Don’t Fight The Fed’s Commodity “Put”

By Ryan Fitzmaurice of Rabobank

Don’t fight the Fed

- Inflation remains a key concern for investors as was clear from Warren Buffett’s comments at the Berkshire Hathaway annual event this past weekend

- Commodity index inflows picked up substantially this week as institutional investors return to the alternative asset class in a big way

- Strong investor interest is providing steady and reliable demand for oil futures

The Fed commodity “put”

Inflation concerns are top of mind for many investors these days, as is clear from the never-ending financial news media coverage of the topic lately. In fact, just last weekend Warren Buffett’s Berkshire Hathaway held its annual shareholder meeting and commodities and inflation were hot topics, unsurprisingly. At the televised event, Buffett talked up mounting inflationary pressures indicating that Berkshire is already seeing substantial inflation in many of its own businesses. Buffett explained, “We are raising prices. People are raising prices to us, and it’s being accepted.” He went on to describe that the spike in input costs and raw materials is being passed on to consumers without much push back given the loose monetary and fiscal policies at play, saying that “people have money in their pocket, and they are paying higher prices”. As is clear from these well-supported comments, there are good reasons to be concerned about inflation given everything that has transpired with the pandemic this past year and now as we look towards the inevitable recovery with financial markets well lubricated from historic stimulus and central bank easing. In fact, the Fed has stated quite clearly that it wants inflation to run hot above 2% for some time to achieve its “longer-term” average of 2% and it appears to be getting what it wants. This is not surprising given what a powerful market force the Fed can be and, as such, investors are generally wise not to stand in its way. To that end, the Fed is telling the market it wants higher oil and commodity prices to achieve this “longer-term” average of 2% inflation. As a result, commodities markets continue to benefit from this widely perceived Fed commodity “put”, with year-to-date gains anywhere from 19% to 27%, depending on which index you look at.

Strategic rotation

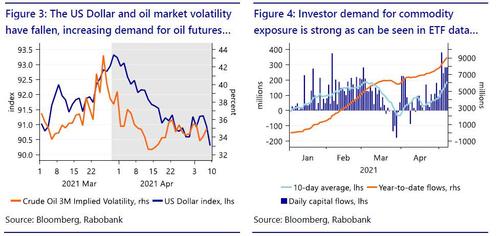

Commodity index inflows picked up substantially this week as institutional investors return to the alternative asset class in a big way. In fact, roughly +1bn USD of inflows were reported in just the last five trading sessions bringing the year-to-date total firmly above the 8bn mark. The 10-day average inflow is now firmly above the +100mm USD per day mark, a level not seen since early March. As is clear from Figure 4, this trend of “new” money into commodity index funds has been in place all year as institutional investors rush to add inflation hedges to their portfolios. Increasing commodity prices are often key drivers of inflation themselves, so naturally commodity-related investments are widely perceived to act as an inflation hedge and the asset class has indeed performed well in high inflationary periods throughout history.

These large inflows suggest that a strategic rotation is taking place across asset classes with investors seeking out higher commodity exposures while likely reducing other holdings on the margin. The increase in investor commodity exposure is clear though when looking at the most actively traded commodity index ETFs which have seen money pour into them this year with the exception of a brief period in late March and early April when the US Dollar rallied sharply, temporarily alleviating inflation fears. Since then, the US Dollar has resumed its downtrend and with that inflows have increased steadily. In our view, we are likely still in the early to mid-stages of this strategic rotation back into commodity markets, given how much money left the space over the past five to seven years coupled with the loose financial conditions currently at play. As we have explained in the past, these funds generally have high oil market weightings, so these inflows have provided steady and meaningful demand for oil futures all year and we fully expect that trend to continue. In addition, CTA funds are heavily “long” oil futures as well on bullish trend, momentum, and “carry” signals. As a result, we expect the speculative interest to remain overwhelming on the “bid” side of oil for the foreseeable future, barring any spikes in volatility or the dollar that could trigger a liquidation event. So in short, we see a strong case to be “long” oil futures, especially in the deferred months, given the Fed’s willingness to let inflation run “hot” in the near-term coupled with the likelihood of continued strong investor appetite for oil futures.

Looking Forward

Looking forward, we see upside risks developing for oil prices as we approach the high demand summer months in conjunction with the re-opening of key cities and regions. We expect this year’s strong investor interest in commodities to be more persistent in nature and related to an ongoing strategic rotation across asset classes. As a result of these strong inflows, OPEC+ appears to be in a position of strength assuming they are restrained in returning supply to the market. That’s not to say there are not downside risk lurking, such as the big job data miss in the US or the still worrisome virus data out of India, but we still see no reason to fight the Fed/trend.

Tyler Durden

Sun, 05/09/2021 – 08:15

via ZeroHedge News https://ift.tt/3vQDk8K Tyler Durden