. Nasdaq, on the other hand, is down for the 3rd straight week. Small Caps managed to cling to the flatline…

Today’s bounce back in Small Caps pushed them to close back above the 50DMA…

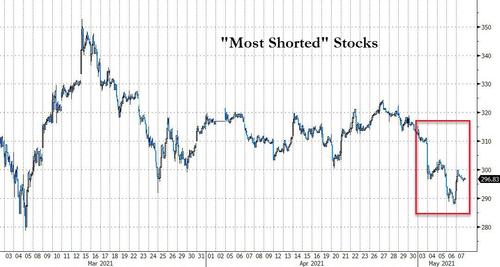

“Most Shorted” stocks suffered their biggest weekly loss since Oct 2020…

Source: Bloomberg

Energy stocks were the week’s biggest winners while Tech, Utes, and Consumer Discretionary all ended lower…

Source: Bloomberg

Cathie Wood’s ARKK was clubbed like a baby seal again (worst week since Feb)…

IPOs saw the biggest weekly drop since March 2020…

Source: Bloomberg

VIX was monkeyhammered back below 17 to end the week…

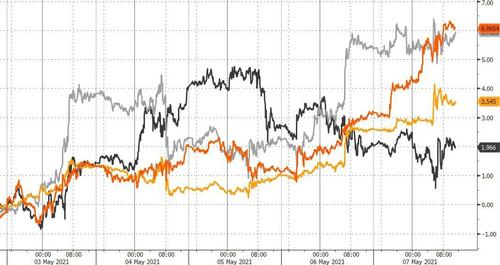

Treasury yields plunged today on the terrible jobs data… then ripped higher. 30Y ended up around 3bps on the day, 5Y down around 3bps…

Source: Bloomberg

For some context (and an idea of the lack of liquidity), 10Y Yields crashed 10bps-plus and ripped back 10bps-plus. Jim Vogel at FHN explains:

“Measured by intensity of price changes and volume in a 30-minute period, we cannot find any event as volatile as this morning’s reaction to April payrolls in the last five years. We actually quit looking after we got to the beginning of 2016.”

But all yields were lower on the week with the belly outperforming (7Y -7bps)…

Source: Bloomberg

10Y Breakevens rose once again, topping 2.50% for the first time since 2013…

Source: Bloomberg

The crappy jobs data took an early rate-hike largely off the table…

Source: Bloomberg

The dollar plunged today on the dismal jobs data, to its weakest since February. This was the 4th down week of the last 5 for the dollar and the biggest weekly drop since early November…

Source: Bloomberg

Ethereum surged to a new record high…

Source: Bloomberg

Dramatically outperforming bitcoin over the same period…

Source: Bloomberg

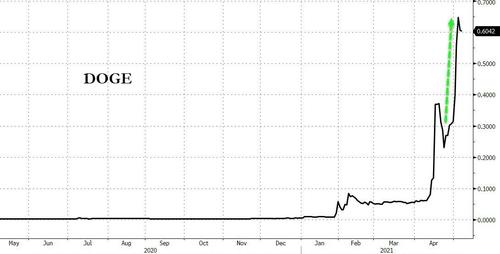

And of course, all eyes will be on DOGE this weekend as Elon Musk hosts SNL…

Source: Bloomberg

Commodities continued their (transitory) charge higher (5th straight week). Spot Commodity Index is up a stunning 65% YoY – a record spike.

Source: Bloomberg

Copper and Silver soared over 6% this week…

Source: Bloomberg

WTI rallied on the week but was unable to hold gains above $66 (in fact closing with a $64 handle)…

Gold rallied to its best week since Nov 2020, ending at $1840, its highest in 3 months. NOTE the double-bottom test below $1700 has set solid support…

Silver pushed back above $27.50, having found support at $25…

Copper hit a new record high this week (along with Iron Ore and Steel) and is now up over 90% YoY…

Source: Bloomberg

Despite gold’s big week, the surge in copper has taken the ratio to its highest since Nov 2014. That suggests 10Y yields should be at least 100bps higher… if not 200bps!

Source: Bloomberg

Finally, we note that stocks are still significantly ahead of global central bank balance sheets…

Source: Bloomberg

Tyler Durden

Fri, 05/07/2021 – 16:00

via ZeroHedge News https://ift.tt/3f5H3Z8 Tyler Durden