14% Of Americans Own Crypto: Here Is A Profile Of The Average HODLer

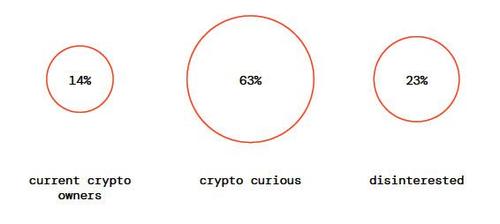

According to the latest just released report on the State of the Crypto Market from Gemini, 2020 which polled 3,000 U.S. adults, ages 18 to 65 with $40,000 or more in household income (survey respondents were polled from October 19-November 16, 2020, and included 921 self-identifying current cryptocurrency owners and 1,697 consumers who were interested in learning more about cryptocurrency), the exchange estimates that roughly 14% of the U.S. population owns cryptocurrency. This translates to 21.2 million U.S. adults who own cryptocurrency, and other studies estimate this number to be even higher. This number is expected to double in 2021.

Gemini then set forth to profile who exactly is the average crypto holder. Here’s what it found:

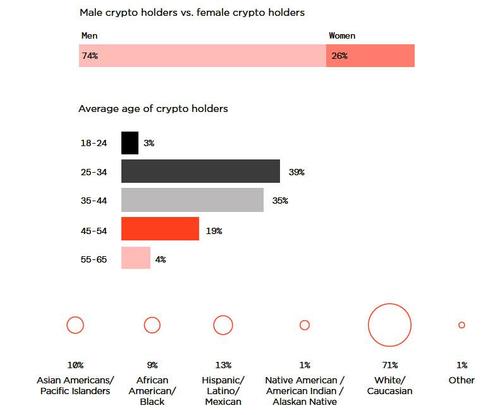

Crypto skews young, male and white: 74% of crypto holders are men, 77% of all crypto owners are under the age of 45, and 71% are white. The data shows that the “average” cryptocurrency owner is a 38-year-old male making approximately $111k a year.

To be sure, not everyone is a HODLer: there are roughly 4.5 times more who are “cryptocurious.”

The crypto-curious audience is defined as those who do not currently own cryptocurrency but indicate either wanting to learn more or planning to buy soon. This group is significant in size, comprising 63% of U.S. adults, and has the potential to disrupt what we think of as the “average” crypto holder.

The most bullish case for crypto? Roughly 13% of U.S. adults plan to purchase cryptocurrency in the next 12 months. This adds up to approximately 19.3 million adults — which would nearly double the current crypto investor population. In taking a deeper look at the “crypto-curious” audience, we see some emerging trends that have the potential to change the profile of the average crypto holder.

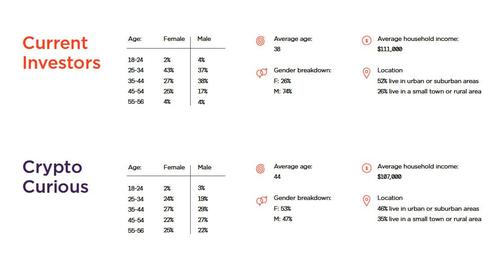

While just 26% of current crypto holders are women, there is potential for this to change significantly. Women account for more than half (53%) of those interested in getting into crypto soon, representing a major potential shift. The next wave of crypto buyers is also likely to be slightly older than current holders — with an average age of 44. They are also likely to have slightly less money to invest than those who are already crypto holders and are more likely to live in a small town or rural area than in an urban area, though it’s also worth noting that the crypto-curious audience remains largely white: 76% of the crypto-curious audience identifies as white or caucasian.

Looking closer at the female breakdown of crypto-curious consumers, Gemini spots an interesting shift in age: 45% of current female crypto owners are under the age of 35, and just 4% are 55 or older. But among crypto-curious women, only about a quarter are under the age of 35, and a notable 25% are 55 or older. Women are not only poised to make up a larger portion of the next wave of crypto buyers, they’re also more likely to be women nearing retirement. This shift in gender, age, average income, and location indicates that crypto is starting to broaden its appeal away from an investment solely reserved for those with a large amount of assets to one that is more mainstream and accessible for the average person.

Here is a full demographic breakdown of the current investor population vs the crypto curious:

In looking at the survey results, it becomes clear that crypto awareness is spreading, and acceptance is becoming more and more mainstream; the survey revealed that there are many more people who are crypto curious than who are completely disinterested in crypto, which is promising for the future of crypto’s growth.

Based on the percentage of respondents indicating that they plan to purchase crypto in the next 12 months, this could mean 19.3 million U.S. adults entering the crypto market very soon. And given what we know about the demographics of the crypto-curious audience, the profile of the average crypto holder could also soon be changing in a very welcome way. The future of crypto looks bright, and we are excited about the influx of a more diverse audience to continue to shape that future

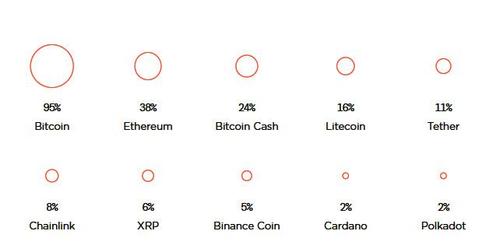

Going back to the survey, the next question tried to pintpoint what the average US adult knows about crypto. Not surprisingly, here it appears to mostly be all about bitcoin even though it is Ethereum that has become the most exciting token in recent weeks ( as we said it would). Some more details from the report:

While the group of crypto-curious U.S. adults is growing, general knowledge about cryptocurrency seems to mirror what we hear in the news: Bitcoin is almost synonymous with crypto, but few have heard of other coins. The vast majority of owners or cryptocurious (95%) have heard of bitcoin, while little more than one-third have heard of Ethereum.

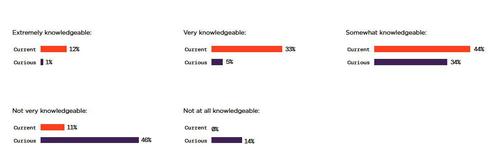

Education appears to be central to converting crypto-curious consumers from simply interested in crypto to actual crypto holders. Over one-third (39%) of those who don’t yet own cryptocurrency consider themselves “somewhat or very” knowledgeable about cryptocurrency. This indicates that consumers are attempting to learn before they dive in head first, but there’s still a significant opportunity for consumers to learn more: 60% of the crypto-curious identify as “not very” or “not at all” knowledgeable about cryptocurrency today. More than two-thirds of U.S. adults (77%) indicate they are open to learning more about digital assets, whether they already own cryptocurrency or not. As the current generation of crypto holders is well-educated — 90% identify as at least somewhat knowledgeable and 45% consider themselves extremely or very knowledgeable — this shows us that the potential “next wave” of crypto buyers will continue to be savvy and well researched about crypto’s purpose and potential.

What is perhaps most surprising, is that the level of reported knowledge shows the vast majority of crypto investors are taking the time to thoroughly understand this space before investing. They’re thoughtful and betting on real promise versus trying out something trendy for fun. The crypto curious audience is taking a similar approach: those who want or plan to buy soon appear to also take time to educate themselves on the industry first. It’s worth noting that these existing crypto holders aren’t just early adopters who have had years to immerse themselves in the space: 26% of current crypto owners first bought crypto within the past year. This indicates again that the market, as expected, is made up of people who take the time to understand and research before investing in crypto.

Next, the survey looked at what crypto holders own, and how they trade.

It found that more than a quarter (26%) of current owners first acquired crypto in the last year, and a full 68% purchased crypto within the last two years. This shows crypto is no longer a niche investment reserved for early-adopters. Widespread interest is growing, and growing fast.

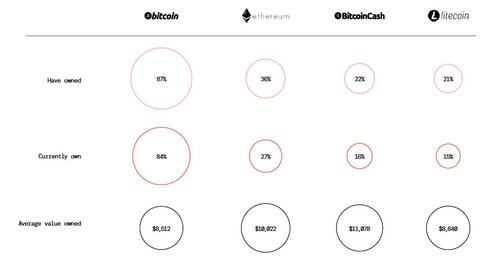

While new cryptocurrencies emerge nearly every day, bitcoin still reigns supreme as not only the coin most people have heard of, but also the coin most crypto holders own. Nearly 9 in 10 current crypto owners currently own or have owned bitcoin (87%), compared to ether at 36%, bitcoin cash at 22% and litecoin at 21%. Bitcoin also appears to have the most staying power: while 87% report they have at some point owned bitcoin, 84% still have it in their portfolio. By comparison, 21% of crypto investors have owned litecoin and only 15% still currently own it.

* * *

One final discovery – and perhaps the least surprising one for the notoriously illiquid space where the float is a tiny fraction of any given token – is that more than two-thirds of crypto investors are indeed HODLers,

The large majority of current crypto owners say they buy and hold crypto for its long-term investment potential. More than two-thirds (69%) buy and hold, compared to the 36% who actively buy and sell as a means to achieve profits and the 27% who actively use it to make purchases on the internet.

A look at the crypto-curious audience reveals a similar split: half of the crypto curious (54%) reported wanting to buy and hold crypto as a long-term investment, while 39% indicated they are interested in actively trading to make a profit.

When it comes to trading activity, investors run the gamut: a quarter of crypto investors trade, buy or sell only a few times a year, while more than another quarter (27%) trade, buy, or sell at least several times a month. This indicates that there’s a mix of “buy and hold” strategists, crypto holders who continue to buy more, and those who experiment with regular trading to achieve short-term profits.

Tyler Durden

Mon, 05/10/2021 – 19:30

via ZeroHedge News https://ift.tt/3hd8Bi9 Tyler Durden